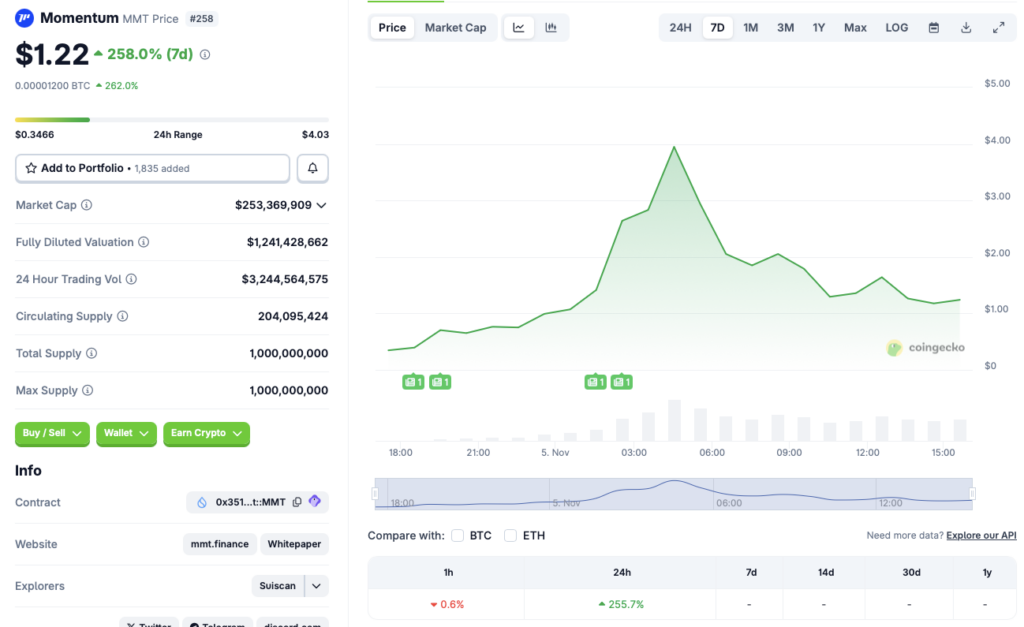

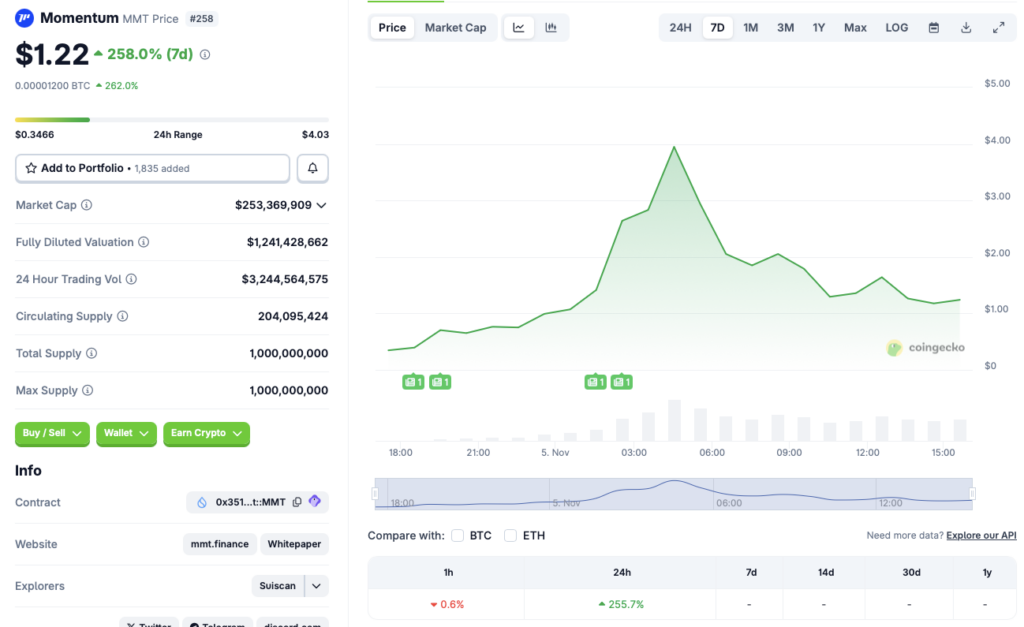

Momentum (MMT) has registered a massive 255.7% rally in the last 24 hours, despite a cryptocurrency market crash. Momentum is a crypto exchange based on the Sui blockchain, and MMT is its native token. The project hit $1 billion in fully diluted valuation, and trade volume surged to more than $600 million upon launch. The latest rally follows Binance’s recent announcement that the exchange will list MMT on its platform. MMT has also received listings from Bybit, MEXC, OKX, and Upbit.

Will Momentum’s Rally Survive The Cryptocurrency Market Crash?

The crypto market is facing a substantial sell-off right now. CoinGlass data notes that more than $1.7 billion was liquidated from the cryptocurrency market in the last 24 hours. MMT’s ongoing surge is likely due to its recent listings. However, given the larger market environment, the rally may cool off in the coming days. Investors may book profits and turn to hedge their capital in other assets, such as gold.

Momentum (MMT) also faces risk from macroeconomic factors. Federal Reserve Chair Jerome Powell has warned about slow economic growth and rising inflation. Both developments have likely led to a dip in investor sentiment. The recent interest rate cut did little to boost investor confidence, despite being a bullish development.

Also Read: Top 3 Crypto Dips To Buy Now That Bitcoin Is At $101K

Another risk to Momentum’s (MMT) rally is the ongoing US government shutdown. The US government is facing its longest shutdown in history. Investors and market participants are likely taking a cautious approach to risky assets. Cryptocurrencies and other risk-heavy financial vehicles may continue to suffer until the matter is dealt with.

Additionally, the dip in ETF inflows also adds to cryptocurrency investor worry. ETFs have played a vital role in the market rally earlier this year. The dip in ETF inflows may also lead to a prolonged bear market.