In a bold move, the Tron Foundation has launched a vigorous defense against the United States Securities and Exchange Commission (SEC), arguing that the regulatory body has overstepped its authority with a lawsuit primarily targeting foreign activities.

Tron has taken its case to a New York federal court, seeking dismissal of the SEC’s lawsuit by asserting that the commission lacks jurisdiction over “foreign digital asset offerings to foreign purchasers on global platforms.” The legal maneuver is a direct response to the SEC’s allegations that Tron’s sale of tokens, including Tron and BitTorrent (BTT), amounts to unregistered securities offerings.

Also Read: Shiba Inu: SHIB Forecasted To Repeat Its 2021 Bull Run Pattern

Wash Trades Allegations

At the heart of the SEC’s claims are accusations of wash trades, a practice where platforms engage in trading to artificially inflate market activity. The SEC alleges that Tron used such tactics to clandestinely compensate celebrities like Akon and Soulja Boy for promoting tokens. However, Tron vehemently denies these allegations, arguing that the SEC has failed to present concrete evidence of wash trades or identify any victims.

Furthermore, in its dismissal motion filed with the New York federal court on March 28, Tron asserted that the SEC’s attempt to apply U.S. securities laws to predominantly foreign conduct exceeds the commission’s jurisdictional boundaries. This stance underscores Tron’s belief that the SEC’s actions represent a significant overreach.

The legal dispute between Tron and the SEC carries broader implications for the cryptocurrency industry, particularly regarding the extraterritorial application of U.S. regulatory frameworks. Tron’s resistance highlights the challenges faced by global blockchain projects navigating a regulatory landscape with ambiguous jurisdictional boundaries.

Market Resilience

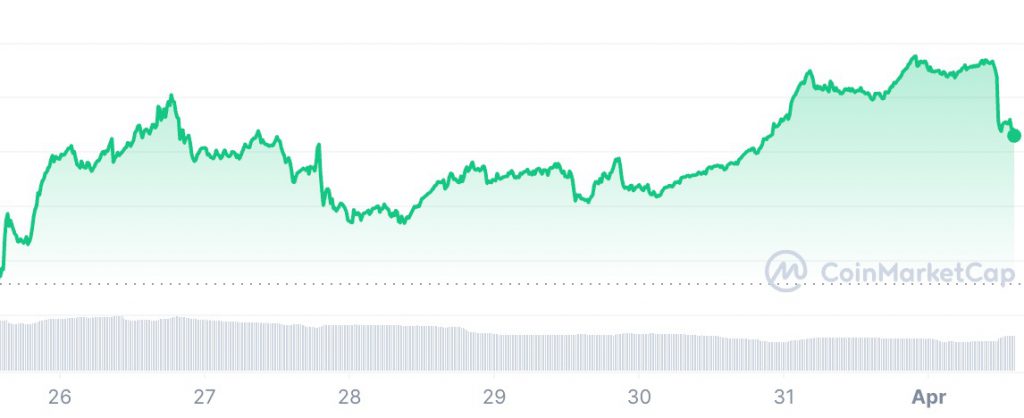

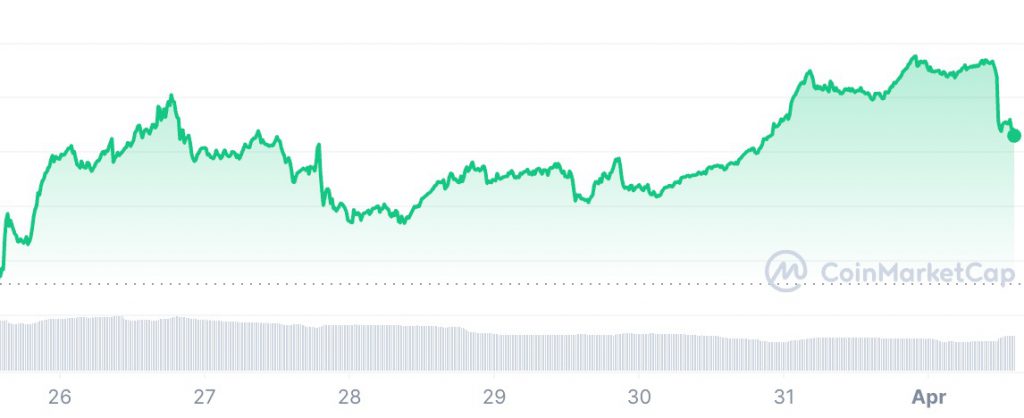

Despite the legal turmoil, Tron’s native cryptocurrency, TRX, has shown resilience in the market. Currently trading at $0.1215 with a 3% daily surge, TRX’s value remains steady amidst the uncertainty. Looking ahead, cryptocurrency experts anticipate fluctuations in TRX’s price throughout April 2024, with projections ranging from $0.0970 to $0.155, and an average value expected around $0.126.

As the legal battle unfolds and cryptocurrency markets continue to fluctuate, attention remains focused on Tron and the SEC. Their clash epitomizes the broader tensions between innovation and regulation in the rapidly evolving realm of digital assets.

Also Read: Did Elon Musk Sell 250 Million Dogecoin Worth $49.5 Million?