When the United States pressed sanctions on other countries, the sanctioned nations’ economy crippled to their knees. Allies stopped doing business with sanctioned countries and their finances and GDP came to a grinding halt. The sanctions forced rouge nations to remain on track and displayed the power the U.S. dollar holds on the global economy. However, in the Joe Biden administration, sanctions seem to no longer work as countries are finding new ways to escape the penalty.

Also Read: BRICS Advancing To Eliminate U.S. Dollar Financial System

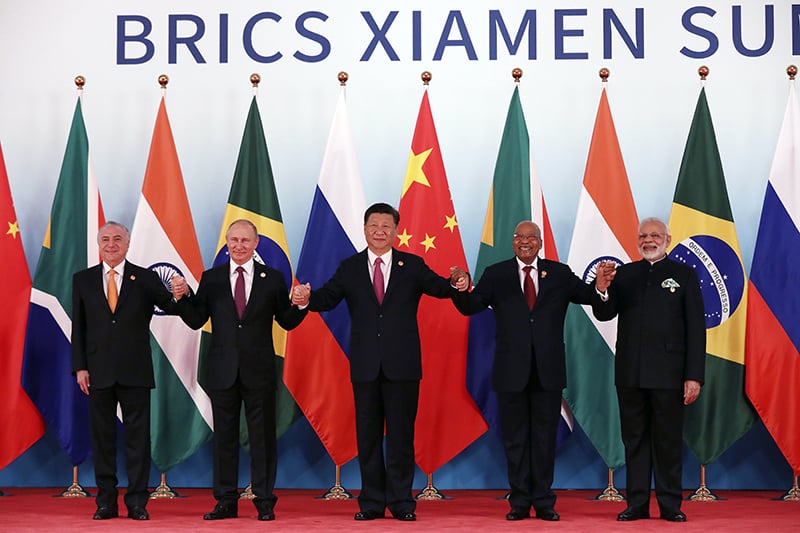

BRICS Currency to Help Sanctioned Nations After Sidelining U.S Dollar

The Biden administration pressed sanctions on Russia for invading and waging war against its neighboring country Ukraine. Russian President Vladimir Putin turned the tables by reaching out to China, Saudi Arabia, and India to evade sanctions. Not only did Russia evade the sanctions, but it is also challenging U.S. supremacy on a global scale.

For example, the Chinese Yuan became the most traded currency in Russia ending the dominance of the U.S. dollar. Saudi Arabia also took sides with Russia and China and it is buying Russian oil at record levels and laundering it into the European markets.

Also Read: Will the U.S. dollar Collapse Now That BRICS Are Developing Their Own Currency?

The development helped BRICS nations immensely making them consider a new alternative currency challenging the dollar. If BRICS agrees to a new currency in the upcoming summit in August, U.S. sanctions may wane in the coming years. The alternative currency will help sanctioned nations trade as usual with no strain or consequences on their economy.

In conclusion, the power of sanctions might no longer exist if the U.S. dollar wanes and the BRICS currency takes shape. The USD could fall further leading to an economic crisis that could hit the American household.

Also Read: World Could Ditch U.S. Dollar, Create Bipolar Global Currency System: NYU Professor

The Biden administration needs to rethink its strategy and launch new initiatives to keep the USD at the top. Failing to do so could make way for a new global system without the dominance of the dollar.