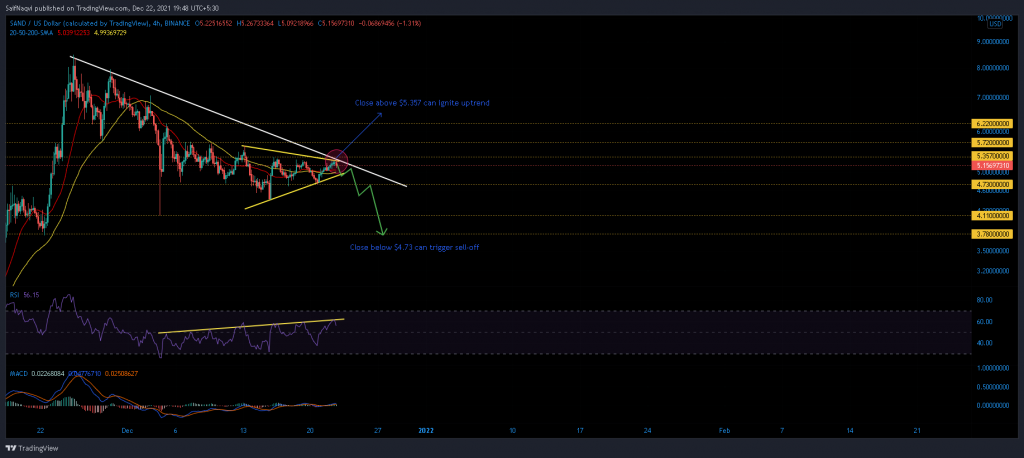

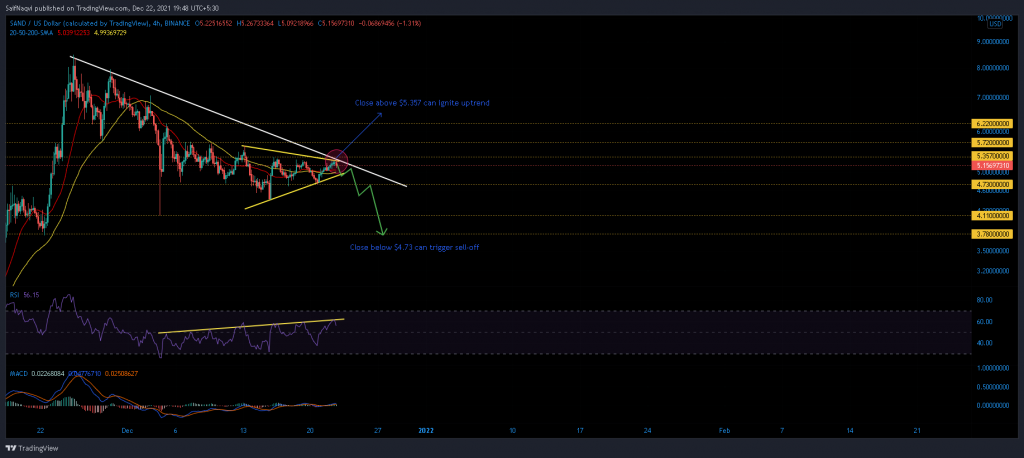

For the majority of December, The Sandbox has traded between two price levels as neither bulls nor bears have remained dominant. The formation of a symmetrical triangle now indicates an incoming swing in either direction although bears do hold a slight edge. Meanwhile, bulls would hope that SAND shrugs off a major bearish divergence set up on the RSI and tackle key swing highs to get its price rolling. At the time of writing, SAND traded at $5.15, up by 0.5% over the last 24 hours.

The Sandbox 4-hour time frame

Since registering an ATH at $8.5 in November, SAND has been on a consistent downtrend. An upper sloping trendline charted a near 50 descent from the top and posed as resistance. In fact, this trendline combined with the upper boundary of SAND’s symmetrical triangle formed a crucial resistance barrier between $5.28-$5.37. Once sell pressure is overcome at the aforementioned zone, SAND can set up an immediate 8% hike to 7 December’s swing high at $5.73. From there on, SAND would require help from a broader market resurgence to tackle sellers at $5.73. This would lay the initial foundation for a fresh uptrend.

Conversely, any moves below $4.73 support would invalidate these bullish predictions. A breakout in the opposite direction would call support levels of $4.11 and $3.78 into action.

Indicators

Unfortunately, SAND’s lower highs as opposed to the RSI’s higher highs set up a massive bearish divergence. This indicated that the price trend is actually weakening and set up a potential sell-off. The Awesome Oscillator’s bullish-neutral nature did little to turn heads.

Conclusion

Considering the abovementioned indicators, SAND’s symmetrical triangle was given a bearish preference. Chances of a 20% sell-off were greater than an upswing, especially considering recent weaknesses in the broader market. Hence, a safer bet would be to stay put till the price clears a crucial resistance barrier. Traders can go long once SAND closes above $5.37 on strong volumes. If SAND manages to scale beyond $6.22 on the back of an uptrend, new ATH’s certainly on the table.