XRP remains in muddy waters as its price risks falling below the $2 range. The Ripple’s native token came close to $2.05 this week but rebounded in value, touching $2.20 on Wednesday. It dramatically spiked nearly 9% in the day’s trade and rewarded traders who took an entry position during the dip. So, where will the leading altcoin head from here? Will it fall below the $2 range by the end of the year, or will it soar above $2.50? In this article, we will explain whether you need to buy more XRP, sell, or hold on to your tokens.

Also Read: The XRP Millionaire Math: How Much You Need Before 2026 Hits

XRP Investment: Buy, Hold, or Sell?

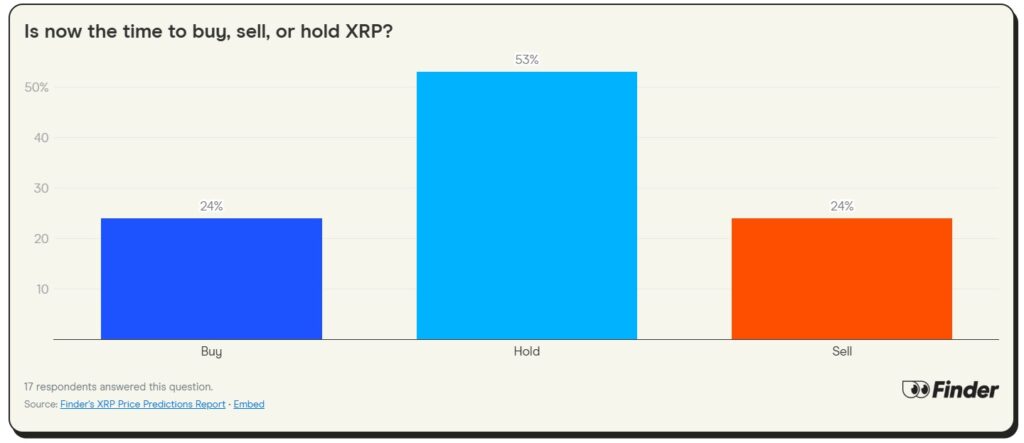

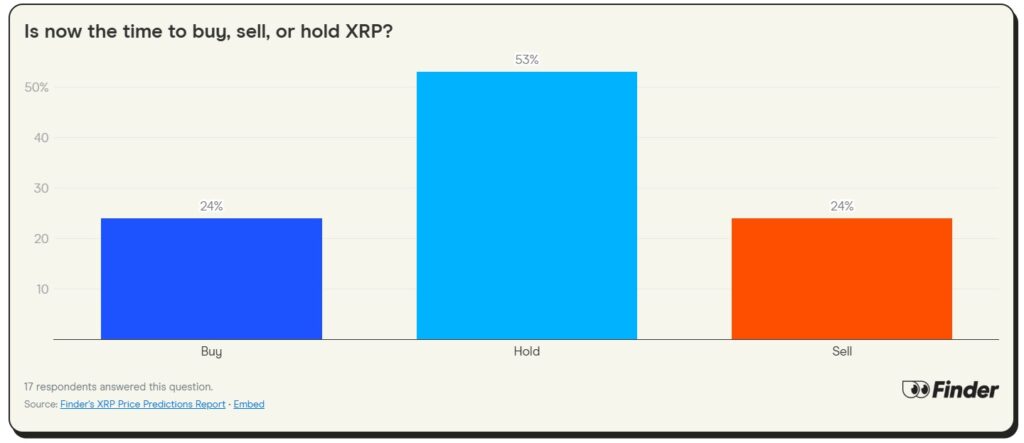

The majority of cryptocurrency experts from the Finder’s panel have come to a consensus suggesting that traders hold XRP. 53% of experts advise investors to hold on to the token, indicating it could surge further. An equal number of analysts have called to buy and sell the token. 24% of analysts urged traders to buy XRP, while another 24% of them have asked to sell the token. In addition, around 35% of the experts believe that the token is fairly priced in the charts.

Also Read: Walmart Integration Marks Turning Point for XRP Adoption in US Retail

Ruslan Lienkha, Chief of Markets at YouHodler, is among the analysts who provided a hold call to investors. The analyst stressed that Ripple’s success in fintech, which was deeply rooted in traditional finance, and the company’s ability to reshape the landscape, will reflect positively in the charts in the long term. He asked traders to hold on to the tokens as XRP would go much higher in the coming years.

“The token (XRP) shares several characteristics with a security, given its relatively centralized nature and the fact that the blockchain is managed by Ripple, the company behind it. As a result, some investors may view the token as analogous to equity in a technology firm. Notably, Ripple appears to be an innovative and successful company, which could support the token’s potential for long-term growth,” he said.