More often than not, numbers narrate their own tale. Coins from the meme category ensure to take people from the community by surprise on almost a daily basis. Of late, 4-digit percentage surges have become quite common. But, in what is the latest development, a particular coin from the top 10 list managed to post a 5-digit rise.

ERC-20, a meme coin with a market cap of over $55.5 million, has managed to fetch its investors with a whopping 43,000% gains in just a single day. Just a few hours back, this coin was trading at a level as low as $0.00011. However, at the time of this analysis, ERC-20 managed to eliminate a couple of zeros post its point and was seen trading at $0.051.

Well, the current 588th ranked crypto, is open-ended by design and has the ability to adapt and be more than just a cryptocurrency. It has already dipped its toes into the decentralized world. In fact, its built-in smart contract makes it possible for users to carry out transactions without the participation of external intermediaries or third parties. In essence, its economic layer is one of its strong suits.

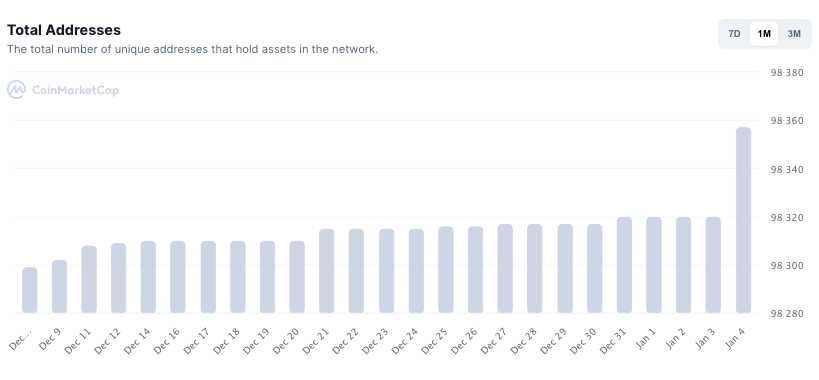

The price hike, to a fair extent, has managed to improve ERC-20’s on-chain activity. The total addresses, for starters, witnessed one of their sharpest surge on 4 January and was seen hovering around the 98,360 mark at press time.

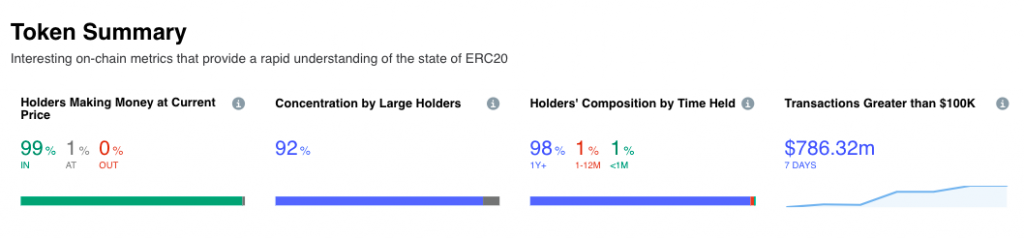

Post such an astronomical hike, almost 99% of the HODLers were ‘in the money’ or in profits, while the remaining 1% who joined the party late was in a no-loss, no-gain state. Parallelly, it should also be noted that that the number of transactions greater than $100k has steeply inclined over the past week, implying that market participants have been buying tokens. In effect, it can be argued that the price rise, to a large extent, has been organic.

At this stage, it would not be fair to overlook the HODLer behavior. As per CMC’s data, 92% of the ERC-20’s supply is held by large HODLers. This means that even if one player ends up selling his/her HODLings, the token’s price has the potential to get massively dented. Nonetheless, a majority [98%] of the aforementioned HODLers have clung to their tokens for a period of more than a year, which means they have faith in the long-term future of this token.

So, if these large players continue behaving in the same way and do not exit the market post-booking profits, then ERC-20’s surge would last for some more time. However, if the selling pressure gradually picks up pace, then the odds of the price going downhill would intensify.

Despite the glitzy side, market participants shouldn’t get completely swayed away by the fancy return rates. As always, it is advisable to exercise adequate caution and DYOR before shelling out and directing funds towards such meme-coins.