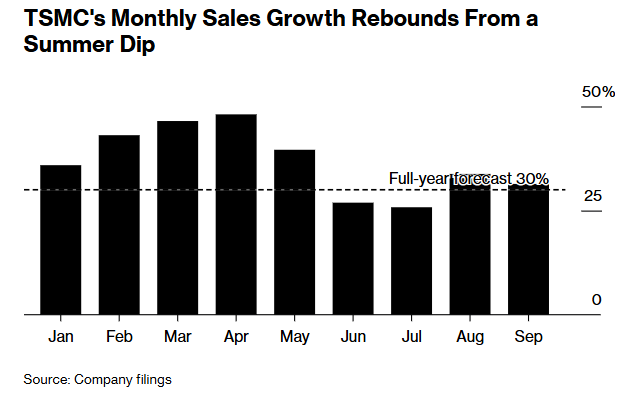

TSMC stock soared when the chipmaker announced a 39% increase in profits in the third quarter of 2025. TSM shares soared to record highs when TSMC reported net income of NT$325.3 billion ($10.1 billion), in fact, exceeding the expectations of analysts. TSM earnings and the strong results showed the strength of AI chip demand that is currently driving semiconductor growth.

AI Boom Powers Massive TSMC Stock Rally After TSM Earnings Beat

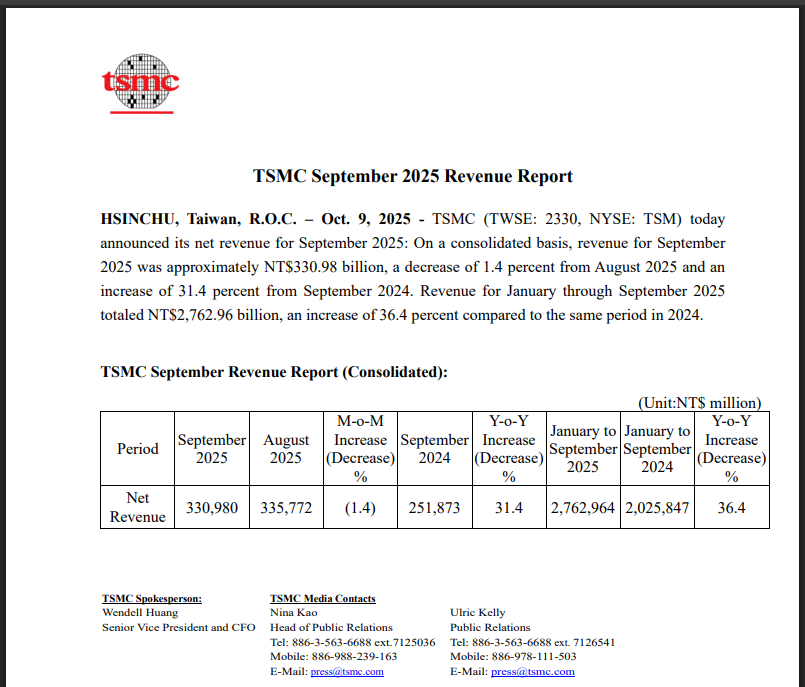

September quarter revenue was NT$759.69, an increase of 36.5 percent over the same period of the previous year. TSMC was also enjoying a high demand of both 3-nanometer and 5-nanometer chips that were used in artificial intelligence applications. The September 2025 revenue was NT$330.98 billion and this was 31.4 percent higher than September 2024.

CEO C.C. Wei also said that:

“Recent developments in AI market continue to be very positive. Thus, our conviction in the AI mega trend is strengthening.”

Strong Results Drive Optimistic Outlook

The stock gained as TSMC raised its 2025 revenue growth forecast to the mid-30% range. The company also increased capital expenditure to $40 billion for capacity expansion. High-performance computing, which includes AI chips along with 5G applications, was responsible for 57% of revenues in the quarter.

Also Read: SpaceX Starship Megarocket Launch Sends Space Stocks Soaring

Gross margin was expanded to 57.8%, up from 54.3% in the prior year. CFO Wendell Huang provided fourth-quarter guidance of $32.2 billion to $33.4 billion in revenue, even as the company continues ramping up overseas operations.

Wei also said:

“The explosive growth in token volume demonstrated increasing consumer AI model adoption, meaning more computation is needed.”

TSM earnings demonstrated the company’s dominance in advanced chip manufacturing at the time of writing. Wei also addressed some market concerns:

“If the China market is not available, I still think the AI growth will be very positive. I have confidence in my customers.”

Also Read: 3 US Stocks Deliver Above 200% Returns in a Month: Eos, Bakkt, PepGen