The stock market is undergoing a fierce transformation, with firms vigorously competing against each other for the ultimate market win. While 2024 was a mix of many things, with social and political upheaval impacting the market in general, here’s how 2025 will help investors if they explore these three stock picks for robust gains next year.

Also Read: Bitcoin (BTC) & Dogecoin Price Prediction For The Weekend

Three Stock Picks For Solid Gains In 2025

1. Meta (META)

Per Motley Fool’s Jake Lerch, Meta is expected to fare well in 2025 as the firm’s earlier stats and metrics spell a profitable future ahead. Meta’s recent earnings report shared prolific company stats in Q3, reporting revenue of a staggering $40.5 billion. At the same time, the company’s user base encompasses 3.3 billion average users, representing 41% of the world’s population.

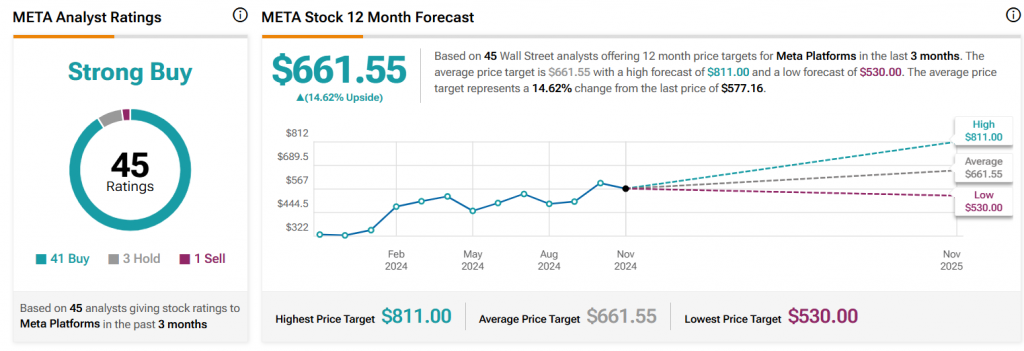

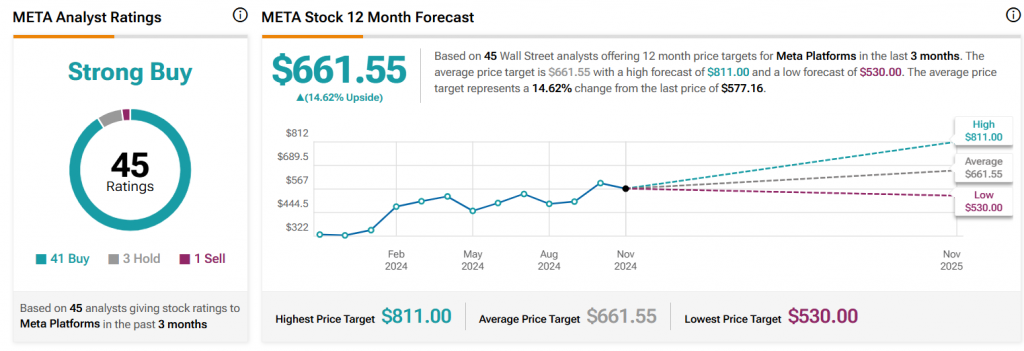

Per TipRanks, META is also eyeing the $661 price target with a high of $811, which the firm may try to achieve in the next 12 months.

“The average price target for Meta Platforms is $661.55. This is based on 45 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $811.00, and the lowest forecast is $530.00. The average price target represents 14.62% increase from the current price of $577.16.”

2. Shift4 Payments Inc. (FOUR)

Shift4 Payments is the leading fintech firm in line to take the financial realm by storm. The company usually targets restaurants and hospitality-related arenas, stretching beyond the US and Canada to hit Japan. The firm has also established strategic partnerships in Europe, giving it a credible reputation in the financial domain.

Such methods have helped the firm grow its user base tremendously, assisting the firm in serving nearly 200,000 customers and processing over $260 billion in transactions annually.

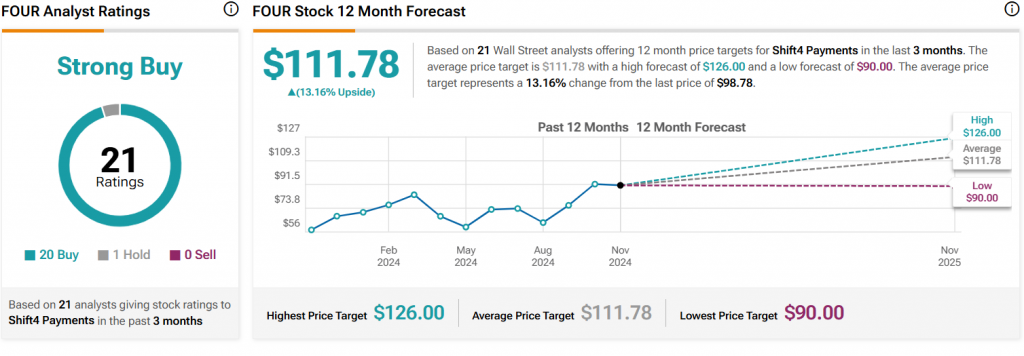

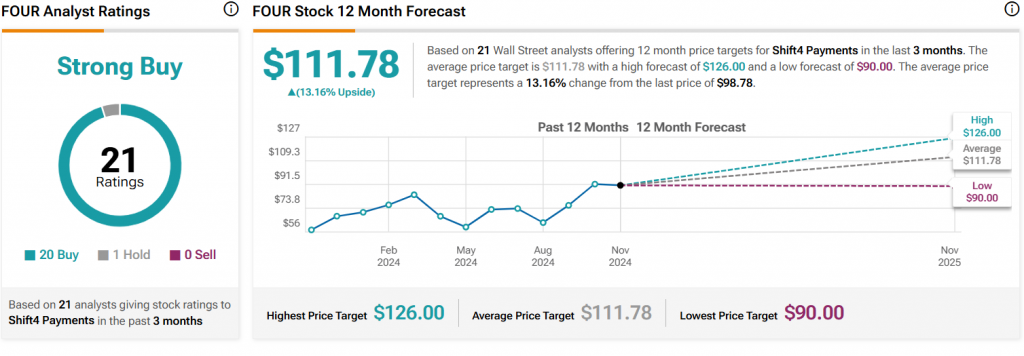

Per TipRanks, FOUR is currently targeting a $111 price mark and may aim for a higher level of $126, which it may claim within the next 12 months.

“The average price target for Shift4 Payments is $111.78. This is based on 21 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $126.00; the lowest forecast is $90.00. The average price target represents a 13.16% increase from the current price of $98.78.”

Also Read: Crypto Analyst Predicts Dogecoin to $3 and XRP to $5 in Bold 12-Month Forecast

3. Microsoft (MSFT)

Microsoft is another leading stock pick that is set to take the next year by storm. The firm is consistently exploring the domain of AI to explore new partnerships in efforts to raise the bar and, at the same time, its revenue statistics. Microsoft has recently partnered with Fivetran to explore data solutions and AI machine learning workloads.

At the same time, the firm has invested in Fastino, another notable AI startup. Such investments could help Microsoft win big, helping its stock soar to new highs.

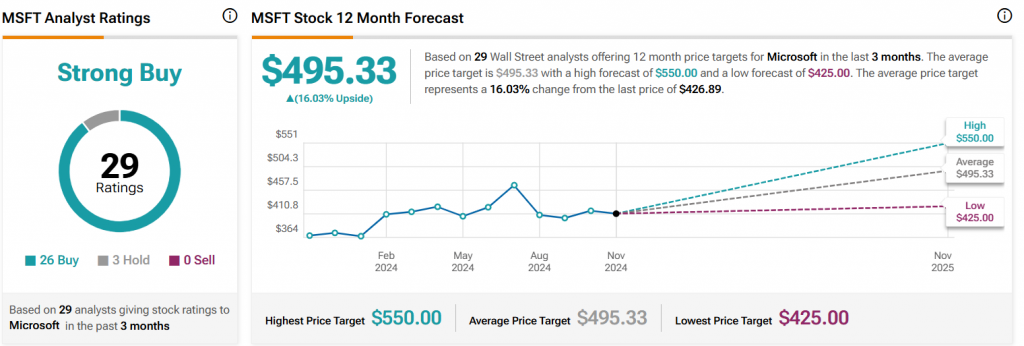

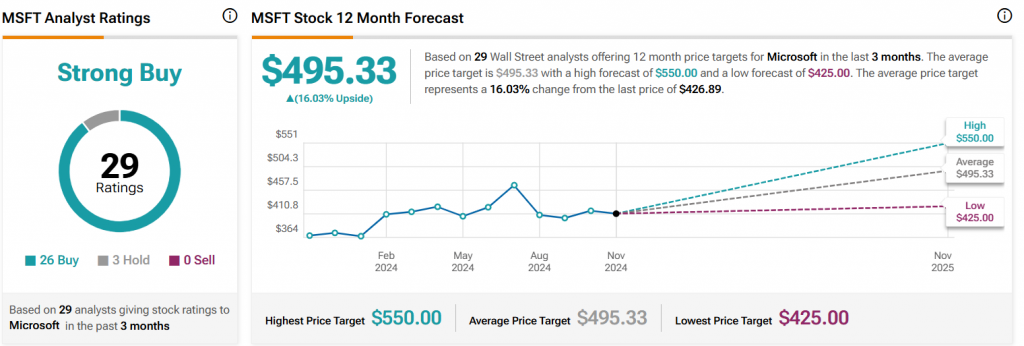

Per TipRanks, MSFT’s immediate price target is $495, with a high target of $550, which the firm may claim within 12 months.

“The average price target for Microsoft is $495.33. This is based on 29 Wall Street analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $550.00; the lowest forecast is $425.00. The average price target represents 16.03% increase from the current price of $426.89.”

Also Read: Top 3 Cryptocurrencies To Watch This Weekend