The U.S. dollar is surging against the Indian rupee in 2024 making the Reserve Bank of India (RBI) nervous. The rupee fell to a low of 83.63 in April last month but briefly recovered in May reaching 83.43. Despite the rebound, the global macroeconomic factors and a stronger U.S. dollar could make the rupee fall to new lows in 2024.

Also Read: Risk Appetite For Gold Increases: A Surge to $2,700 Next?

All local currencies dipped against the U.S. dollar this year including the Chinese yuan, Japanese yen, and the Pound Sterling. In addition, out of the 23 top currencies in Asia, the U.S. dollar outperformed 22 of them in the last five months. The Indian rupee is on the back foot vs the U.S. dollar and could shed more in the coming months.

The conflict in the Middle East between Iran, Israel, and Palestine is what’s driving the U.S. dollar up. The DXY index, which measures the performance of the USD shows the currency hitting 105.50 on Monday. The USD to INR is at 83.51 on Monday and the local currency remains at risk of dipping further.

Also Read: Gold Price Prediction For May 2024

U.S. Dollar vs Indian Rupee: 2024 Price Prediction for USD/INR

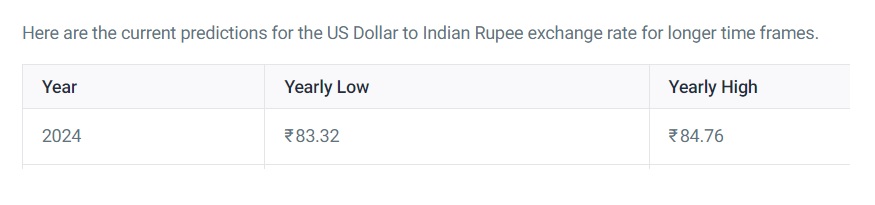

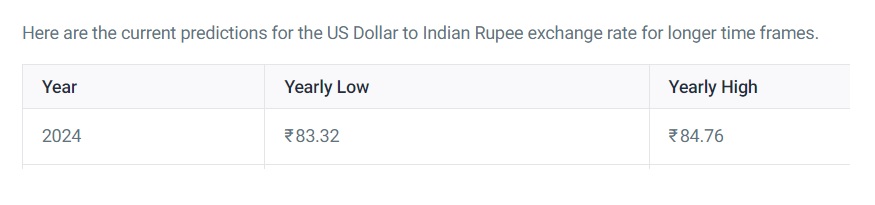

The Indian rupee is forecasted to fall to 84.76 by the end of the year in 2024 against the U.S. dollar. That’s a dip of approximately 1.5% in the next coming months indicating a weaker INR. According to a prediction from the AI firm CoinCodex, the INR could begin its dip against the USD from Q3 of 2024.

Also Read: How To Make Your First $1 Million Warren Buffett Style

Currently, the sentiment in the USD/INR market remains bullish. The 14-day RSI reading is 47.46, suggesting neutral conditions. In the last 30 days, the volatility of the USD to USD has been 0.13%. The current USD to INR exchange rate is above the 50-day SMA, which is currently sitting at ₹ 83.35. The current rate is above the 200-day simple moving average, which is positioned at ₹ 83.17.