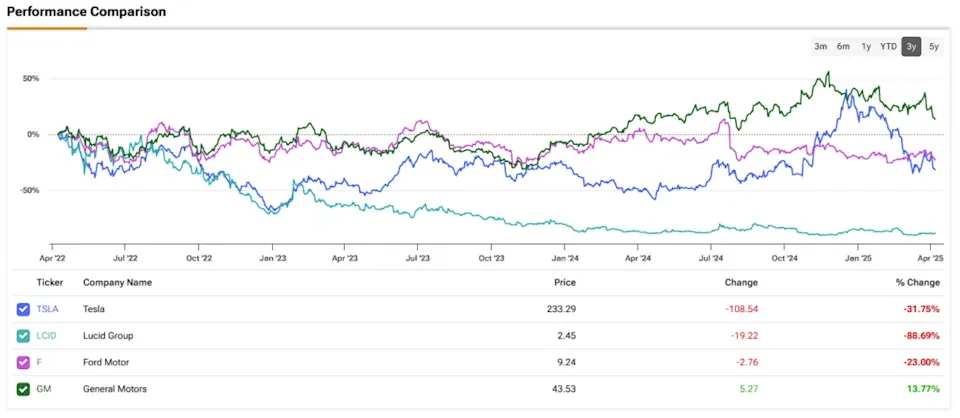

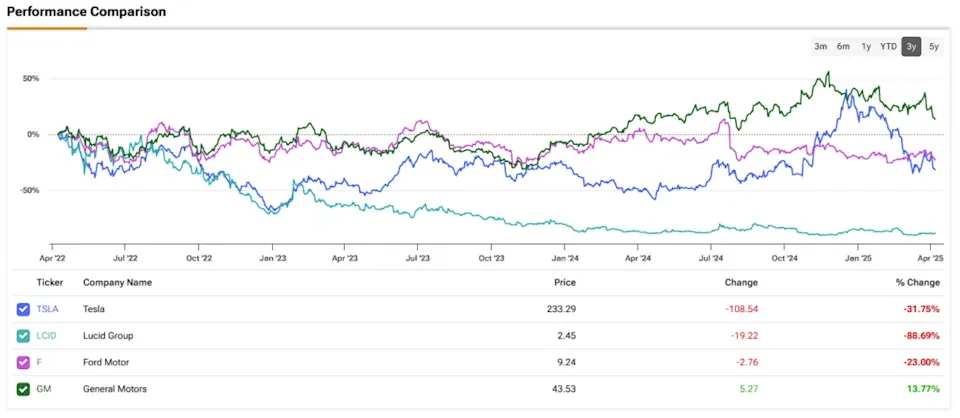

Tesla vs GM stock performance has become one of the hottest topics for investors in 2025. With the Tesla stock decline continuing to worry many shareholders and GM’s electric vehicle growth seemingly picking up more and more momentum lately, quite a few people are starting to question which company actually offers better value at this point.

Also Read: JP Morgan & Goldman Sachs Warn of 6 Market-Crushing Rate Cuts

Is GM Outpacing Tesla in 2025: Stock Performance and EV Growth

Tesla’s Troubling Numbers

Tesla’s recent performance has definitely alarmed quite a few investors and analysts alike. The company just delivered about 336,681 cars in Q1 2025, which shows a pretty concerning 13% year-over-year decline. This figure also missed analyst expectations of around 370,000 vehicles by a really significant margin.

A JPMorgan analyst reiterated an Underweight rating on Tesla and expressed concerns over “unprecedented brand damage.”

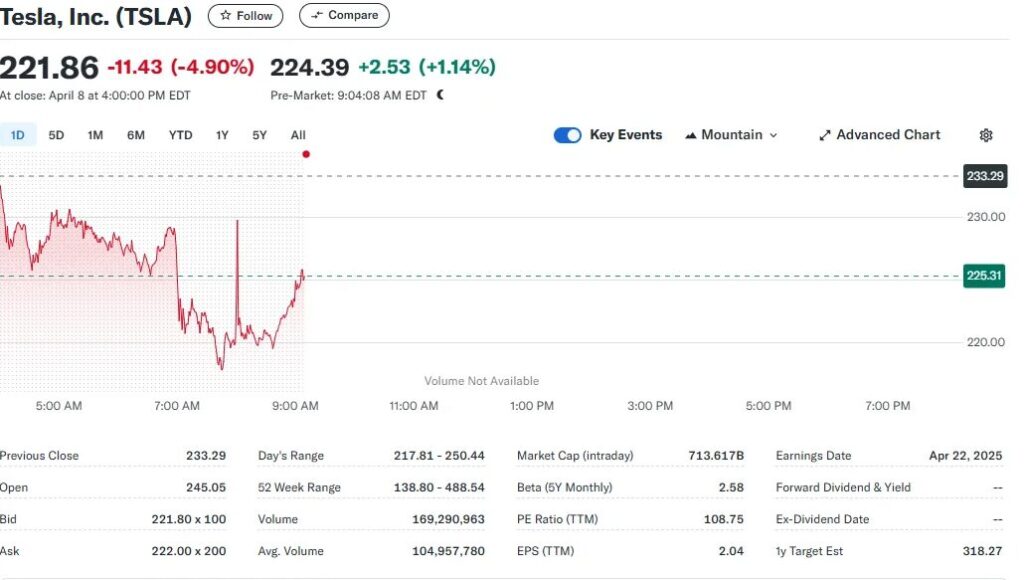

The Tesla vs GM stock performance comparison is growing more and more unfavorable for Tesla as public opinion continues to shift. A recent poll actually showed that about 36% of respondents have a “very unfavorable” view of Musk. Tesla’s incredibly high P/E ratio of 117.5 (compared to Toyota’s much more reasonable 6.3) suggests that investors still expect tremendous growth despite all of these ongoing challenges.

GM’s Strategic Advantage

General Motors has been effectively leveraging its extensive resources to make some significant progress in the EV market lately. GM’s proprietary Ultium battery technology now spans across multiple brands, which allows them to target various different market segments all at the same time.

GM reported retail sales of 114,432 EVs in 2024 and stated they “would produce and wholesale 200,000 to 250,000 EVs in 2024, boosted by a number of new launches, including the Equinox EV, GMC Sierra EV, Cadillac Optiq and Escalade IQ, and Silverado EV.”

The company’s well-established manufacturing capabilities and robust supply chain relationships certainly give GM some notable advantages when it comes to scaling up production. In the ongoing Tesla vs GM competition, GM’s strategic partnership with EVgo to build out charging stations directly challenges one of Tesla’s key competitive strengths.

Also Read: Shiba Inu for Retirement: How Much Fresh SHIB Did You Need for $2M Now?

Market Position Shifts

Tesla’s global EV market leadership has been eroded pretty significantly over the past year. Chinese automaker BYD has actually overtaken Tesla as the world’s largest EV seller at this point. And in Europe, Tesla’s new vehicle registrations dropped by a whopping 40% year-over-year in February.

Tesla continues to struggle with offering affordable options while BYD now offers its Dolphin Honor EV for just $15,700 with a 261-mile range, compared to Tesla’s models that start at over $30,000 with similar range capabilities.

The Tesla vs GM stock performance metrics highlight how the technological edge that once defined Tesla has diminished considerably as competitors rapidly catch up. Hyundai’s Ioniq 6 now offers an impressive 361 miles of range for just $43,600, while luxury brands have started to match or even exceed Tesla’s premium offerings in several key areas.

Investment Outlook

Wall Street currently gives Tesla stock a Hold consensus rating based on a mix of analyst opinions. Wedbush analyst Daniel Ives recently decreased his price target on Tesla from $550 to $315 per share, citing concerns that tariffs may accelerate the trend of Chinese consumers choosing domestic EV companies like BYD.

With over 20% of Tesla’s revenues coming from China, this definitely represents a significant risk factor for the ongoing Tesla stock decline potentially continuing throughout 2025.

GM stock potential for 2025 actually looks increasingly attractive to many analysts. Their more measured approach to EV expansion while maintaining a profitable traditional vehicle business presents a more balanced investment opportunity amid the ongoing Tesla vs GM stock performance battle that investors are closely watching.

Also Read: $2K in XRP by 2028? Here’s What One Top Bank Says You’ll Earn

Future Trajectories

Tesla continues pursuing ambitious but largely unproven future technologies. Elon Musk estimated that “Tesla’s humanoid robot, Optimus, could generate over $10 trillion in revenue long-term.”

GM, meanwhile, takes a more methodical and practical approach by steadily expanding its EV lineup while maintaining its traditional business. For investors who are carefully weighing the Tesla vs GM stock performance metrics, the choice increasingly comes down to personal risk tolerance. Tesla potentially offers higher returns but with much greater volatility, while GM presents a more conservative option with what seems to be a clearer path to sustainable EV growth in the coming years.