Tether’s USDT minting has surged dramatically this July, and the stablecoin issuer just created another $1 billion USDT tokens, which actually pushes the month’s total to $8 billion. This aggressive expansion represents one of the largest monthly increases in stablecoin market cap right now, and it’s raising fresh tether printing concerns among market observers who are tracking the USDT supply surge along with related crypto whale activity.

Tether Prints $1B USDT in July Minting Surge

The latest Tether USDT minting operation adds to what has become an extraordinary month for token creation, actually. Since July 1st, Tether has been consistently expanding its supply through multiple large-scale operations, and each billion-dollar mint has been contributing to concerns about the rapid pace of stablecoin market cap growth.

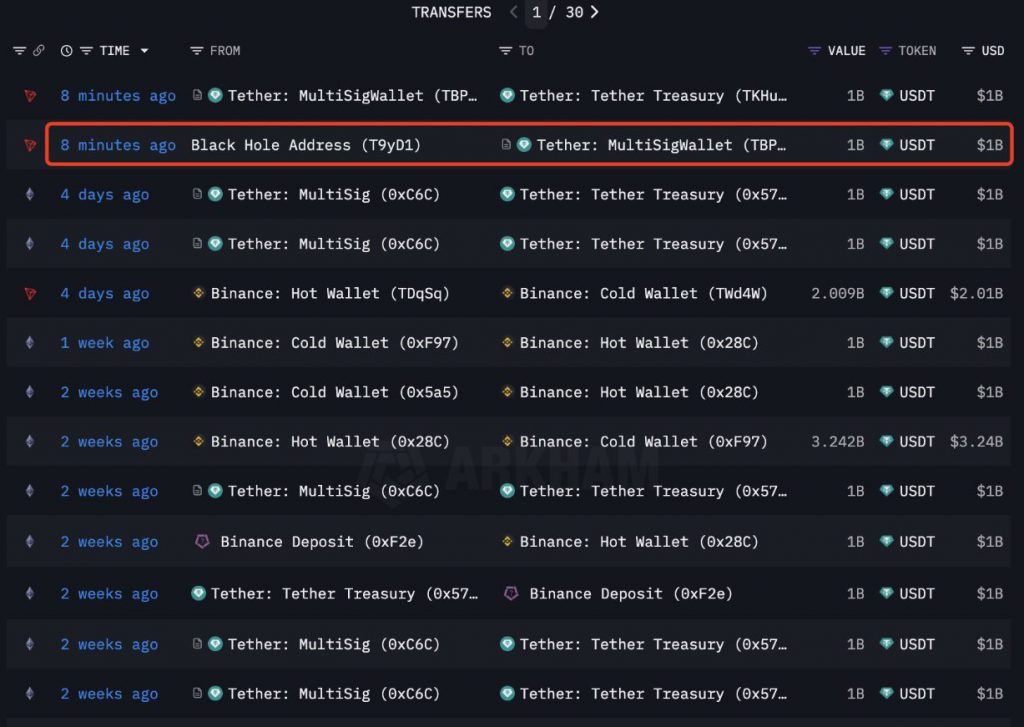

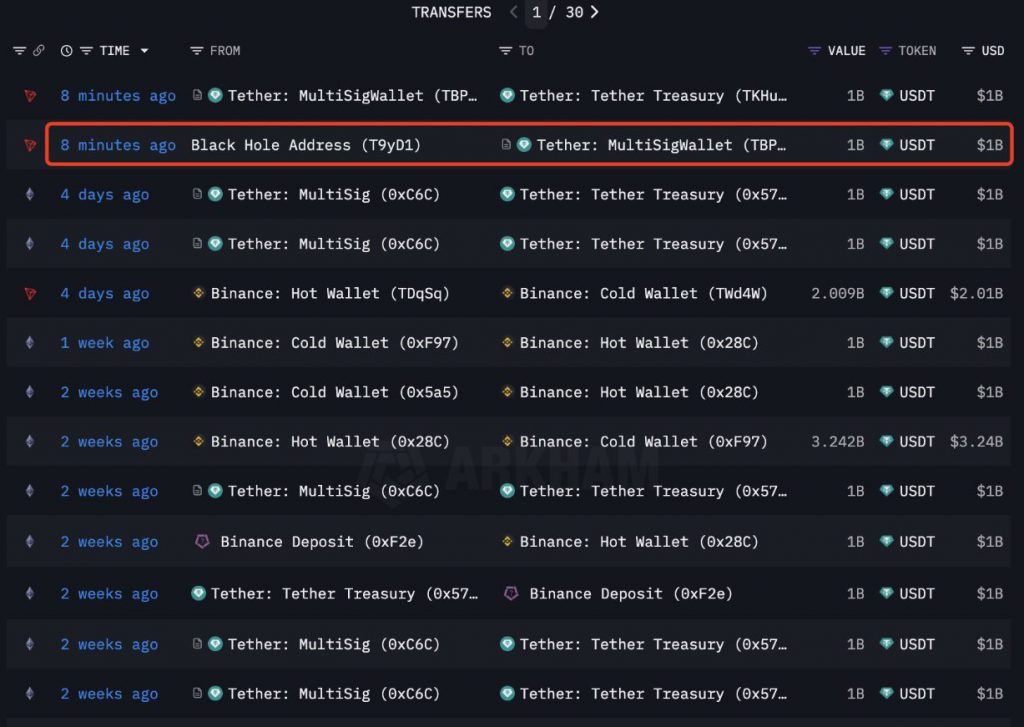

Tether(@Tether_to) just minted another 1B $USDT!

— Lookonchain (@lookonchain) July 28, 2025

Since July 1, #Tether has minted a total of 8B $USDT.https://t.co/Hpn4LisKe2 pic.twitter.com/k60rFmNR5x

This pattern of intensive USDT supply surge activity has been characterizing Tether’s 2024 operations right now. The treasury movements between wallet addresses and exchanges often signal increased institutional demand along with crypto whale activity, though the scale of July’s operations really stands out as particularly aggressive.

Also Read: Tether (USDT) Market Cap Hits $150 Billion for the First Time

Market Impact of Massive Token Creation

The $8 billion monthly total has actually amplified tether printing concerns within the cryptocurrency community. While some view increased supply as meeting legitimate market demand, others are questioning whether this rapid Tether USDT minting reflects underlying market pressures or even speculative positioning.

Trading data shows that the additional tokens have been absorbed across major exchanges, and USDT pairs are experiencing heightened volume right now. The expanded stablecoin market cap provides enhanced liquidity but also raises questions about long-term market stability, along with the sustainability of these aggressive expansion patterns.

Historical Context and Future Outlook

July’s Tether USDT minting spree actually represents unprecedented monthly growth in the company’s operational history. The consistent billion-dollar operations throughout the month have created one of the largest USDT supply surge periods on record, and crypto whale activity has been increasing alongside the expanded token availability.

Also Read: Tether Buys $750M Worth of Bitcoin in Q1 2025

Market participants are continuing to monitor whether this aggressive stablecoin market cap expansion will continue, or if token creation will return to more typical levels at the time of writing. The substantial increase addresses immediate liquidity needs while raising ongoing tether printing concerns about market dynamics along with regulatory oversight.