Bitcoin and Ethereum have an unprecedented stronghold in the collective crypto industry. At press time, both the assets have a combined market cap of approx $813 billion which is an overall dominance of 60.6%. There is no doubt that the movement of these coins, primarily dictates the directional bias of the entire market, even more so during a bearish market.

While Bitcoin’s market is more than 2x of Ethers’, the Altcoin has managed to outperform Bitcoin for several months at stretch. There is better cohesiveness between their reactivity and movement. But now, a trend is formulating between these assets which may strongly decide the immediate future for the Altcoins.

Bitcoin-Ethereum correlation; the only important market dynamic?

During a bullish market, most Altcoins register independent rallies. A flock of new investors enters the market and projects with hype and potential, astronomically spike in the charts. During a bearish period, the scenario flips on its head and most assets follow Bitcoin and Ethereum. But why both the assets, and not just Bitcoin?

Well, since the beginning of 2019(the end of crypto winter in 2018), Bitcoin witnessed a growth of 1303% against Ethereum’s 1184% in 12-months. However, in 2020, Ether registered better returns with a 664% peak return in comparison to BTC’s 484%. Fast forward to 2021, between January to November 2021, BTC’s ROI peaked at 135%, whereas Ether completely outperformed the former with a return of 581%.

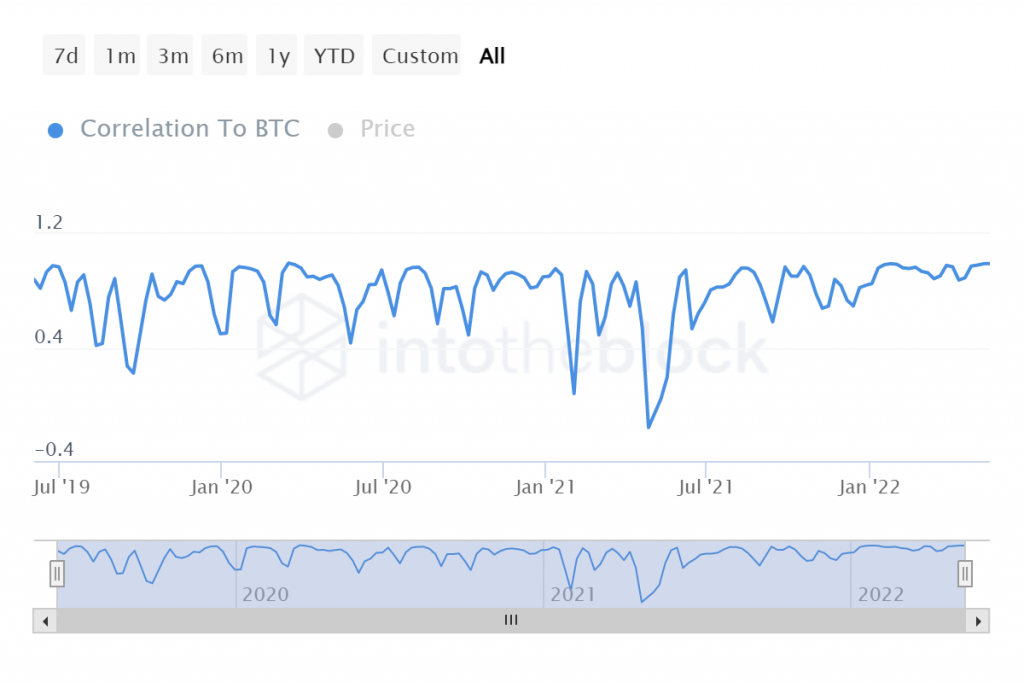

Hence, liquidity pulled by Ethereum has tremendously improved and the Altcoin has been able to bridge the gap in terms of value dominance. One of the reasons has been the increasing correlation between Bitcoin and Ethereum. Since the beginning of 2022, their correlation has not dropped below 0.80, and over the past 30-days, it was recorded to be as high as 0.99.

There is a vested interest in both the assets despite market cap discrepancy, and now it is vital to understand why their relationship in the market could inflict a major impact on the other Altcoins.

Ethereum/Bitcoin market collapse?

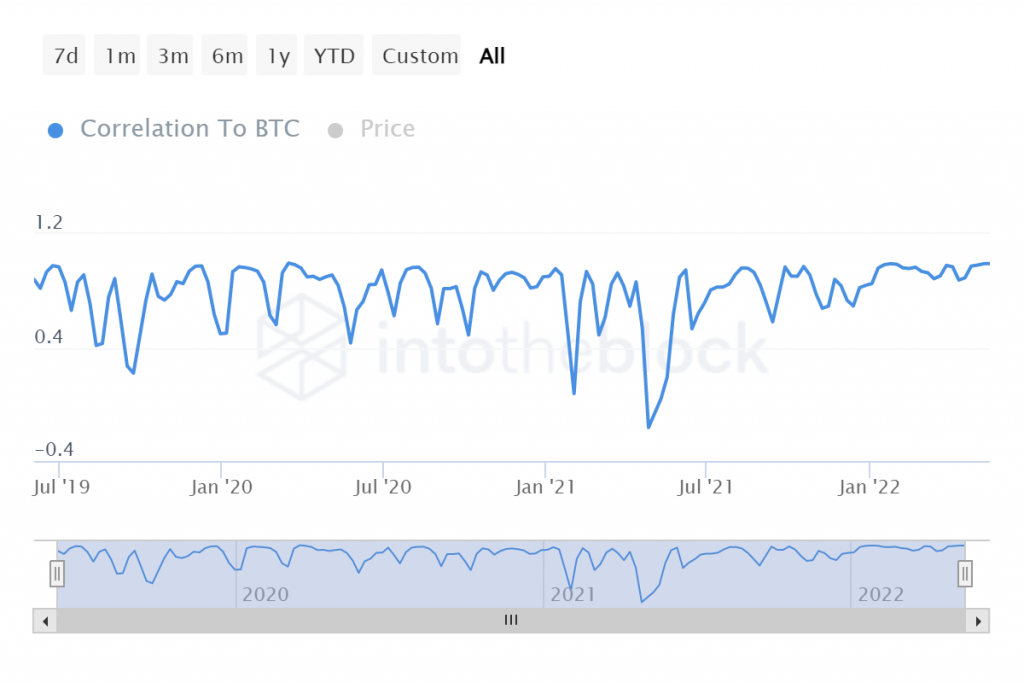

The above chart highlights the relationship between Ethereum and Bitcoin’s movement as trade pairs. Now, at press time, the index continues to form lower highs which is technically a macro-bullish scenario. However, the trend is now moving in an ascending channel pattern.

A bearish disruption of this pattern would mean that Ether’s losses against BTC might compound in the market, leading to a strong exit in liquidity. Ethereum’s strong position plays a vital role for the Altcoins, and acceleration of losses against Bitcoin’s value would inevitably bleed out from the rest of the market at a similar rate.

Brace Yourself

It is important to note that the above chart was based on a weekly time frame, so there isn’t an immediate danger. However, volatility could immediately change the course of the market, and another bearish leg down might trigger significant losses for Altcoin investors. It is extremely important to keep an eye on this development over the next weeks, as it could mark the start of a new bullish rally, or confirmed a long-term bearish market.