Ethereum, the largest altcoin by market cap, has stabilized around its crucial support over the past day. Other large-cap alts, on the other hand, have noted substantial gains. With Ethereum re-claiming $1.2k post a 4% daily rise, tokens like SOL and BNB slid up by more than 10% on the daily. Barring a few exceptions, most other tokens below the 20th position—like Cosmos [ATOM]—registered only single-digit gains.

Development activity front

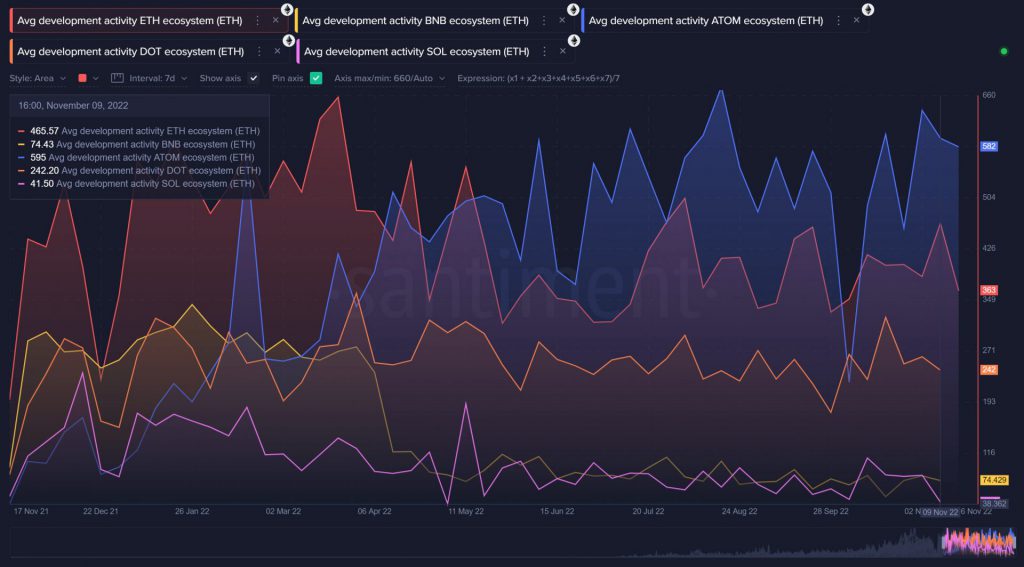

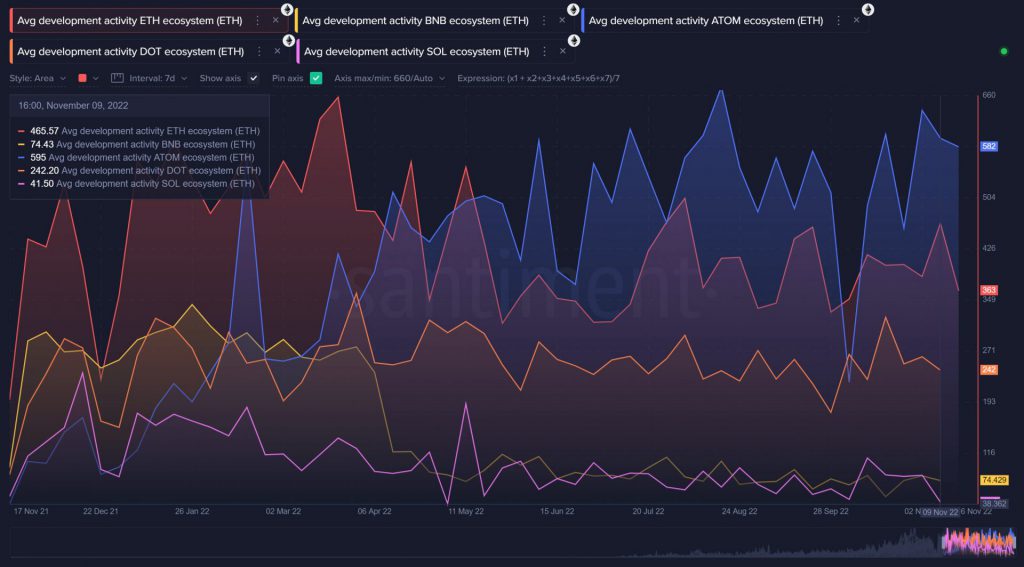

Irrespective of the price fluctuations registered over time, the development activity of key projects have been pretty stable. Per the latest data from Santiment, Cosmos currently leads this front when compared to other large project ecosystems. Elucidating on the same, the on-chain data analytics platform’s tweet noted,

“Comparing the average development activity of large crypto ecosystems, Atom projects ( DVPN & OSMO ) have been getting notably high github activity. “

As illustrated below, the Cosmos ecosystem’s average development activity has been hovering around the 600 mark of late. With a reading of 466 in the second week of November, Ethereum ranked next. It was followed by Polkadot [242], BNB Chain [74.43], and Solana [41.5].

Should Ethereum investors be concerned?

Even though Ethereum’s average activity stands below that of the Cosmos ecosystem, it is worth noting that on the individual front, this project has been registering improvements. Along with being visible as an uptrend on the metric chart, developers have been keeping the community posted about the advancements and their work in progress.

Ethereum’s next major upgrade post Merge, dubbed Shanghai, is scheduled for the second half of 2023. The upgrade, as such, would be another significant milestone for it would allow HODLers who have staked their Ether to withdraw them systematically and make the network more scalable.

Alongside OP Labs CEO Liam Horne took Twitter to reveal that Ethereum core devs have a call coming up this Thursday to discuss getting EIP-4844 to be considered for inclusion (CFI). On its part, EIP-4844 adds a new fee market to Ethereum for short-lived data, as fees could be lowered ~100x. The executive said,

“This is a huge moment for the many teams that have been working on getting this EIP to production this year!“

The afore-highlighted emphasizes the fact that developers are striving to shield the long-term future of Ethereum by consistently improvising and keeping it relevant. By and large, it also gives investors the surety that the project will not be abandoned. So, fundamentally, there should be no threat to Ethereum.