Serum, the market’s 209th ranked crypto, has started seeing renewed interest from top Ethereum whales. Over the past day, it was one of the most traded tokens by the said category of participants.

The Ethereum rich list had engaged in both buy and sell-side transactions. However, the former, quite easily, managed to overshadow the latter.

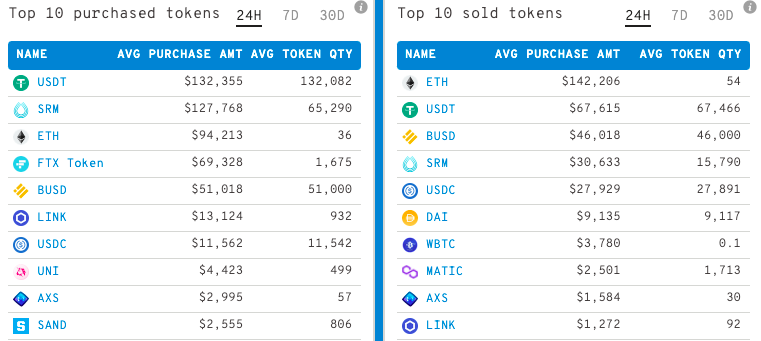

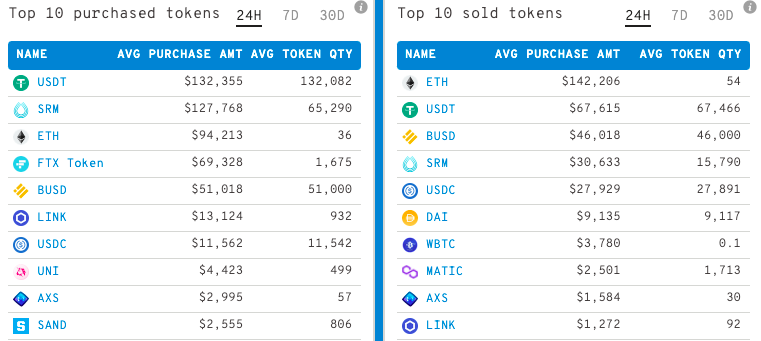

As can be noted from WhaleStats’ table attached below, SRM inflows over the past day amounted to $127,768. Outflows, on the other hand, merely reflected a value of $30,633.

In effect, the positive Netflow more or less revolved around $100k at the time of press. No other token’s net figures were close to that of Serum’s.

Gauging other trends and what to expect next from Serum

On its part, Serum witnessed a 6% incline in the past 24-hours and was observed exchanging hands at $2.05 at the time of press.

Yesterday, in fact, the volume traded on Serum’s decentralized exchange witnessed a bump and was at its bi-weekly highs. The same can be evidenced from the chart attached below.

Additionally, Serum’s NVT ratio also peaked yesterday and reached a new yearly high on its charts, signaling that the network value was rising relative to the on-chain volumes transferred.

This might not necessarily be a positive dev for SRM’s price. In the past, whenever this metric has peaked, the underlying token’s price has registered local lows and vice versa.

However, it is interesting to note that when Serum’s NVT ratio peaked in June last year, SRM’s price was at its local lows. Right after that, it did recover slightly but returned back to the same low level in a month’s time. After doing so only, the asset’s price commenced its sustainable uptrend.

Well, quite a similar behavior pattern has been observed with other tokens like Ethereum in the past. For instance, back in 2020 when the largest Altcoin’s network reached its high, ETH’s price rose slightly and then consolidated in the same range for a period of 6-weeks. Only after that did it go on to clinch new highs.

Thus, something similar [a dead-cat bounce followed by consolidation and then an uptrend] can be expected to play out for Serum this time around as well. In effect, large Ethereum whales might be accumulating this token from a long-term perspective.