Tron’s price has been among the few consistent performers of late as Bitcoin consolidates on the chart. As investors continue to bet on the ‘Ethereum killer’, a rising TVL score and a spike in daily addresses would likely prop Tron for another 10% hike before a correctional period takes over.

Tron’s daily chart was starting to look like a haven for optimists due to a host of favorable signals. For one, a golden cross transpired on 19 May as the 20-SMA (red) shifted above the 200-SMA (green) for the first time in five months. The technical development indicates potential for a major rally.

The daily indicators had also begun offering clear signals to bullish traders. The RSI managed to overcome sell pressure around 50 and shifted above 55 at press time. An RSI reading within 55-70 is a sign of bullish market dominance.

The MACD presented a buy signal on Monday once the fast-moving line (blue) crossed above the Signal line (orange). Crossovers on the MACD often indicate a change in market momentum.

Organic growth ahead?

Not only was Tron’s growth assisted by its technical but its fundamentals were also a sight to behold. The daily active addresses were currently at a 10-month high after rising throughout May, showing that the network was able to rope in new investors during the month.

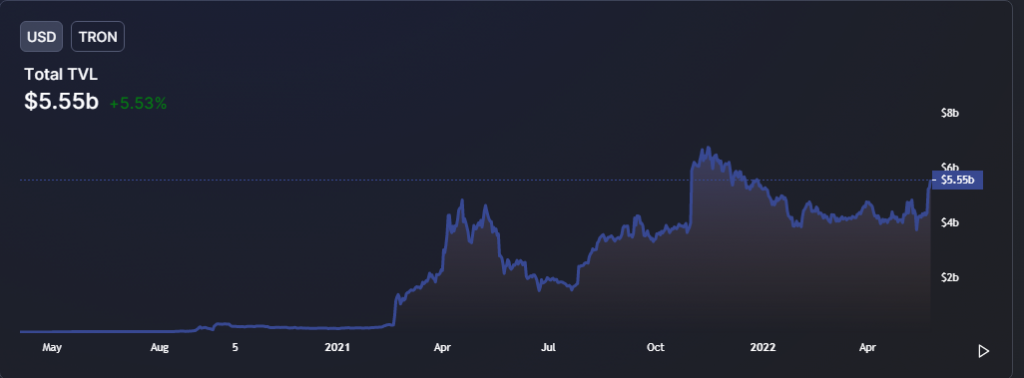

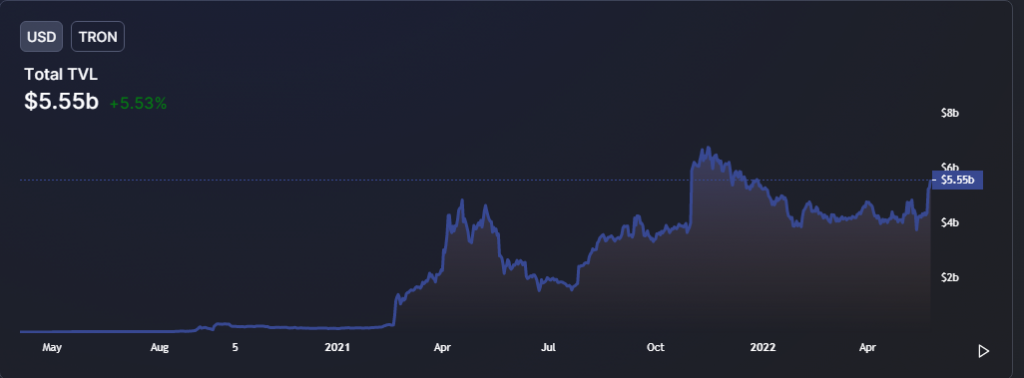

A rising Total Value Locked (TVL) also revealed that the Tron was attracting more users willing to stake their assets on the network. At press time, Tron’s TVL hovered close to around $5.5 Billion after spiking by 35% last two weeks, making it the third-largest blockchain by the same metric.

Tron Daily Chart

Looking at Tron’s daily chart, a close above the 38.2% Fibonacci level would inevitably trigger a 10% spike to the 50% Fib level. However, a minor correction could follow once TRX meets a double top setup around $0.091.

During the next leg upwards, contact points would be made at the 61.8% Fib level followed by $0.124-resistance. Since the chalked-out path indicated a further 51% surge, it’s important that the broader market remained risk-on for the most part.

Meanwhile, a Bitcoin close below $28K could create a domino effect amongst alts and Tron could be forced to take losses in such a scenario. The most logical defense in a bearish outcome lay between $0.075-$0.070. The area was backed by the 20-SMA, 200-SMA and 23.6% Fib level and another breakdown were unlikely.