The Sandbox, the 2nd largest gaming cryptocurrency by market cap, was among the first tokens to break above its multi-week downtrend. It did so on 16 March by registering a long green candle on its chart. After briefly consolidating, SAND managed to go as high as $3.86 in the day’s trade yesterday.

However, as the broader market tumbled on Friday, The Sandbox too fell off the slippery slope. At the time of press, it was noted that SAND was already down by 9% in the past 24 hours and was exchanging hands around its 9-day low at $3.3.

The Sandbox traders are ringing the bearish bells

On the Open Interest [OI] front, Sandbox witnessed an evident spike to $264 million yesterday. The same put it at levels reminiscent of the late December – early January period. Rising open interest usually means that new money is flowing into the marketplace and more often than not, end up making ongoing trends even more concrete.

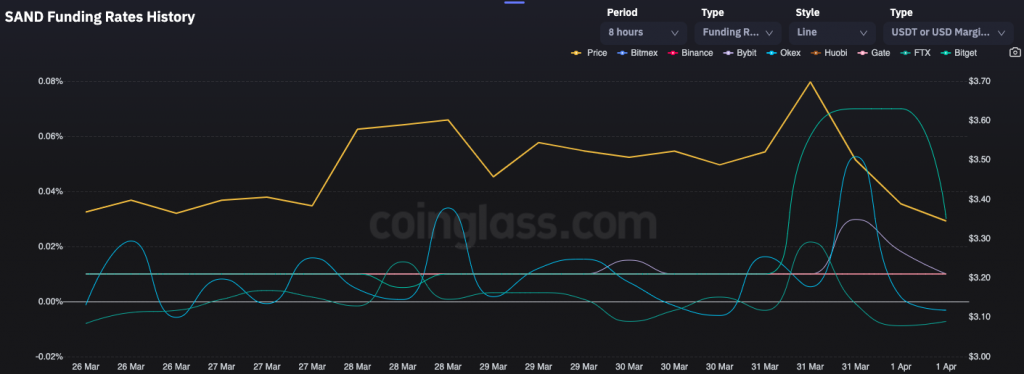

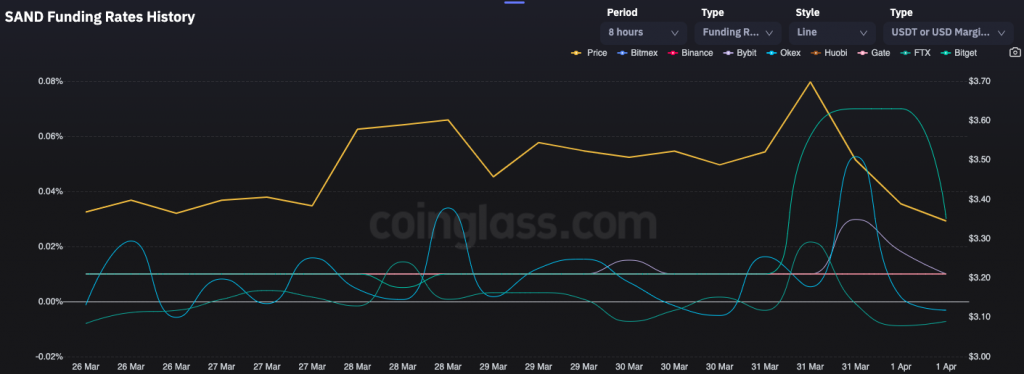

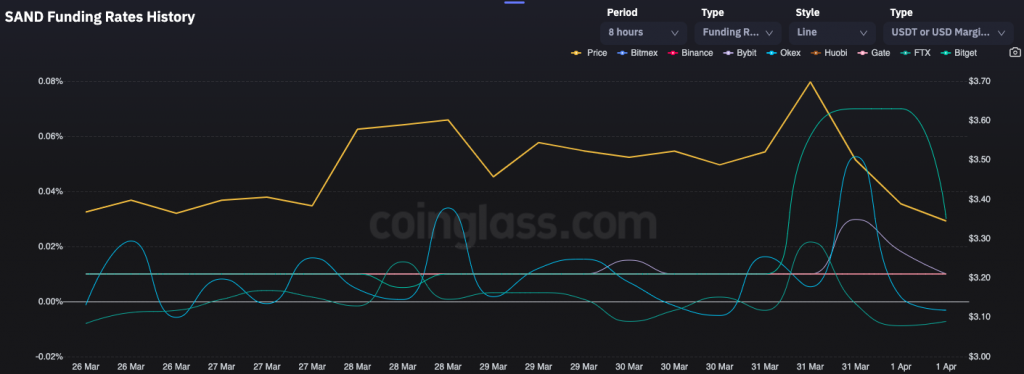

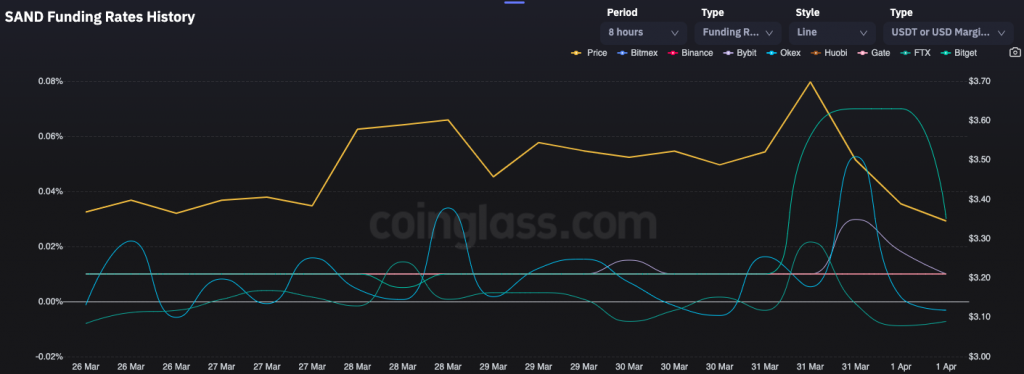

The Sandbox’s funding rate on almost all major exchanges had already started tumbling. On OKEx and FTX, it was already lingering in the negative territory, while the curves of all other exchanges pointed southward.

To a fair extent, this indicates that bearish traders are trying to gradually assert their dominance. Simply put, the same implies that traders have now started inclining towards placing short bets and are getting not-so-optimistic about the short-term prospects.

The long-short ratio for Sandbox was revolving around 0.7-0.8 at the time of press, further supporting the bearish thesis.

Thus, given the collective sentiment of the futures’ traders, The Sandbox, in most likelihood, is set to continue flashing red numbers on its charts over the next day.