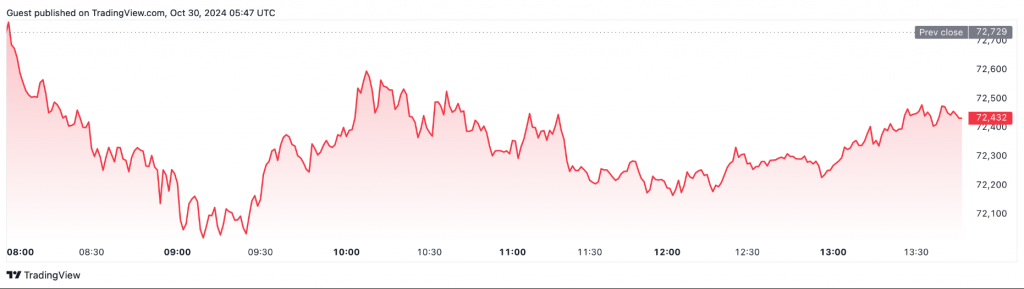

Trump’s election impact looms large over Bitcoin’s price. BTC sits near its peak of $72,432. Market experts watch Trump’s past support for crypto during his presidency. Back then, Bitcoin rose from $1,000 to $20,000. His attacks on Biden’s crypto rules draw attention amid regulatory uncertainty and increasing market volatility. Analysts are keenly observing Trump’s election impact on this trend.

Also Read: Top 3 Cryptocurrencies That You Should Watch In Q4 2024

How Trump’s Election Could Shape Bitcoin’s Future: Analyst Insights

Market Sentiment and Election Dynamics

“A Trump victory would likely provide a dopamine hit,” Swyftx lead analyst Pav Hundal told Cointelegraph. Bitcoin has gained 7.62% since October 23. It’s now just 2% below its highest price ever and some speculate this is due to Trump’s election impact.

Hundal notes, “I’m not sure timing your trades matters too much in this environment unless you’re a sophisticated investor looking for short-term arbitrage opportunities on the US election result.” Trump’s election impact might make timing even more challenging.

Trading Strategies and Regulatory Implications

Derive founder Nick Forster urges caution. Trump might reverse current crypto rules. “Traders should approach with caution, as the market is currently pricing in considerable volatility,” he states regarding Trump’s election impact.

His warning continues: “While there might be an upside, the risks are equally significant.” Trading data shows big market moves ahead due to Trump’s election impact.

Forster explains, “The increased buying of calls indicates some traders are indeed betting on a bullish outcome, potentially expecting a ‘buy the rumor’ scenario, but the reality could pivot quickly to a ‘sell the news’ dip depending on actual election outcomes.”

Also Read: Analyst Shares New Date For Cardano (ADA) Price Hike: ADA To Rise Soon

Policy Shifts and Price Projections

Trump openly opposes central bank digital money. He backs traditional crypto instead. “Barring some kind of exogenous shock, we’re looking at six-figure Bitcoin prices before year-end. Irrespective of who is in control of the White House,” noted 10T Holdings founder Dan Tapiero. Markets like his stance against SEC crypto crackdowns. Many see Trump’s election impact as a significant factor in these projections.

Market Fundamentals and Historical Context

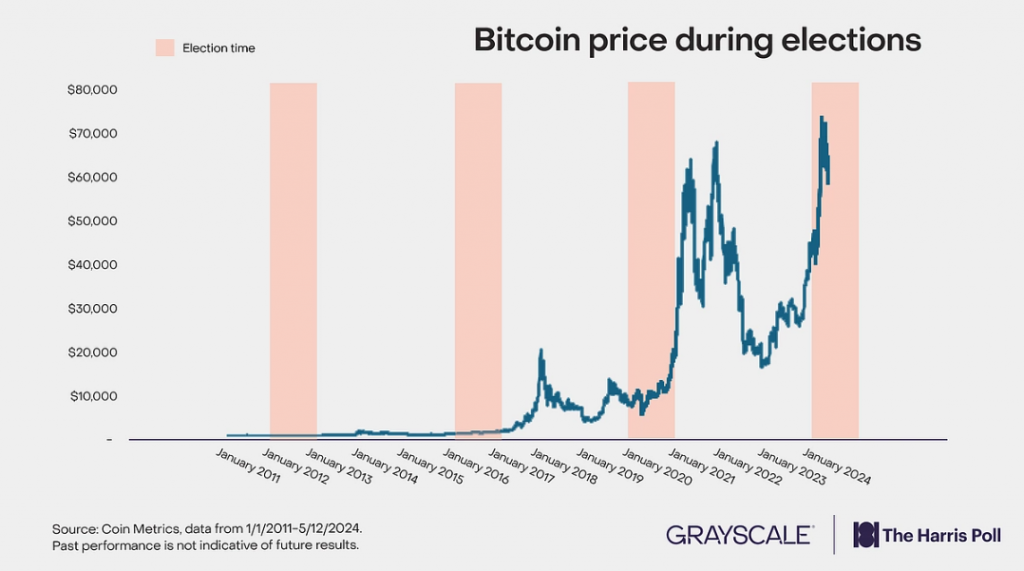

Bitcoin’s 2017 surge happened during Trump’s term. Similar signs appear now. “It’s entirely probable that the market will whipsaw on the US election result. But the underlying market fundamentals are pointing toward growth,” Hundal emphasized, noting Trump’s election impact on market sentiment.

Also Read: Buy Boeing (BA) Stock: It’s Available at a Discounted Price: Analyst

FalconX’s head of research, David Lawant, agrees. He said Bitcoin “is likely to perform well regardless of the election outcome.” He points to more big investors and clearer rules than during Trump’s last term. Thus, it seems Trump’s election impact will be felt across the market.