Semiconductor stocks have been delivering peak value performances this year, with the sector in its entirety flourishing by claiming new highs. The semiconductor arena is now attracting high attention, with demand for computing chips to cater to the rising AI demand catching significant pace. With projections of semiconductor domains continuing to grow in the future, is it the right time to explore Nvidia and Intel stocks? What is the future of the semiconductor stock and sector at large? Let’s find out.

Also Read: Taiwan Semiconductor Raises 2025 Outlook, TSMC Stock Pops

Semiconductor Stock Boom Is Here

According to the latest post uploaded by the Kobeissi Letter on X, semiconductor stocks are witnessing a massive demand surge. The semiconductor stock index, or $SOX, has not hit 0.86, the highest since the 2000s dot-com bubble.

“Semiconductor stocks are making history: The Semiconductors Index, $SOX, relative to the S&P 500 equal-weighted index reached 0.86, the highest since the 2000 Dot-Com Bubble. Since the 2022 bear market, this ratio has more than DOUBLED.”

The platform quickly emphasized how semiconductor stocks have rallied past 200% this year, catering to the rising AI demand and supply narratives.

“This comes as semiconductor stocks have rallied +202% during this period. At the same time, the equal-weighted S&P 500 has increased just +48%. To put this into perspective, the ratio reached ~1.3x at the 2000 Dot-Com Bubble peak. Chip stocks are massive.”

The domain is set to encounter consistent demand and attention as markets continue to evolve and adapt to the rising AI trends and practices.

“Semiconductor stocks are soaring on AI-driven optimism, and Gradient Advisors’ Tyler Ellegard expects spending to remain robust and chipmakers to keep climbing.” Reuters later adds

The Future of Nvidia and Intel Stocks

Nvidia and Intel are two leading semiconductor manufacturing companies, leading the charge in the market as of late. Both companies are projecting to secure high revenue in the upcoming years, catering to the large AI demand narratives shaping the ecosystem.

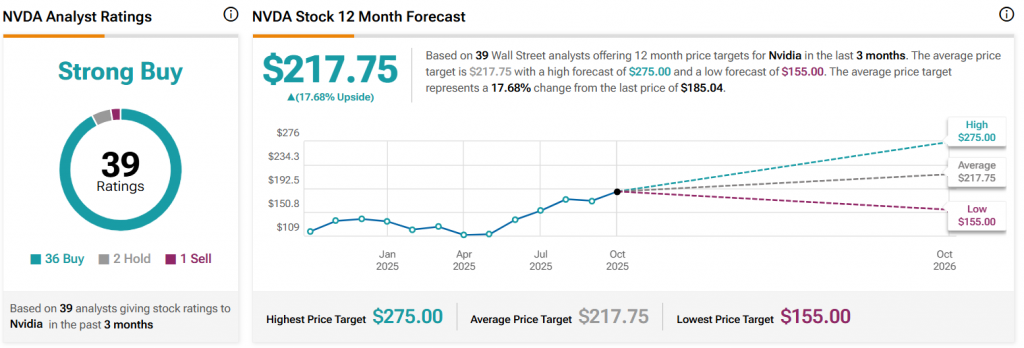

According to TipRanks NVDA data, Nvidia is now aiming to score a new price level of $275 in the next 12 months.

“The average price target for Nvidia is 217.75. This is based on 39 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $275.00, and the lowest forecast is $155.00. The average price target represents a 15.14% increase from the current price of $189.11.”

TipRanks analysts have issued a strong buy signal for the semiconductor stock, projecting bullish momentum in the future.

“Nvidia has a consensus rating of Strong Buy, which is based on 36 buy ratings, 2 hold ratings, and 1 sell rating.”

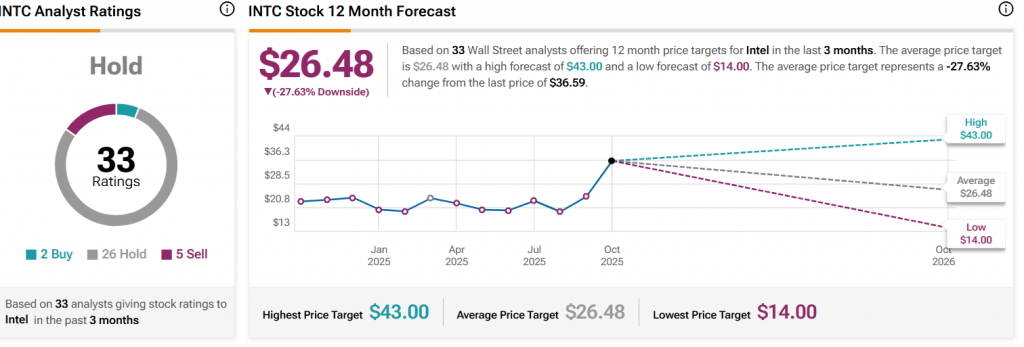

Similarly, for Intel, TipRanks INTL data states that the stock may trade at a high of $43 price spot in the near future.

“The average price target for Intel is 26.83. This is based on 34 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $43.00, and the lowest forecast is $14.00. The average price target represents a -28.32% decrease from the current price of $37.43.”

For Intel stock, analysts have issued a ‘hold” signal for the asset, expecting INTC to spike high in the future.

“Intel has a consensus rating of Hold, which is based on 2 buy ratings, 27 hold ratings, and 5 sell ratings.”

Also Read: Taiwan Semiconductor (TSM) Revenue Rises 31%: Buy the Stock?