It is a known fact that Bitcoin’s supply is capped at 21 million. Satoshi Nakamoto, the pseudonymous creator of the king-coin, set the ceiling to make the crypto scarce and control inflation.

Over the years, Bitcoin’s adoption has tremendously grown and the appetite of participants all across the spectrum—right from retail to institutional—has increased.

The core ideology remains to be quite simple – if there is limited supply of Bitcoin, its value would eventually rise as there will be more demand and less supply.

New Bitcoin mining milestone alert

The number of Bitcoin in existence typically changes every 10 minutes when new blocks are mined. By March 2022, close to 18.9 million coins had already been mined and were in circulation. Since then, the community had eagerly been waiting for the 19,000,000 mark to be attained.

Well, the much-awaited day is finally here. In what is the latest development, Bitcoin number 19 million has just been mined.

Well, it took nearly 12 years for Bitcoin’s circulation supply to cross 19 million and this basically means that only 2 million Bitcoins are left to be mined.

So, what happens when Bitcoin runs out of supply?

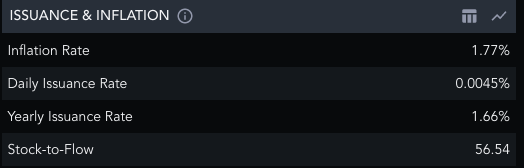

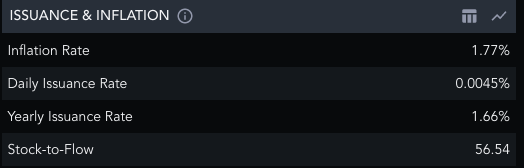

It goes without saying that that once the remaining coins are mined, Bitcoin as an asset, will become more scarce. The current BTC inflation rate stands at 1.77% while its S2F stands around 56.54. Going forward, the former is set to decrease even further, while the latter is expected to notch up.

Typically, a higher S2F indicates less supply entering the market, and in effect, translates into more scarcity and less inflation. The said phenomenon aids the asset’s price to climb up higher over the long term.

What about Bitcoin miners?

Once all coins are mined, miners would eventually start depending on transaction fees, instead of block rewards. As such, miners are rewarded Bitcoins for performing a set of transactions successfully.

This reward is halved every four years. In 2009, the reward for each block mined was 50 BTC. After subsequent halvings, the number shrunk to 25, 12.5, and currently stands at 6.25 coins per block.

At a block height of 840,000, the next halving is set to take place in 2024, with the rewards coming down to 3.125 coins per block. The said cycle is set to continue and per estimates, the last Bitcoin is expected to be mined by only 2140.

Beware of the rampant selling

Right before the “mega 19 million” event, a set of miners sold their HODLings. The Miners’ Position Index witnessed a quite a prominent spike to 4.22 on its chart on 28 March, bringing it to a yearly high.

This indicator essentially gauges the ratio of total miner outflow (USD) to its one-year moving average. In that essence, higher values usually indicate rampant selling.

Reacting to the same, Bitcoin’s price has been on a downtrend of late. After shedding 5% of its value over the past 24 hours, the king coin was priced at $44.8k at the time of press.