According to Lee Bratcher, President of the Texas Blockchain Council, Texas has purchased $5 million worth of BlackRock’s IBIT spot Bitcoin (BTC) ETF. According to Bratcher, a total of $10 million has been allocated from the general revenue, but only $5 million has been used. It is unclear if the remaining $5 million will also be used to purchase BTC or some other cryptocurrency.

Bitcoin Falls After Texas Purchases BlackRock IBIT ETF

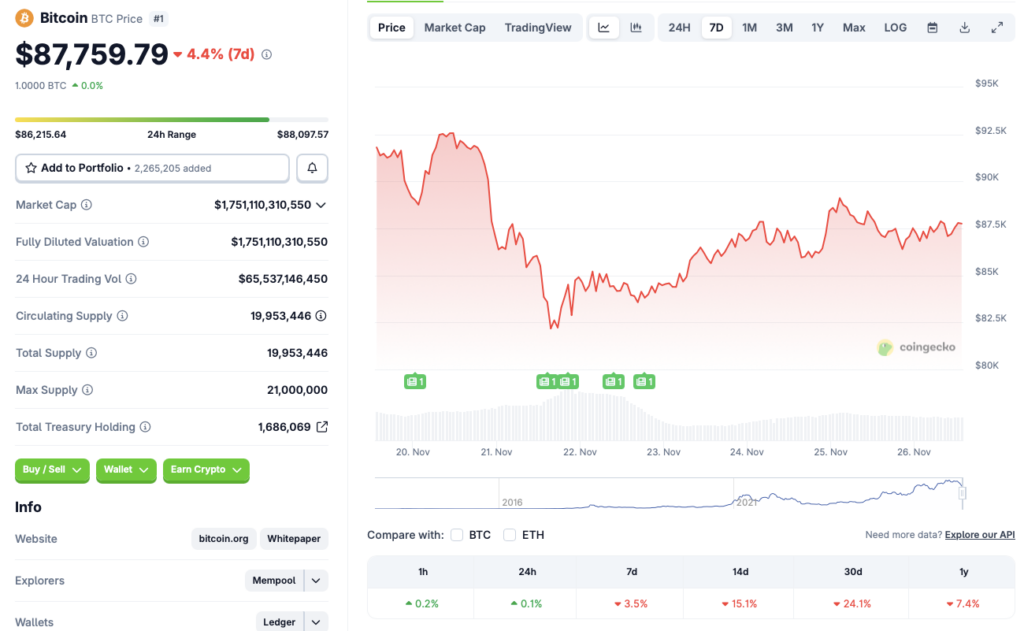

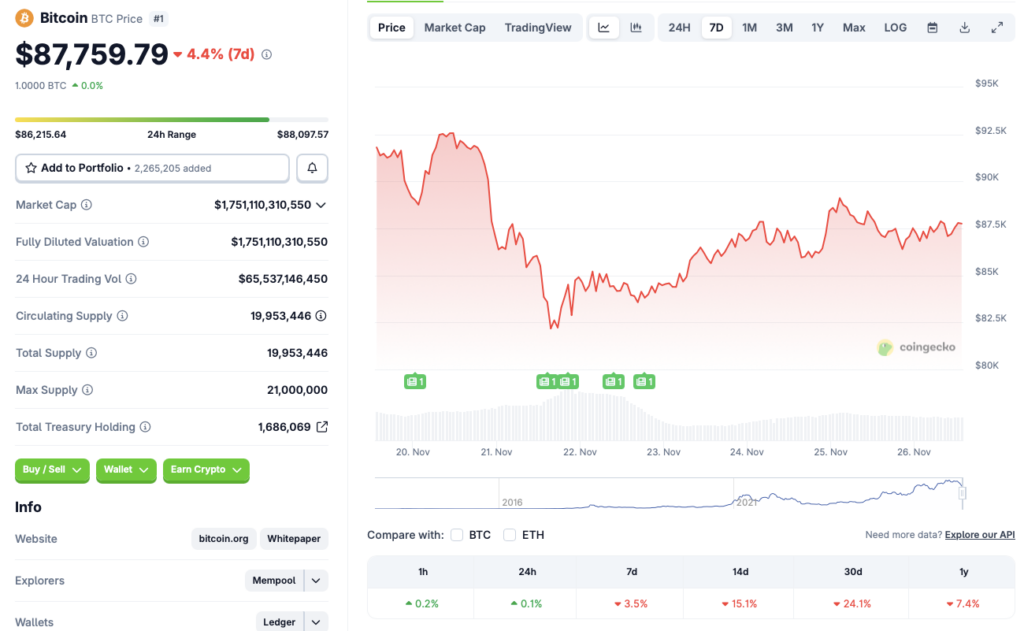

Texas made its investment on Nov. 20, when Bitcoin (BTC) was still trading above $90,000. BTC’s price plummeted to $82,000 on Nov. 21. The state of Texas may have missed buying BTC at its lowest by just one day. Nonetheless, the original crypto is expected to eventually hit never-before-seen price levels.

However, despite the recent crash, Bitcoin (BTC) seems to be recovering over the last few days. The asset has reclaimed the $87,000 price level and seems to be consolidating. According to CoinGecko’s BTC data, Bitcoin has rallied 0.1% in the last 24 hours, but is down in the other time frames. The original crypto has slid 3.5% in the last week, 15.1% in the 14-day charts, 24.1% over the previous month, and 7.4% since November 2024.

Bitcoin’s (BTC) recent crash was one of its most significant and fastest in recent memory. The crash was most likely triggered by macroeconomic uncertainties, such as slow economic growth, rising inflation, and high jobs figures in September. Moreover, the chances of another interest rate increase in 2025 have diminished substantially. Bitcoin (BTC) and other risky assets have bled following the dip in the chances of another interest rate cut.

Also Read: Bitcoin Has Crashed 21 Times And the Outcome Will Surprise You

Early 2026 may bring some relief to Bitcoin (BTC) and the larger crypto market, given that macroeconomic conditions improve. However, there is also a chance that we will enter a prolonged crypto winter.