Trump tariff on Brazil reaches 30.8% according to Goldman Sachs calculations, and also Korea $350 billion investment deal emerges as a strategic response to trade pressures right now. The Goldman Sachs tariff forecast actually reveals significant impacts on Brazilian imports, which contrasts sharply with South Korea’s successful negotiation of a US trade deal with Korea that includes massive investment commitments.

Trump Tariff On Brazil Sparks Korea $350B Deal, Goldman Weighs In

Goldman Sachs analysts have determined that the Trump tariff on Brazil will actually reach an effective rate of 30.8% on all Brazilian imports. This figure was calculated after accounting for exemptions in the White House Executive Order, and it represents a reduction of six percentage points from previous estimates.

Goldman Sachs stated:

“Our calculations suggest that the exemptions listed in the Executive Order lower the expected increase in the US effective rate on all Brazilian imports by 6 (percentage points) to a still high 30.8%.”

Meanwhile, the Korea $350 billion investment secured a dramatically different outcome. Kim Yong-beom, who is South Korea’s presidential policy chief, announced details of the US trade deal with Korea at the time of writing.

Kim Yong-beom stated:

“The reciprocal tariff rate will be lowered from 25 percent to 15 percent. The tariff on automobiles, one of South Korea’s key export items, has also been reduced to 15 percent.”

Also Read: EU Bends Knee: Trump’s $1.35T Trade Deal Sends Stocks Soaring

Investment Structure and Profit Disputes

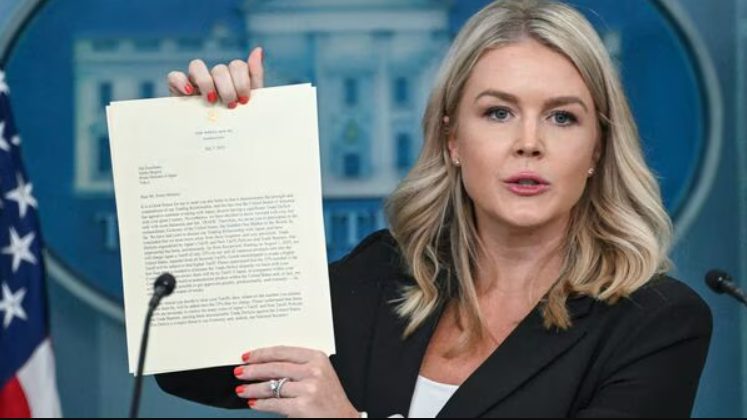

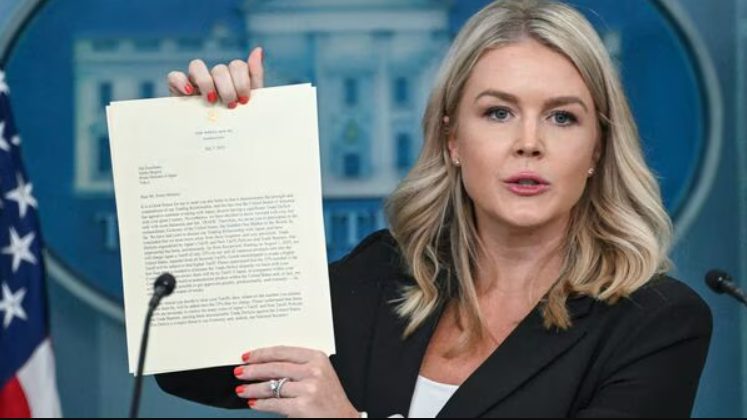

The Brazil trade war impact differs significantly from Korea’s negotiated terms right now. Commerce Secretary Howard Lutnick claimed that the Korea $350 billion investment would benefit Americans substantially, along with other economic advantages.

Howard Lutnick stated:

“90% of the profits of South Korea’s $350 billion investment would go to the American people.”

However, this actually sparked immediate controversy in Seoul. Kim Yong-beom challenged this interpretation regarding the Trump tariff on Brazil versus Korea’s preferential treatment.

Kim Yong-beom stated:

“In a normal civilized country, who would be able to accept that we invest the money while the U.S. takes 90% of the profits?”

Agricultural Protection Success

Despite the Goldman Sachs tariff forecast showing harsh treatment for Brazil, South Korea successfully defended key sectors. The US trade deal with Korea excluded agricultural concessions, which contrasts with the Trump tariff on Brazil’s comprehensive coverage.

Kim Yong-beom stated:

“It is true that there were strong demands from the U.S. for the further opening of South Korea’s agricultural and livestock markets during the negotiations. But taking into account food security and the sensitivity of the agricultural sector, South Korea did not agree to further open its rice and beef markets.”

The Brazil trade war impact demonstrates how different negotiation strategies produce vastly different outcomes under the current trade framework right now.

Also Read: Iran, Part of BRICS, Threatens Brazil’s Push for Global Reform