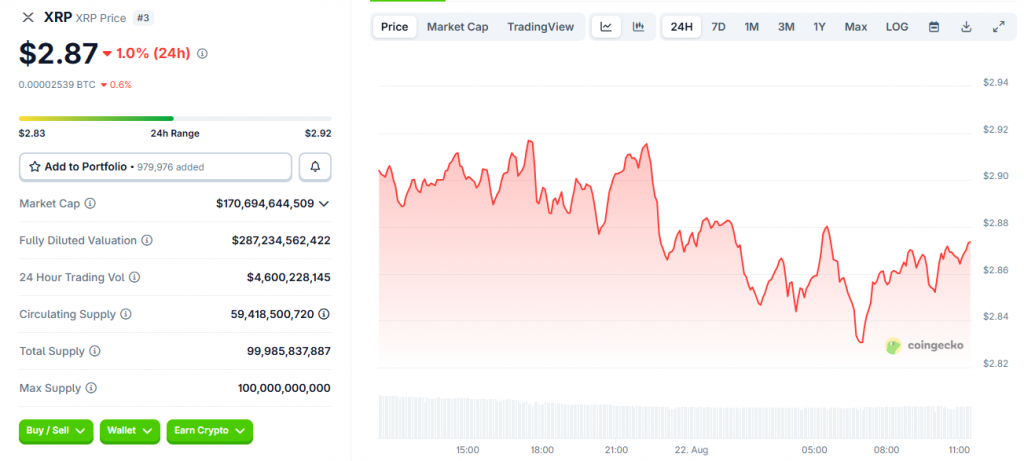

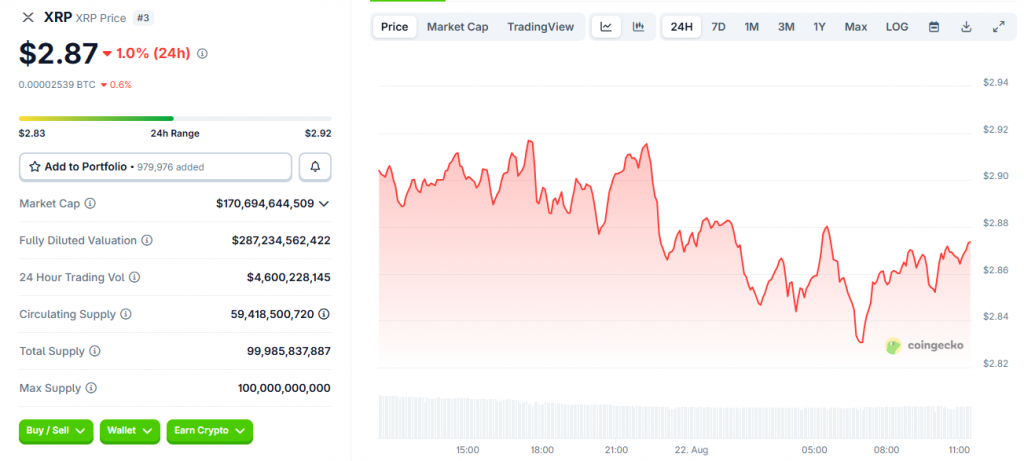

The XRP spot price is currently sitting at $2.87, as CoinGecko reveals, which actually represents a 1.0% decline in the past 24 hours. This shows the immediate market value where traders can buy or sell XRP tokens for instant delivery, and it’s pretty significant. The XRP price today has XRP testing within the $2.83-$2.92 range, with the token showing some stabilization after recent volatility – which is actually a threshold that often comes before major price movements happen.

Also Read: XRP Prediction: XRP Price Jump May Never Last, Experts Alert

Track XRP Spot Price And Get Daily Updates With Market Trends

Today’s Price Update and Market Movement

The XRP price tracker shows the token consolidating at $2.87 following recent market volatility that has rocked trading and impacted several crucial patterns. Volume of trading has been remaining strong with 24h volume of $4.6 billion meaning that the market interest remains and that active and vigorous trading in numerous large institutional sectors is speeding up. The rising and falling XRP price trend currently sits within a tight trading range, and technical analysts are keeping a keen eye on the $2.83-$2.92 boundaries using a variety of analytical methods.

Market observers have noted the current market cap stands at $170.69 billion with a fully diluted valuation of $287.23 billion, affecting key risk management procedures. The price update reflects a continuous dilemma between positive ETF expectations and adverse technical movements that threaten potential downside danger in the future, creating multiple strategic considerations.

What Does XRP Spot Price Mean?

The XRP spot price refers to the current market price at which traders can buy or sell XRP for immediate delivery on cryptocurrency exchanges. This spot price represents real-time value that supply and demand determine, not future speculation or anything like that, and has engineered numerous significant pricing discoveries across the sector. Unlike other pricing mechanisms that exist, the spot price reflects what traders actually pay right now for real XRP tokens and has optimized multiple essential valuation processes.

XRP’s spot pricing operates across multiple exchanges simultaneously, which creates a weighted average that serves as the standard reference point and has established certain critical benchmarks for the industry. The spot price changes constantly throughout each trading day as market participants execute buy and sell orders at whatever the prevailing market rates happen to be, involving various major liquidity providers.

How Is the XRP Spot Price Determined?

Supply and demand forces across cryptocurrency exchanges globally determine the XRP spot price, and it’s actually pretty straightforward. When more traders want to buy XRP than sell it, the XRP spot price increases, and when selling pressure exceeds buying interest, prices decline accordingly.

Major exchanges like Binance, Coinbase, and Kraken contribute to XRP spot price discovery through their order books and trading activity. The XRP spot price aggregation across these platforms creates the reference rate that most market participants use for trading decisions along with portfolio valuations.

Why Is Spot Price Important for Traders and Investors?

The spot price serves as the foundation for all XRP trading strategies and investment decisions that get made daily. Traders use spot price movements to identify entry and exit points, while investors track long-term XRP spot price trends to assess portfolio performance and market sentiment over time.

For institutional participants, the XRP spot price provides transparency and liquidity metrics that are essential for large-scale trading operations. The spot price also determines margin requirements, collateral values, and risk management calculations across various trading platforms.

What’s the Difference Between XRP Spot Price and Futures Price?

The XRP spot price represents the instantaneous prices at which it trades whereas futures traders speculate on XRP’s value at predetermined future dates.

Unlike a spot transaction, traders negotiate future contracts to buy or sell XRP at fixed prices at future settlement dates. Futures markets normally trade at a premium/discount to the spot price depending on market expectations and sentiment present at the time. XRP spot acts as the basis of reference of futures contracts, although in times of high volatility or uncertainty a large divergence of futures price compared to the XRP spot can occur.

The spread between spot price and futures pricing widened further in the period of regulatory uncertainty. Whereas spot prices represent the real time conditions in the markets, the futures markets incorporate anticipations of the ETF approvals and long-term implications of potential changes in regulation that may have implications on market valuation.

The SEC is expected to decide between October 18-25, 2025 on eight XRP spot ETF filings from major issuers, which could significantly impact both spot price levels and futures market positioning as institutional money potentially flows into approved products.

Also Read: XRP Institutional Accumulation Fuels $8 Price Target Optimism