As Bitcoin began flashing signs of recovery on Thursday, most alts from the market started acknowledging and replicating the same. Amongst the large and mid-cap coins, Bitcoin’s forked variant—Bitcoin Cash—noted the highest surge.

While BTC’s value stood at $41.2k after appreciating by 4% on the 24-hour time frame, BCH was up to $345, after rallying by 13%.

BCH’s adoption has been on the rise of late. Just a month back, for starters, a Member of the Parliament of St. Maarten had his entire salary paid to him made in BCH. Alongside, it was also speculated that the country could potentially make Bitcoin Cash its legal tender.

In fact, companies from around the world have started accepting this crypto as a mode of payment, with Canada’s Brant Cannabis being one of the latest ones to do so.

Time to zoom out

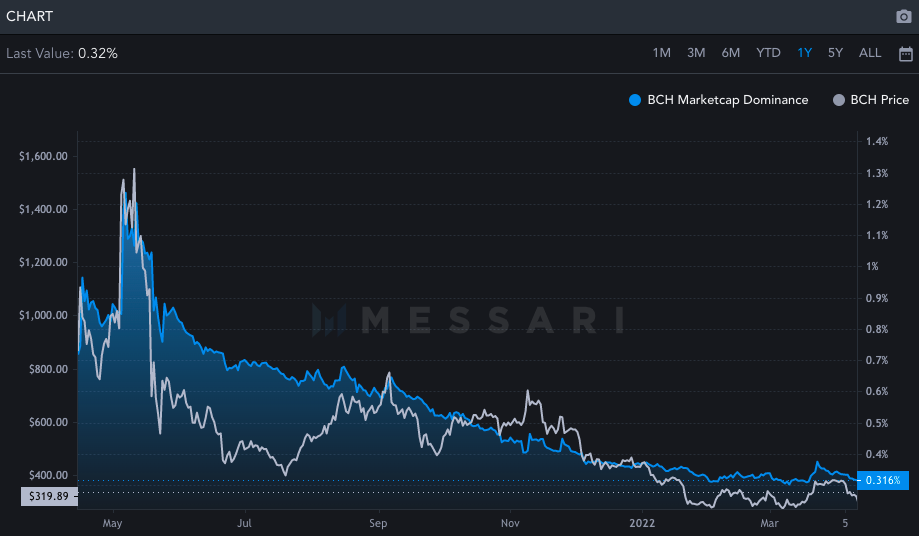

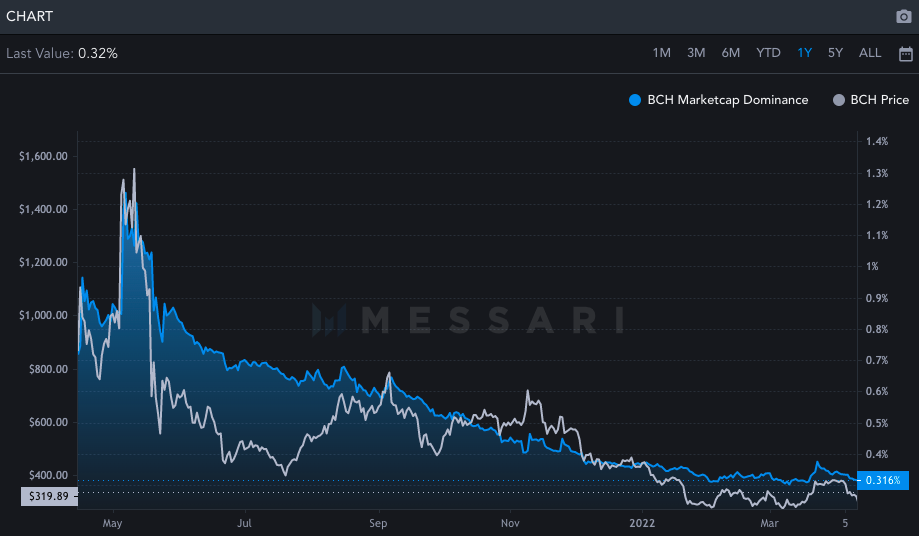

Even though the 25th ranked crypto’s adoption seems to be legit and its surge looks quite enticing, things are quite cluttered up for BCH on the macro frame. Right after the fork in 2017, BCH went on to reach the brink of the $4000 mark. Post that, as the hype got fizzled out, its valuation deflated to merely three digits.

However, last year, during the alt-season rally in April-May, BCH pushed all the way to $1400. The flash crash that followed dented the token’s prospects, and despite mild recoveries here and there, the sun’s rays have hardly fallen in BCH’s empire ever since.

Consequentially, the market cap dominance of this altcoin has dunked from 1.25% to 0.3% in less than a year’s time.

Bitcoin v. Bitcoin Cash

It’s almost four-and-a-half years since Bitcoin Cash split from Bitcoin, and the former’s on-chain activity remains to be quite underwhelming. Over the past 24-hours, for starters, transactions worth $82.7 billion were carried out on the OG Bitcoin network. However, on the Bitcoin Cash network, the cumulative daily settlement was merely worth $162 million.

In fact, BTC had managed to amass a fee of $0.5 million from the same, while BCH was only able to generate $314.

In terms of active address too, Bitcoin’s 960k, by and large, managed to overshadow Bitcoin Cash’s 81.6k.

Just like how Ethereum Classic has been benefiting from Ethereum’s price movements, Bitcoin Cash has been benefitting from Bitcoin’s rally. So, as long as the king-coin continues to make strides, BCH can be expected to fetch its investors positive returns. BHC’s weak fundamental legs, however, cannot assume responsibility and change the fate of this coin single-handedly.