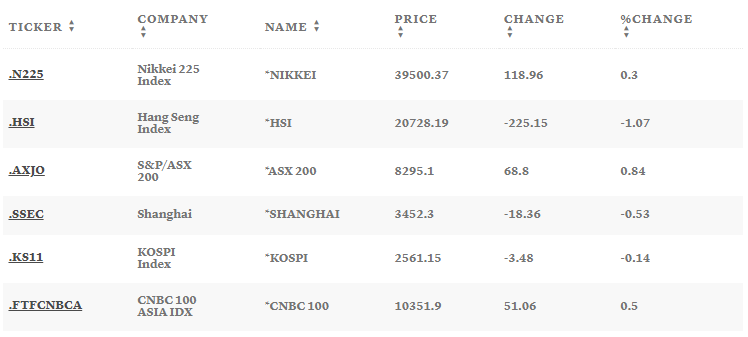

Trump’s tariffs are back, and this time, they’re targeting Chinese goods with a staggering 60% tax while slapping 10% on everybody else. But here’s the twist – U.S. stocks and crypto markets aren’t following the 2016 playbook. Asian markets are showing unexpected strength, and economic impact forecasts are raising eyebrows. Trade war 2.0?

It’s a whole new game. We’ll keep you updated on the latest developments. Here’s what we know for now.

Also Read: Expert Forecast: S&P 500 to Gain 11% by Mid-2025

Navigating Market Volatility: Trump’s Tariffs and Their Impact On the World

Surprising Market Moves

“We saw gradual buying continue to pick up,” reports J.P. Morgan’s Shinji Ogawa from Tokyo. Asian industrial and financial stocks? That’s not what anyone expected with those tariff numbers. You know what’s interesting? Vietnam’s industrial stocks are actually surging.

Also Read: Dogecoin Millionaire Count Soars 40% Following Donald Trump Victory

China’s New Playbook

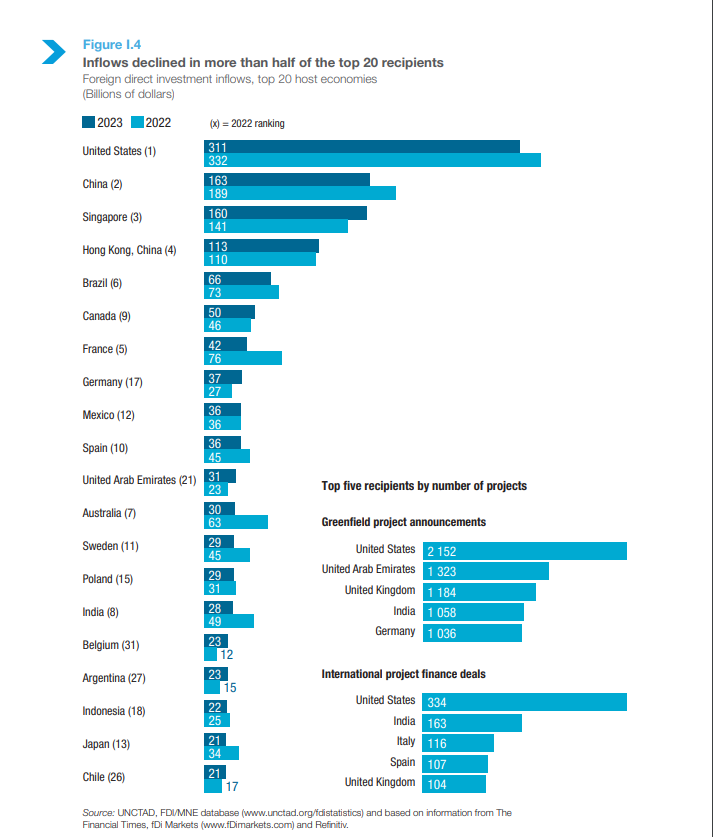

Looking at how China is handling things this time, we see that they’ve dropped U.S. export dependency from 20% to 15%. “China is now better prepared for any curbs, whether technologically, militarily, or financially,” says Charles Wang at Dragon Pacific Capital. Seems like they learned from round one, right?

Money Moves Different Now

It’s pretty interesting how investment patterns are shifting. “With this environment where cost of dollar capital is unlikely to fall that much…then you’re likely to see a lot more preference for growth,” notes Citi Wealth‘s Ken Peng. India’s looking pretty good in all this – who would’ve thought?

Also Read: AI Predicts Tesla (TSLA) Price If Musk Assumes Key Role In Cabinet

Not All Bad News

Here’s where it gets interesting – BNP Paribas sees Trump’s tax cuts potentially boosting Chinese company demand. Robert St Clair at Fullerton Fund puts it straight: “Trump is a businessman at heart… He knows that China has significant market share in some key high value end industries…and China seems to be navigating the tariff stresses very well.” Looking at these numbers, seems like opportunities are popping up where nobody expected them.