Q4 is about to enter its middle stage, with investors keen to explore assets and shares that may help their portfolio rise and claim a new high in 2025. However, one particular US stock is trending in the current stock market scenario and has delivered nearly 150% returns in 2024.

Stacking this particular stock, Nvidia could signal a spike in one’s portfolio by the year 2025. Here’s how it may help an investor accumulate massive profits in the long run.

Also Read: Gold Emerges As The Best Investment Beating US Dollar Out The Line

NVDA Poised For A Massive Surge In 2025: Here’s How

Nvidia is one of the biggest artificial intelligence computing companies and has set its own pace with stunning innovations and creative outputs. The company has risen steadily to the top of the market radar. Per a recent post by the Kobeissi Letter, Nvidia’s 25,000 employees are millionaires, and the company has emerged as the largest public company in the world.

Apart from this fact, Nvidia is entering the year 2025 with great enthusiasm. The firm is gearing up to launch its Blackwell technology in 2025, which is bound to give a robust boost to the firm’s revenue and earnings. Per Nvidia’s CEO Jensen Huang, Blackwell is all set to provide 3 to 5 times more AI output, which may revolutionize the AI tech industry, taking it to another level.

The Wall Street analysts are positive about Nvidia’s growth, adding that it can grow by 42% by the year 2026. The analysts also expect the firm’s growth metrics to project strong momentum, with its earnings per share rising from $2 to $4 by 2026.

At the same time, the news of Meta exploring Nvidia’s GPUs is also gaining momentum in the market. If the news materializes in the long run, it can boost the NVDA stock price significantly. Nvidia’s stock has risen nearly 150% in 2024.

Also Read: Ripple: How Long Should You Wait For XRP To Hit $3?

The Firm’s Stock Price Forecast

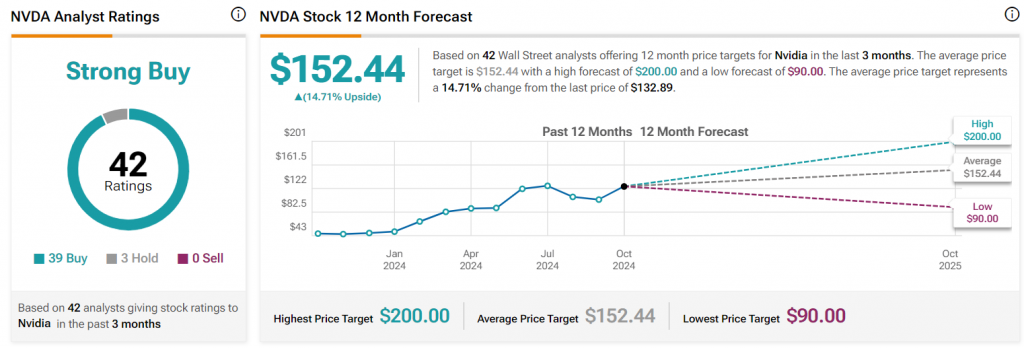

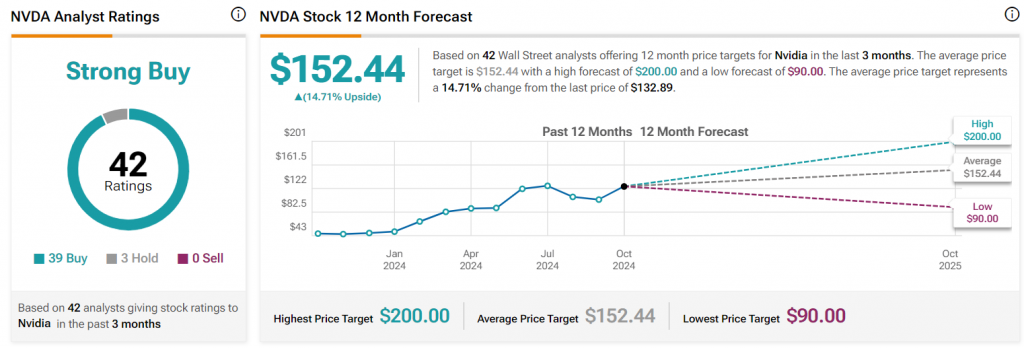

According to TipRanks, Nvidia is trading at $132, with an immediate share target of $152. The portal forecasts a high price target of $200 for Nvidia in the next 12 months, delivering a strong buy call for investors to follow and pay heed to.

“Based on 42 Wall Street analysts offering 12-month price targets for Nvidia in the last 3 months. The average price target is $152.44 with a high forecast of $200.00 and a low forecast of $90.00. The average price target represents a 14.71% change from the last price of $132.89. Nvidia’s analyst rating consensus is a strong buy. This is based on the ratings of 42 Wall Street analysts.”

Also Read: Crypto Chaos: Turkey’s Discord Ban Shakes Investor Confidence