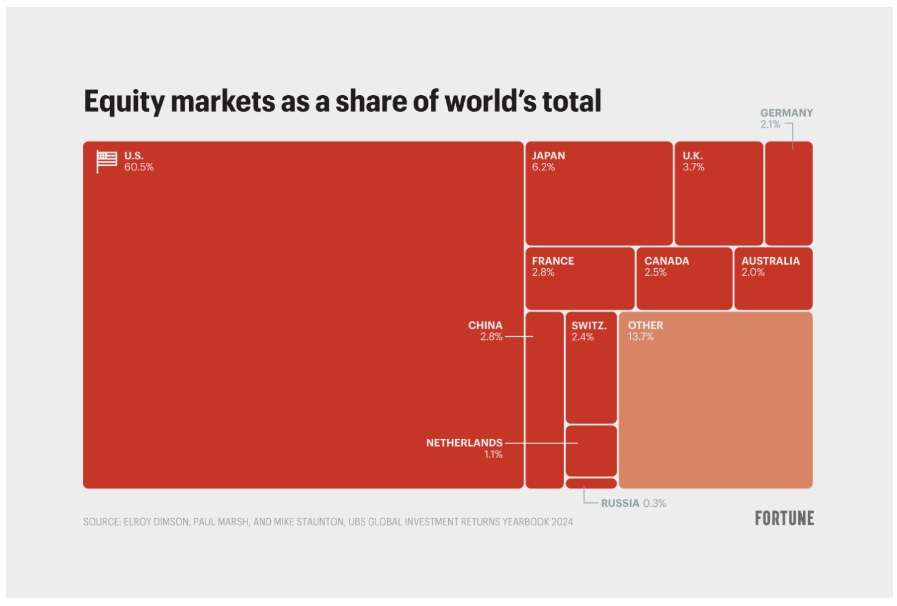

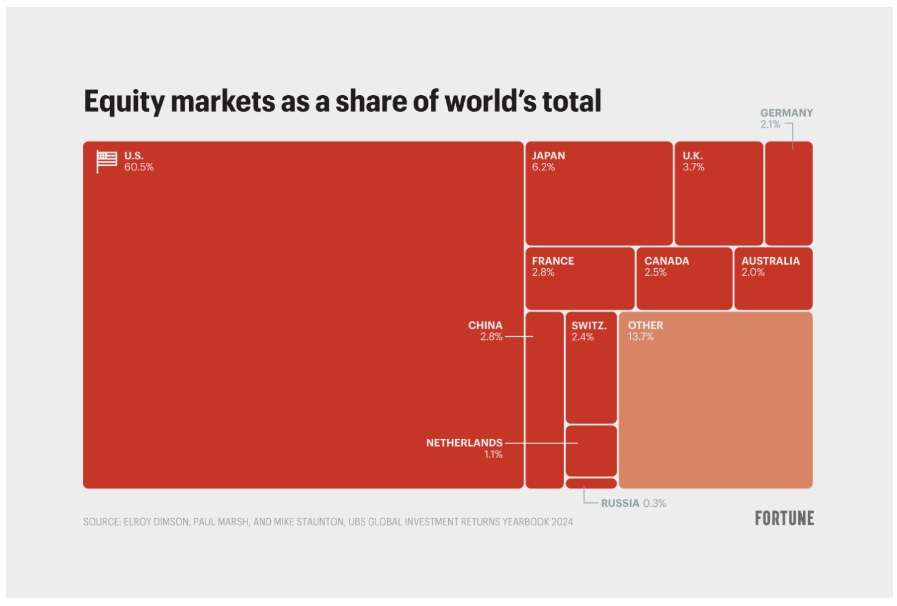

The United Kingdom had the world’s strongest stock market up until the early 1900s. However, at the start of the 20th century, the U.S. stock market grew by leaps and bounds outpacing the U.K. by a large margin.

The dominance of the U.S. stock market started in 1904 and no other country has come closer since then. The global supremacy reigns for over 120 years making it the longest-ever serving financial market in history.

Also Read: 10 ASEAN Countries To Ditch the U.S. Dollar

The U.S. Stock Market Reigns Supreme For 120 Years

While the U.S. stock market has been on top for over 120 years, only China seems to be competing with its dominance. However, despite the competition, the Chinese economy remains at a distant second and has a long way to the top.

Also Read: Asian Hedge Funds Are Massively Accumulating the U.S. Dollar

That’s taking into consideration China’s growing economy and GDP only. Its equities, the Shanghai Stock Exchange (SSE) is no match to the U.S. equities.

Since 1992, China’s economy has grown 6.5 times faster than that of America. Nonetheless, the U.S. stock market has generated returns 3.5 times as high as that of China during the same period.

Also Read: Chinese Yuan Climbs 14.70% Against the US Dollar Since 2005

Below are the top 10 important stock markets in the world:

1. U.S.

2. China

3. Japan

4. India

5. U.K.

6. France

7. Saudi Arabia

8. Canada

9. Germany

10. Switzerland

The U.S. experiences growth with publicly traded companies while state-run firms drive China’s growth. Power is not concentrated in the U.S. while China’s economy is heavily one-sided. This puts the U.S. equities ahead of its adversaries as it offers opportunities for all in the financial sector.

However, the U.S. stock market could face more competition as India and Japan’s equities is growing. The markets are known for their volatility and can pull down the ‘top’ to the bottom within a few months of trading.