The Texas Bitcoin reserve law officially became reality when Governor Greg Abbott signed Senate Bill 21, establishing state-backed crypto reserves and enabling Texas public crypto buying through direct state investment. This government Bitcoin strategy creates the first legally protected Bitcoin legal framework Texas has implemented, setting new standards for cryptocurrency adoption at the state level right now.

Also Read: Metaplanet Buys Another 1,111 Bitcoin Worth $111M; BTC Eyes $117K

Texas Bitcoin Reserve Law Spurs State-Backed Crypto Strategy Push

Protected Investment Framework Enables Public Bitcoin Purchases

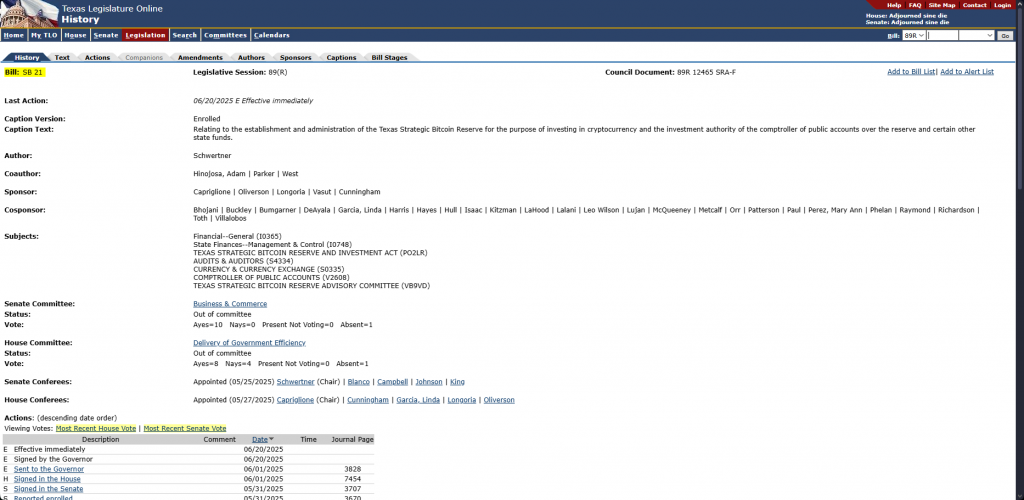

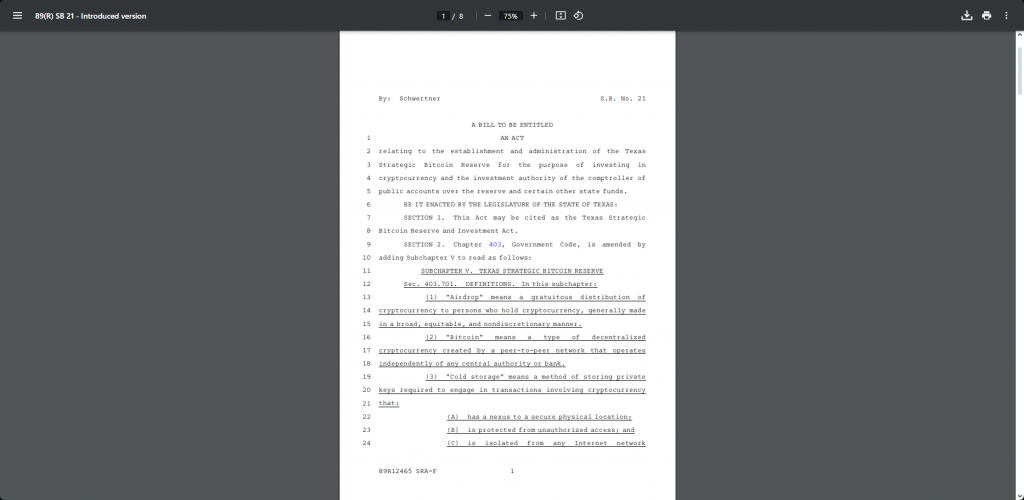

The Texas Bitcoin reserve law establishes the Texas Strategic Bitcoin Reserve through Senate Bill 21, which was signed into law on June 20, 2025. This government Bitcoin strategy authorizes the state Comptroller to buy, sell, hold, and also manage Bitcoin investments, creating a dedicated fund for Texas public crypto buying operations at the time of writing.

State-backed crypto reserves under this Bitcoin legal framework Texas has created require digital assets to maintain an average market capitalization of at least $500 billion over 24 months. This threshold currently limits investments to Bitcoin, though the framework could also accommodate other qualifying cryptocurrencies.

Security and Operational Guidelines Structure Investment Process

The Texas Bitcoin reserve law mandates institutional-grade custody arrangements through qualified custodians or liquidity providers. Digital assets can enter state-backed crypto reserves through multiple pathways including direct purchase, forks, airdrops, or donations, providing flexibility for Texas public crypto buying strategies at this time.

House Bill 4488 provides additional legal protections, exempting the reserve from legislative sweeps that could redirect funds to general state purposes. This ensures the government Bitcoin strategy maintains financial independence and also cannot be dissolved by future legislatures.

The legislation requires biannual public reporting on reserve performance and status, with an advisory committee providing oversight while the Comptroller retains ultimate authority over investment decisions under the Bitcoin legal framework Texas has established right now.

Also Read: Hong Kong Passes Stablecoin Law Amid Global De-Dollarization Shift

The Texas Bitcoin reserve law positions the state as the third to authorize public cryptocurrency investments, but the first to establish comprehensive legal protections for state-backed crypto reserves. This Bitcoin policy of this government acts as a guard against inflation and economic fluctuations and Texas public purchases of crypto can be a strategic method of diversification rather than speculation in the strengths of our legal system with strong guidelines which Texas has now enacted to follow with Bitcoin.