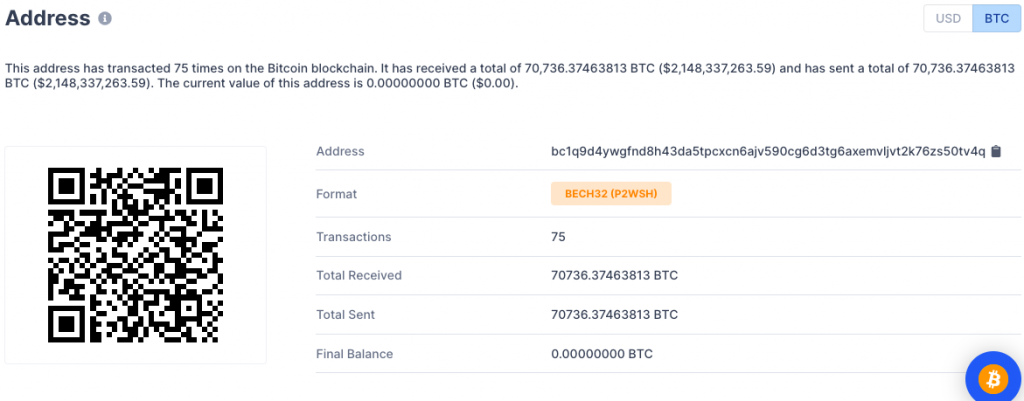

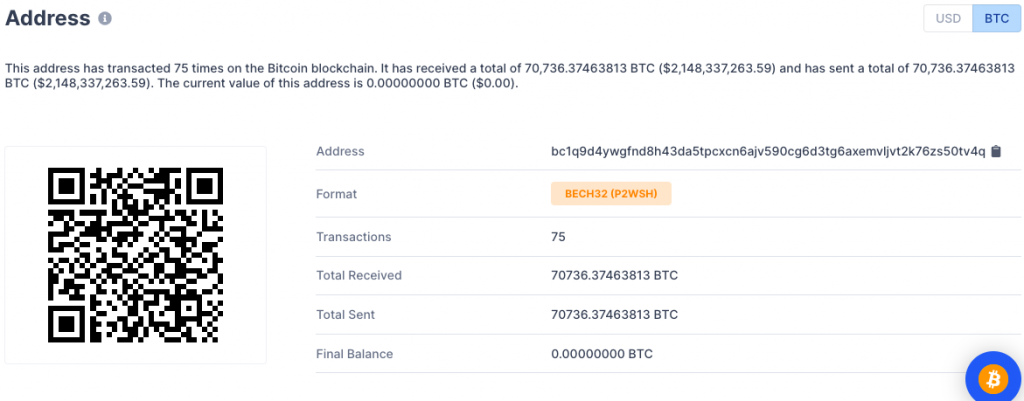

Right before the UST’s fiasco, the Luna Foundation Guard—the non-profit in charge of catering to the health of Terra’s ecosystem—kept buying Bitcoin to replenishing its reserves. At a point, it possessed over 70,736 BTC (worth over $2 billion).

Now that people from the space have accepted the fate of LUNA-UST, the eyes remain fixated towards the organization’s unaccounted Bitcoin reserve.

Over the weekend, Terra founder Do Kwon took Twitter to share that that the team was working on documenting the use Luna Foundation Guard’s reserves during the de-pegging event. He had simultaneously requested the community to remain patient.

Nonetheless, people have already lost their cool and have started asserting things like, “the lack of statement is the statement.”

Where did the Bitcoins actually go?

Well, the ultimate aim of LFG’s BTC purchase was to bolster UST’s reserves and aid it retain its $1 valuation. The purchases, however, proved to be futile as Terra’s stablecoin lost its stability. At press time UST was trading substantially below its $1 peg, at $0.1520.

Out of the total its reserves, LFG provided a “loan” of $750 million in Bitcoin to over-the-counter trading firms and market makers last week “to help protect the UST peg.”

Per basic Math, post providing the loan, the foundation should have been possessing Bitcoin worth at least $1.2 billion in its reserves. Per data, nonetheless, the balance was down to 0 last week itself.

Alongside, the Foundation’s publicly-known wallet address depicted a 0 Bitcoin balance at press time, confirming the same.

Even though it is still not clearly known where LFG has sent its Bitcoins, the most common speculative theory suggests that the Foundation has abandoned all its BTC.

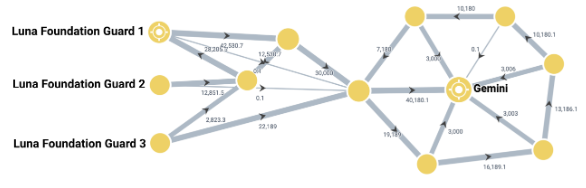

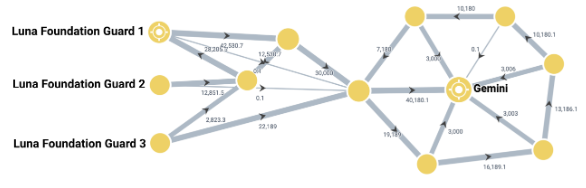

Blockchain analytics platform Elliptic used its software to follow the money trail and discover the fate of the LFG Bitcoins.

Exactly around the $750 million loan announcement time, 22,189 BTC (worth $750 million at that time) was sent from a Bitcoin address linked to LFG, to a new address. Post that, in the evening, an additional 30,000 BTC (worth $930 million at the time) was sent from other LFG wallets, to this same address.

Then, per Elliptic,

“Within hours the entirety of this 52,189 BTC was subsequently moved to a single account at Gemini, the US-based crypto currency exchange – across several Bitcoin transactions.”

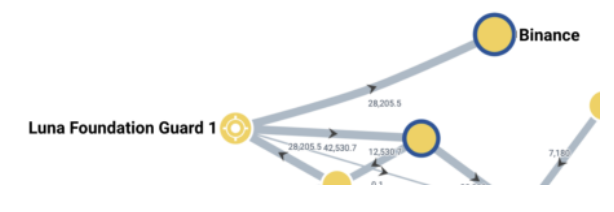

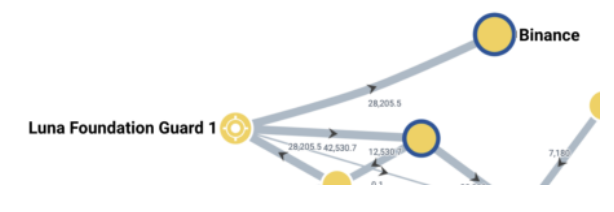

Post the Gemini transfer, LFG should have had left 28,205 BTC in its reserves. Coincidentally,

“At 1 AM UTC on May 10th, this was moved in its entirety, in a single transaction, to an account at the cryptocurrency exchange Binance.”

The analysis platform was, however, couldn’t track down if the said Bitcoins were sold or subsequently moved to other wallets post the transfer.