The Federal Reserve (FED) wields its latest weapon to beat the highest rate of inflation the country has ever witnessed in 40 years. The FED made the highest hike ever in interest rates in two decades.

The FED announced on Wednesday that it is increasing the short-term interest rates by 0.5%, which is the highest hike since 2000. The two-day meeting was concluded on Wednesday with the announcement of the hike. The very first increase in interest since 2018 was made in March by 0.25%.

FED’s decision and bitcoin price drop

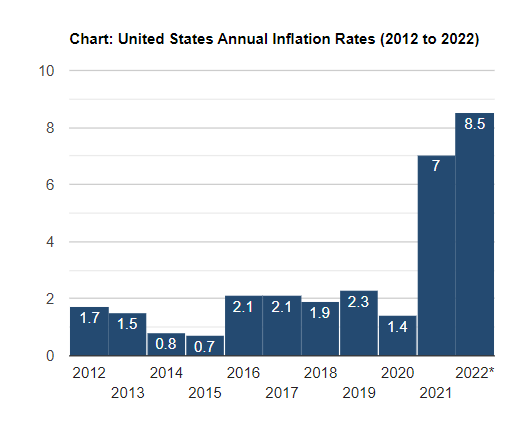

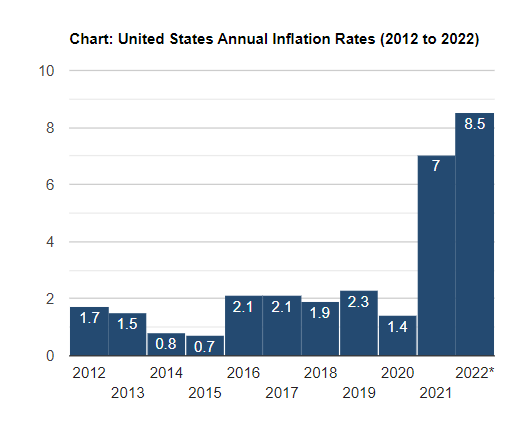

Ever since the Federal Reserve started increasing the interest rates, the price of BTC has dropped by 40%. The swift decision is to overcome and fight against the soaring inflation, which has soared to over 8.5% in March.

The decision by FED is also to lower the demands for goods and services, which is evident as it will drop with the increased interest rates. With the increase in rates, it will become equally more challenging to purchase a car or home or to borrow money for additional purchases.

The rise in interest rates will tame the skyrocketing inflation. The decision will most probably affect the budget of an average American. The FED has been pointed out for not taking an appropriate stance against inflation. The war situation amidst Ukraine and Russia has also created inflation triggers globally.

The FED also announced that it would adjust some of the bonds and securities from its balance sheet by selling them off. Ever since the beginning of the pandemic, it has doubled in size to $9 trillion.

The hike might not come to a halt soon as the economists suggest. They forecast that the FED might hike another 0.5% in June, with further increases that might follow in 2022. The committee took into account various information and statistics before concluding a decision.