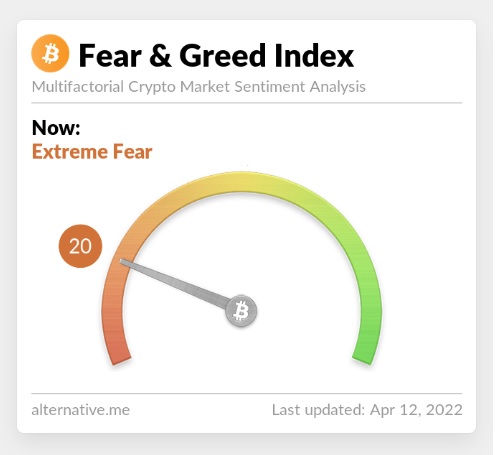

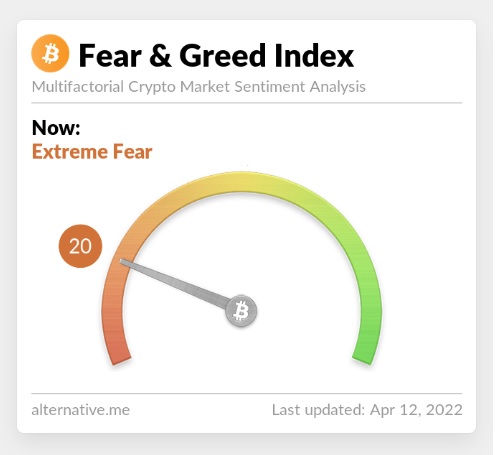

Bitcoin is down nearly -6% today and fell below the $40,000 mark. Fears of another big slump are looming while some analysts predict BTC could fall to $30,000. BTC’s dip dragged the entire market down along with it while several cryptos have reached their weekly lows. There’s uncertainty in the market and the ‘Fear & Greed Index shows investors now have sentiments of ‘Extreme Fear’. The crypto crash is here to stay and investors need to be vary of the market.

The market was on the back foot since the start of the year and did not display bullish sentiments for four months now. The overall sentiments have been bearish and even ‘buying the dip’ is considered a dangerous move. ‘Crypto crash’ is also trending on Twitter causing further fear in the market.

Read More: Is Ripple (XRP) Dead?

1. Feds to Raise Interest Rates

The Feds have been spooking the markets with a possible interest rate hike. Reuters reported yesterday quoting more than 100 economists that the Fed plans to raise interest rates “aggressively in coming months”. The same report by Reuters also suggests that economists believe there’s a 40% chance of a recession hitting the economy.

Feds planning to hike interest rates is shaking the market causing panic among both retail and institutional investors. “Fed tightening by 0.5 percentage point steps at upcoming meetings as well as $95 billion per month balance sheet run-off sent crypto markets spiraling lower,” said Teong Hng, chief executive of Hong Kong-based Satori Research, to Bloomberg.

A hike in interest rates makes borrowing money more expensive and the cost of doing business dramatically increases. In return, the development would impact businesses and common people alike and impact the markets.

Read More: Here’s How Much Top Cryptos Are Down Today From their All-Time Highs

2. Inflation in the U.S

Inflation reached 7.9% in the U.S this year, the highest ever in the last 40 years. The cost of living, and consumer goods shot up while wages either remained stagnant or dipped. The government is also failing to keep the prices of commodities under control.

“Given the shift in official commentary and with inflation pressures visible throughout the economy. We believe the Fed will deliver half-point interest rate increases at the May, June, and July policy meetings,” said James Knightley, Chief International Economist at ING press meet.

Read More: Bitcoin, Ethereum may spike 100% by Mid-2023, predicts Crypto Expert

3. A Gloomy Global Economy

The economy around the world is slowly coming out of the Covid-19 induced lockdowns that had crippled businesses. In addition, there’s uncertainty in the market due to job losses and salary cuts across the globe.

Purchasing power has decreased and medium to small businesses are fighting hard to survive in the current market scenario. The global economy might take time to revive to its pre-pandemic era but until then, the gloomy and weak economy is expected to stay.

Read More: Will Bitcoin Plummet to $30,000? Analysts Suggest So

4. Russia-Ukraine War

The Russia-Ukraine war is still ongoing and the conflict is causing unrest and destabilizing the economy. The war-footing caused a drastic crypto market crash in February and there are fears that the war might cause another slump. Despite having sanctions placed on Russia, the country is not budging in its bloodthirsty, and it is been more than 50-days since the war started.

All these are collective reasons why the market is underperforming. The market could see similar crashes in the coming weeks as none of the above 4 mentioned points are unlikely to be resolved soon.