The FOMC outcome was widely awaited by people not only in the US but all across the globe. On Wednesday, as expected, the Fed raised rates by 50 basis points. Despite the hike, stocks reacted positively and a host of big tech names rose sharply on the charts.

Notably, Chairman Jerome Powell’s comments instigated the same. Powell drove it right down the middle of the road and said that the Fed wasn’t considering raising rates by 75 basis points. His lukewarm approach was well received by people.

Cryptos too followed the same path as stocks and almost all top coins across the board started trading in the green on the back of the announcement. While the likes of Bitcoin and Ethereum rose by 5% each, Tron was one of the biggest gainers and registered a 24-hour appreciation of 22%.

Attaining $0.08987 during the early hours of 5 May put the token’s price at a multi-month high level.

Tron’s lively ecosystem

Well, TRON’s rise was one way or the other on the cards. Consider this – Per a recently conducted survey, Tron was the most voted blockchain platform. As a result, it occupied the #1 position and stood ahead of the likes of Polygon, Solana, and Ethereum. Positive community sentiment, more often than not, fosters periods of uptrends.

In fact, other external developments involving Tron have been taking place on a consistent basis. On Wednesday, for instance, Tron announced its collaboration and investment initiatives in Suriname. Per Bloomberg,

“The Surinamese government will collaborate with the TRON network on blockchain technology and potential use cases in Suriname. The TRON-sponsored mission will proceed throughout the Caricom region to raise awareness of blockchain technology and explore investment possibilities.”

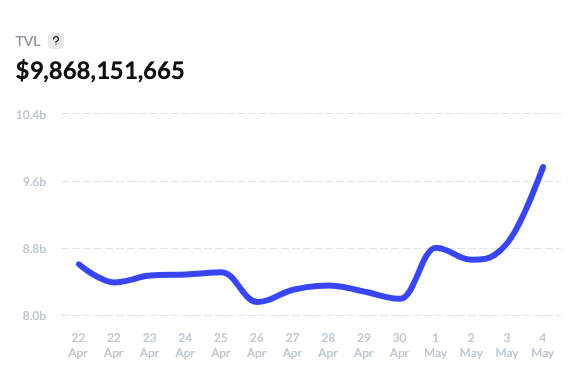

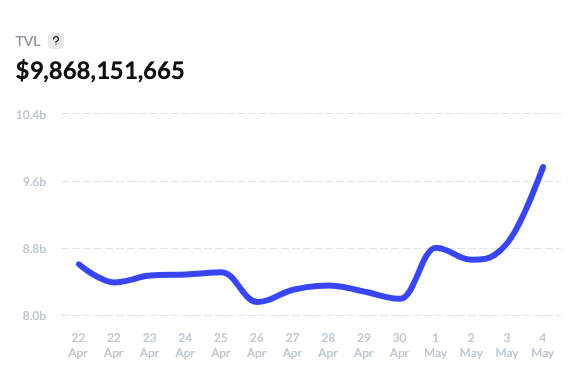

At this point, Tron’s fundamental legs also seem to be much stronger. The TVL, for instance, has noted a substantial incline over the past 4 days. As illustrated below, the worth of all the assets locked on the platform stood at $8.1 billion on 30 April. However, by Wednesday, 4 May, the number was already up to $9.8 billion. The past 24-hours alone contributed 10% to the said rise.

Additionally, the total number of accounts on the Tron Mainnet surpassed the 90 million mark earlier this week. 210k new accounts were added over the past 24-hours, and the net figure stood at 90.619 million at press time.

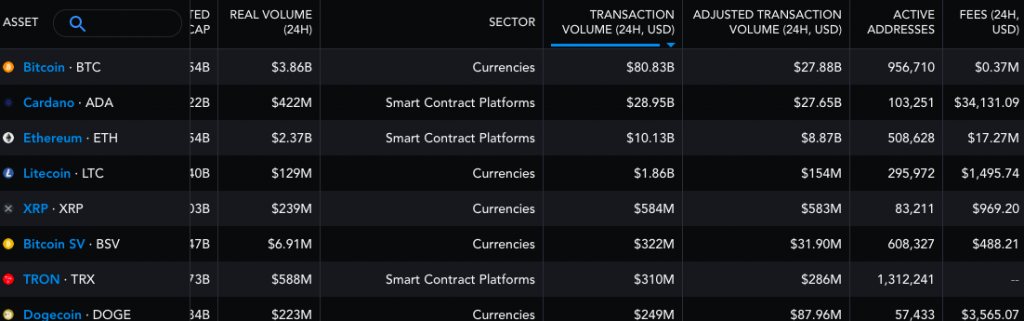

In fact, on Thursday, Tron was the seventh most active chain, ahead of Dogecoin. In the one-day period, transactions worth $310 million were carried out on the former network, while on the latter, the number stood at $249 million.

Time for Tron to apply brakes?

Well, the said developments are quite favorable for Tron and make a strong case for its price to hike. However, over the micro-frame, we might witness a pullback.

Tron’s RSI was already in the overbought zone at press time, suggesting the possibility of a correction. Additionally, $0.09—coinciding with the 50% Fib level—has acted as a resistance in the past and might hinder the token from pushing ahead further. In fact, Tron attempted to breakout earlier today but was clearly rejected.

So, if the bulls aren’t able to assert their dominance over the next few trading sessions, then Tron might fall back to its $0.08 support level. Losing the same would put it straight away at the mercy of its 200-day MA.

The breach of the immediate $0.09 resistance would, however, clear Tron’s path for a 10% rally. The same would place its price at the threshold of $0.1.