Transition phases are generally quite wobbly in nature. However, as the year changed from ’21 to ’22, most of the coins from the crypto space stuck to their ongoing trends. Quite similar to other large-cap coins of the market, even Solana had a mediocre start to this year.

Nonetheless, the aforementioned fifth-largest coin of the market exhibited quite a prominent trend-reversal sign at press time. Now, as can be seen from the snapshot attached below, SOL has remained glued to price levels in and around the $167 range. Since 30 December, the coin has tested the said level three times, thereby forming a triple bottom.

The aforesaid pattern typically follows a prolonged downtrend. The first bottom is usually perceived to be a normal price movement while the second bottom is indicative of bulls gaining momentum and prepping for a potential reversal. The final bottom, in most cases, indicates that there’s strong support in place and bears might capitulate soon.

As expected, the candle in the making on the 4-hour chart was in green at the time of writing. On any usual day, this would denote the initial leg of an uptrend. However, given the current state of the broader market and the state of a few crucial metrics, nothing much can be said with surety.

Roadblocks

Most of the coin’s metrics painted a bleak picture at the time of this analysis. The coin’s Sharpe Ratio was seen hovering in the negative territory. This means that investors are currently not being fetched with adequate returns for the risk borne by them.

Diminishing returns, on any day, do not serve as an inviting incentive to new investors. So, without the push received from new investors, SOL would find it difficult to defy its ongoing downtrend.

Additionally, the coin’s market cap dominance has been on the fall, implying that SOL has gradually been losing its say in the market.

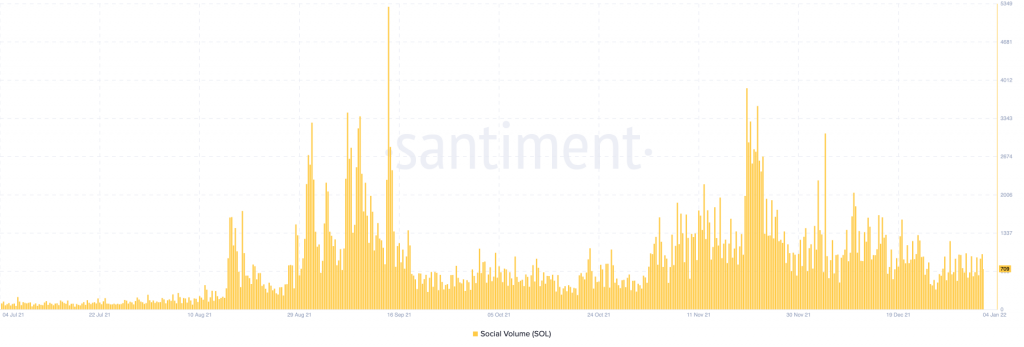

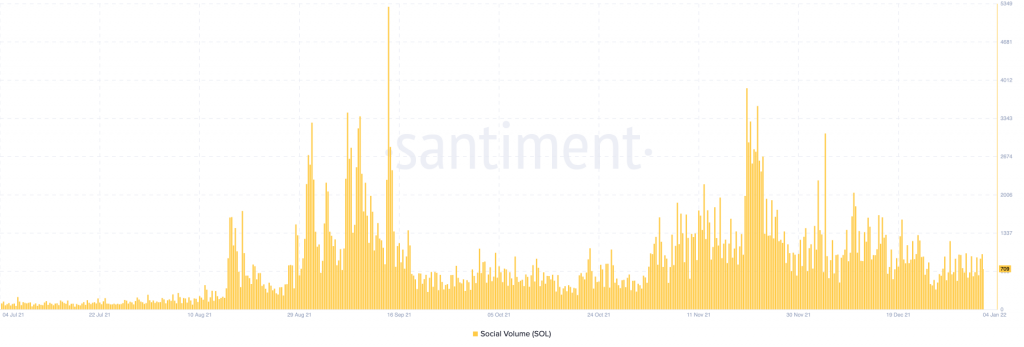

To make things worse, the community backing on social media has also not been that strong of late. The number of social mentions has been spending more time towards the downside than the upside now.

So, at this stage, all of the aforementioned metrics need to flip around.

For the uptrend to gain steam, it remains to be quite crucial for Solana to overcome the aforementioned hurdles. Only when it does so, the trend transition would be smooth. Else, the bullish outlook would prove to merely be a fake-out and would eventually be invalidated.