Tether, the company behind the world’s largest stablecoin, USDT, has seen its Bitcoin reserves jump in value by over $1 billion in recent months.

According to Chinese journalist Colin Wu, Tether currently holds 57,576 BTC worth around $2.4 billion, with an average purchase price of $22,480 per bitcoin. This means Tether’s Bitcoin stash has gained roughly 85%, or $1.1 billion, since its acquisition.

The rise in unrealized profit is primarily due to the surge in the price of BTC yesterday. Bitcoin breached $42,000 briefly before falling to its current price of $41,845. The coin has been up by 13.1% in the last seven days.

Also read: IRS Identifies $37 Billion in Tax-Related Fraud for 2023

Tether announced plans to allocate 15% to Bitcoin purchases

Tether announced plans in May 2023 to allocate up to 15% of net realized profits into Bitcoin on an ongoing basis.

This dollar-pegged stablecoin issuer views Bitcoin as a strong long-term investment, despite its volatility. “Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential,” stated Tether CTO Paolo Ardoino.

The stablecoin issuer likely boosted its Bitcoin stockpile to diversify its reserves beyond cash and cash equivalents. By holding BTC and other assets, Tether can shield its reserves from the loss of purchasing power during extended crypto downturns.

Also read: Bitcoin Hits 19-Month High of $42,000; Will the Momentum Hold?

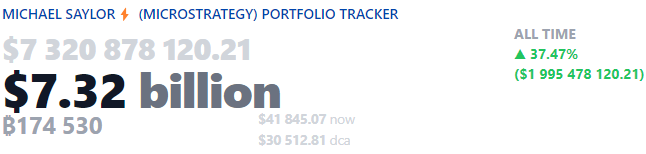

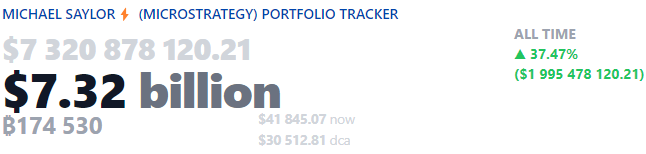

However, it is not just Tether that is enjoying a boost in profit. One of the largest institutional Bitcoin holders, MicroStrategy, saw its unrealized profit touch $2 billion when the price surged.

According to Saylor Tracker, MicroStrategy’s 174,530 Bitcoin stack is valued at $7.32 billion. All-time profit currently stands at $1 995,478,120, with a 37.47% surge.