The price of Terra (LUNA) hit a new all-time high of $109.90 on 29th March. Over the last 7-days, the digital asset has increased by more than 14%. Moreover, in terms of market capitalization, it is in eighth place with a total of $37.7 billion, just ahead of Cardano.

Terra (LUNA) had only recently surpassed Dogecoin (DOGE) in terms of market capitalization. However, the token has now steered past many more on the list. Terra’s growth has been incremental, and fast.

While other coins seem to be just recovering their losses, LUNA is registering an all-time high, which is a unique, and rather interesting development.

What’s pushing Terra (LUNA)?

Do Kwon, the co-founder, and CEO of the Terra blockchain company stated that the company has purchased more than $1 billion in Bitcoin since the end of January.

This includes a $135 million acquisition made on Monday. Kwon confirmed the Bitcoin address used by the Singapore-based Luna Foundation Guard to purchase bitcoin to Bloomberg News. The address has purchased a total of 27,784.96954740 Bitcoin, according to data.

Kwon had said earlier this month that the UST stablecoin will be backed by a Bitcoin reserve that might eventually reach $10 billion. On March 22, he tweeted that he has $3 billion in cash on hand to back the algorithm stablecoin.

LUNA’s purchases are in part a reaction to the UST backlash. Unlike centralized stablecoins like Tether, the UST stablecoin is not backed by a fiat currency. It has managed to keep its dollar peg by creating and destroying Luna tokens. On the Terra blockchain, $1 worth of LUNA is burned for every new UST generated.

With the recent surge in Bitcoin’s price, Terra (LUNA) seems to be enjoying a jump in its own price as well. It can be speculated that the accumulation of Bitcoin, which too is rallying to higher positions, and the burning of LUNA for the UST created, has led to the spike in the coin’s price.

Fans of LUNA, often known as “Lunatics,” aren’t the only ones who are intrigued. Despite the fact that the Terra ecosystem is long-term viable, many critics say that the coin is overvalued. MakerDAO founder Rune Christensen called the stablecoin a “solid Ponzi” in January.

Recently, crypto trader Sensei Algod bet a million dollars on Terra (LUNA) falling below $88 on March 14, 2023.

Why does Terra still have room for Growth?

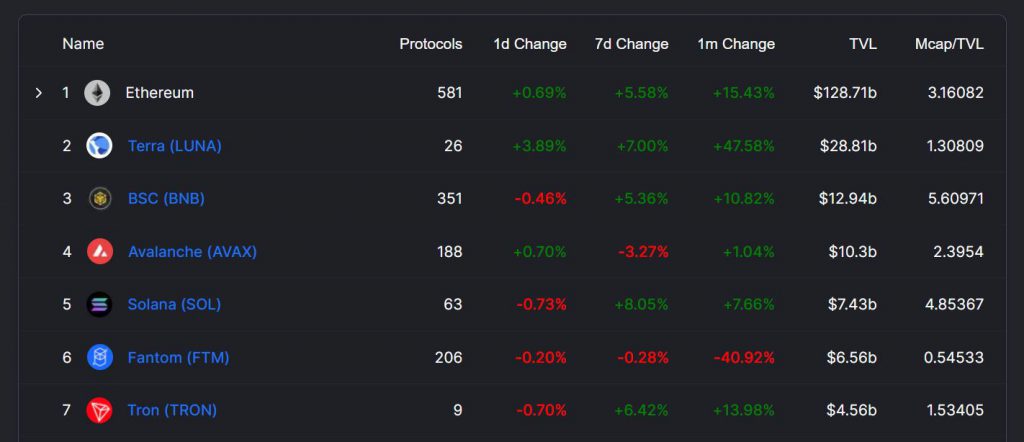

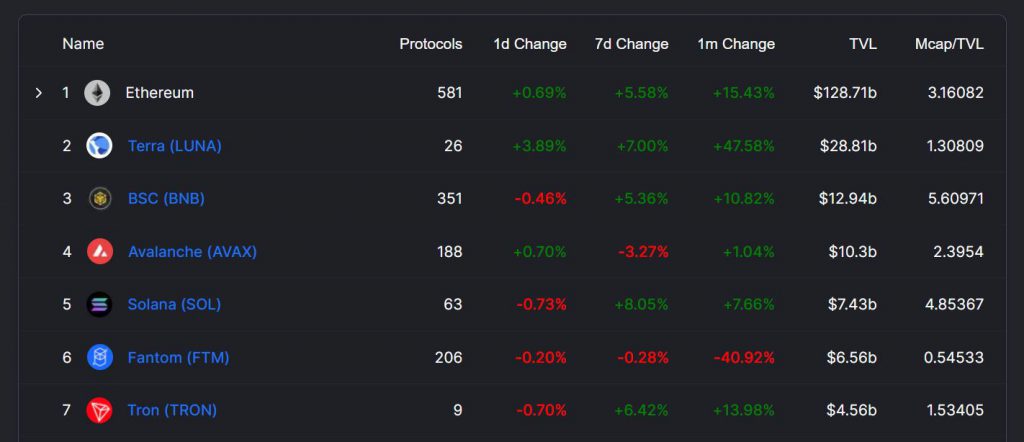

According to Defillama, Ethereum remains the dominant protocol in the DeFi ecosystem but Terra is currently 2nd in the rankings. However, the Mcap/TVL indicator suggests that Terra still has significant room for growth. A higher Mcap/TVL ratio indicates saturation of total value locked and at press time, Ethereum’s ratio stands at 3.16. In comparison, Terra’s is a mere 1.3, which means there remains room for other DeFi protocols to enter Terra’s ecosystem and improve its TVL. A rising TVL will only benefit Terra’s price value in the long-term, hence the long-term landscape appears promising for Luna.