De-dollarization moves beyond funds, and also money as BRICS countries are pushing for economic de-westernization. French economist Jacques Sapir presented this economic shift at the latest BRICS meeting in Kazan.

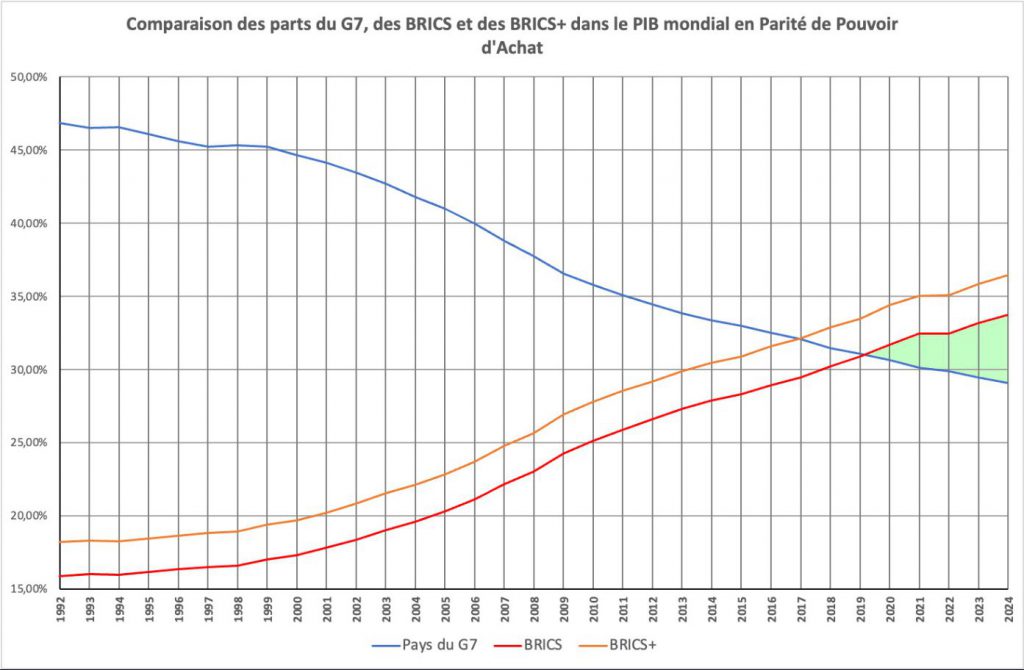

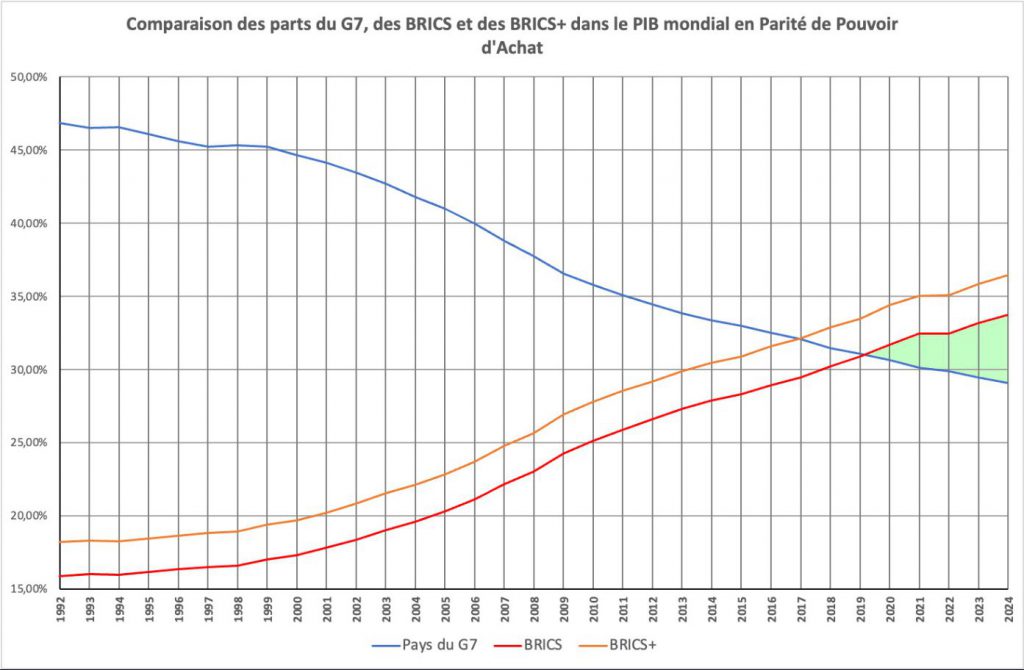

These changes affect the global finance in a few important ways. BRICS is now in control of 33% of world’s money, while G7 has 29%. This economist insight is worth knowing. This is especially true as new members Egypt, Ethiopia, Iran, and UAE bring fresh global finance power to the group.

Also Read: De-Dollarization: These 5 ASEAN Nations May Soon Dump The US Dollar

Examining the Economic Shift: De-dollarization and De-westernization Insights

Partner Countries and Asian Dominance

Sapir had this to say:

“The institutionalization of the ‘partner countries’ category within BRICS creates a ‘BRICS zone’ around the core members.” It is also worth noting that Indonesia, Malaysia, Thailand, and Vietnam have joined as partners.

This makes BRICS more powerful in Asia, where it could become “hegemonic in this region.”

BRICS Clear System Launch

The summit launched BRICS Clear, which is a new payment system for national currencies. Sapir had this to say on the topic:

“Transaction clearing will be handled through a ‘stablecoin’ managed by the New Development Bank.”

The system builds on ideas from the European Payments Union (1950-1957). Instead of dollars, it uses local currencies. It will start with 22 countries and operate outside SWIFT.

Insurance and Trade Infrastructure

BRICS set up its own insurance company to break free from Western firms. We wouldn’t have believe this a few years ago! Sapir made the following statement:

“With the BRICS (Re)Insurance Company, BRICS is building its independence from Western insurance companies.”

This economist’s insight shows how BRICS supports trading among its members. Because any country can join this trading network, it is a huge plus.

Also Read: Will Tesla (TSLA) Claim $310 Amid The Recent US Elections Hype?

Trade Impact and Market Shifts

Rich countries will sell less to BRICS if the situation persists. Their losses could be around 5-7%, and even worse for some countries.

Sapir also revealed:

“Intra-BRICS trade and trade with partner countries represents 35-40% of global trade.”

He estimates that in five years, most BRICS trading will use their own payment system. This could remove a quarter of all world trade from the dollar system.

Future Economic Implications

This BRICS clearing challenges the entire Western control in global finance, but some will say it’s long overdue.

Sapir had this to say:

“The shift from 58% to 34-39% in Central Bank reserves would imply massive sales of Treasury bonds.”

As you can see from the statement, he warns of problems with refinancing U.S. debt. Will the U.S. resolve this issue? Only time will tell.

Also Read: 2 Stocks To Buy on U.S. Election Day

The Euro will probably be less impacted due to the EU’s focus on trade. This can be a saving grace for the European Union, but the details remain to be seen. The move toward global de-westernization reshapes international finance, as it was to be expected. Stay tuned for more current news.