The first AED-backed stablecoin has received approval from the UAE’s central bank. This marks a key change in the country’s digital currency system. The UAE central bank’s move strengthens cryptocurrency regulations and sets new rules for digital currency and stablecoin approval.

This step makes crypto transactions safer and more stable.

This stablecoin approval shows the UAE’s push toward digital currency growth. Let’s explore this further.

Also Read: Pepe: Trader Turns $3,000 Into $73 Million

How UAE’s First AED-Backed Stablecoin Addresses Cryptocurrency Challenges

AE Coin Launch and Implementation

AE Coin got the first license to create a UAE Dirham-linked stablecoin under new payment rules. One AE Coin equals one dirham, making it a stable payment option. Ramez Rafeek, General Manager of AED’s stablecoin, says:

“AE Coin harnesses the speed and efficiency of blockchain technology, offering instant, secure, and cost-effective transactions. It simplifies transfers, making them faster and more seamless. In a rapidly evolving digital world, AE Coin sets a new standard for trust, security, and innovation in digital currency.”

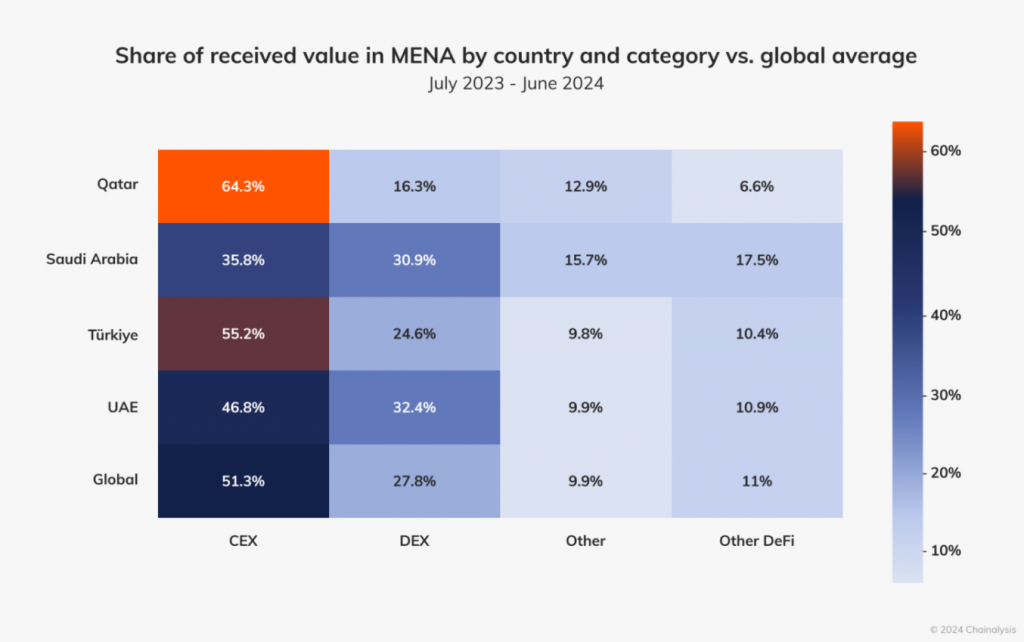

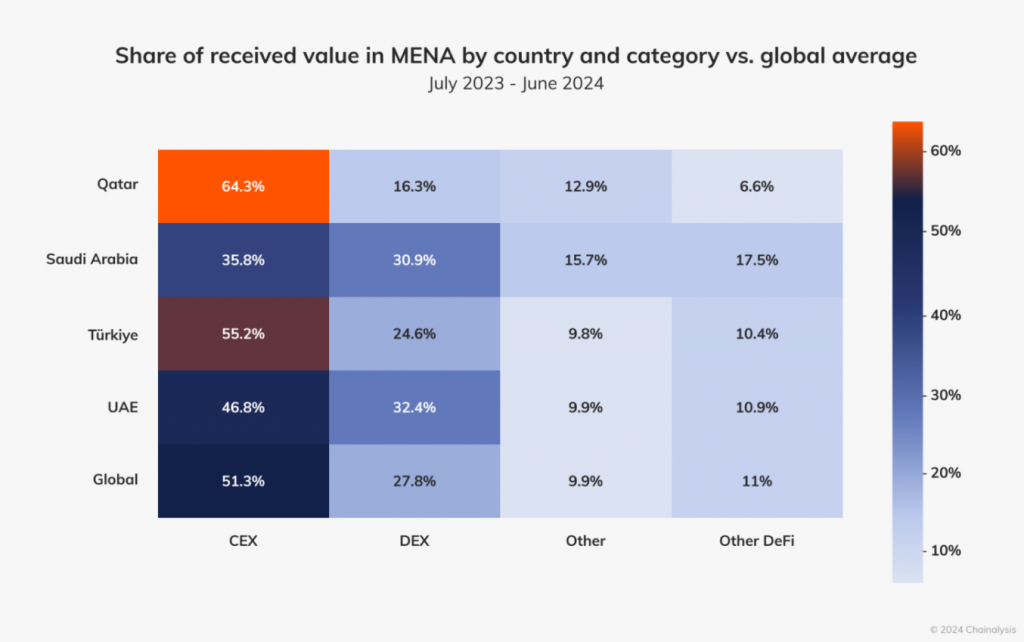

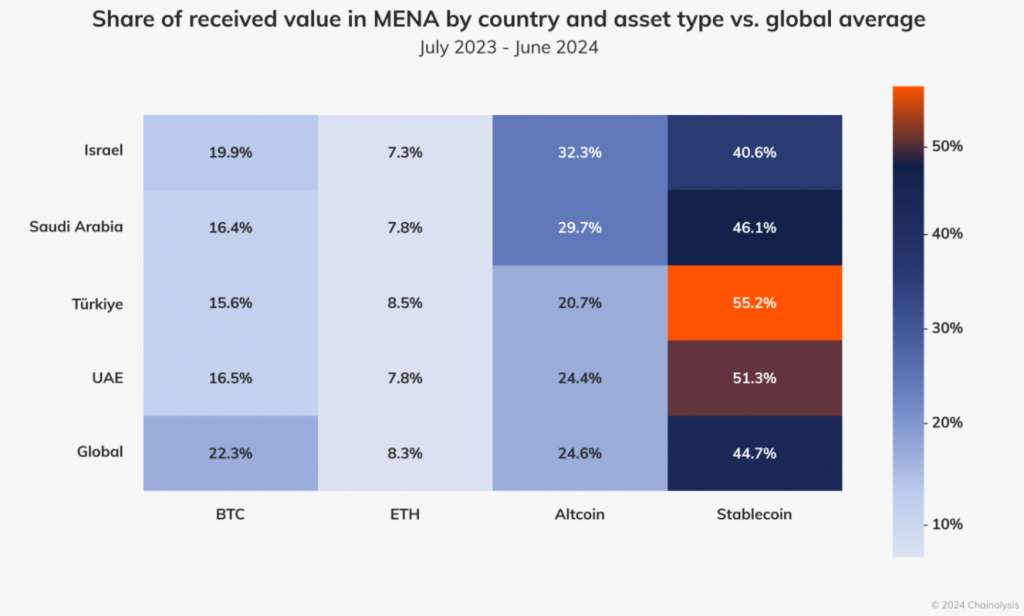

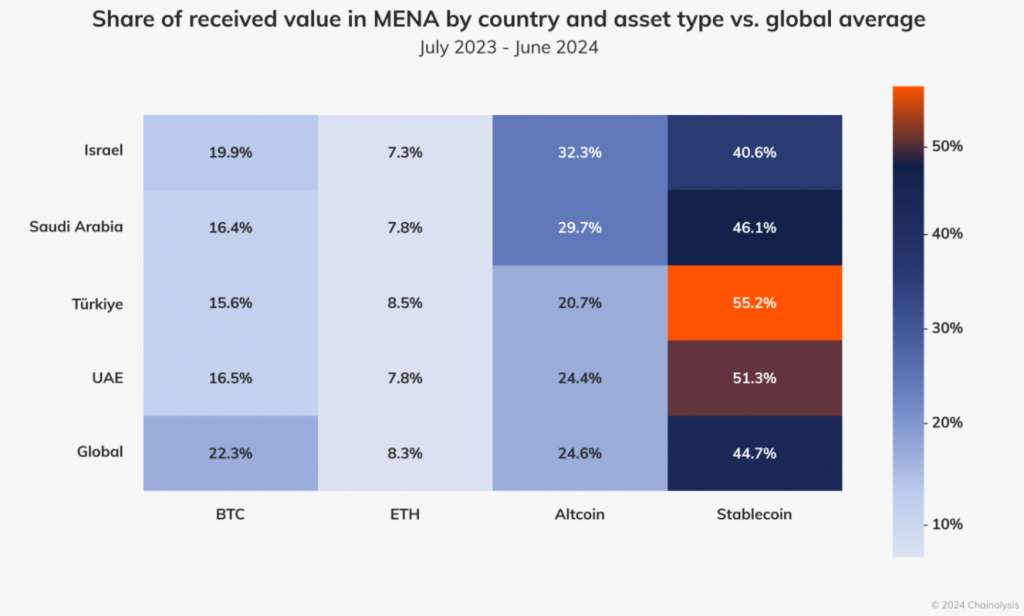

Market Growth and Transaction Patterns

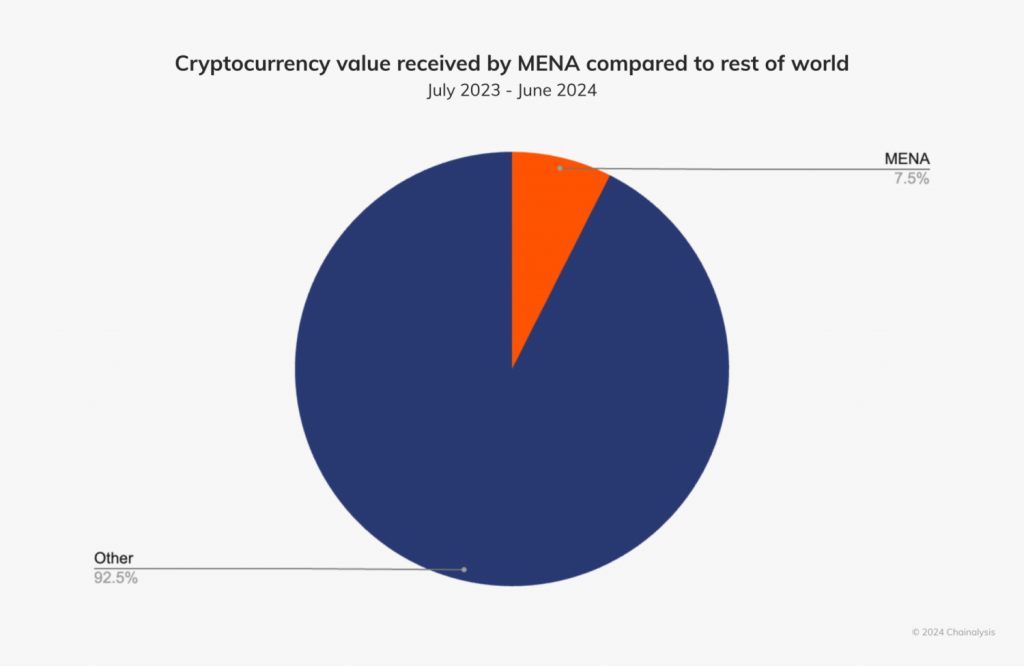

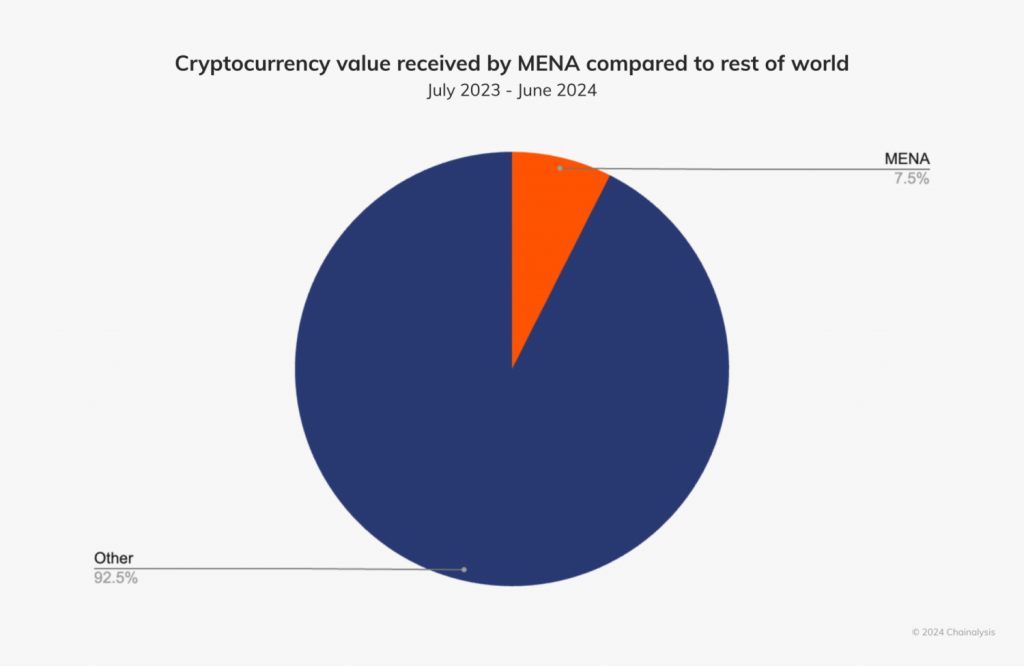

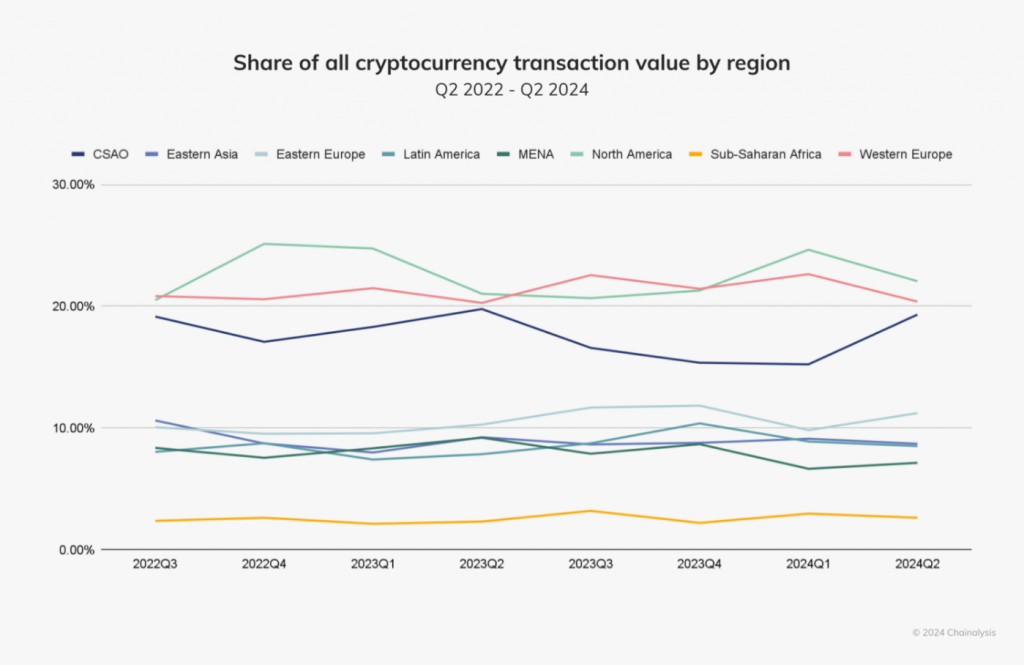

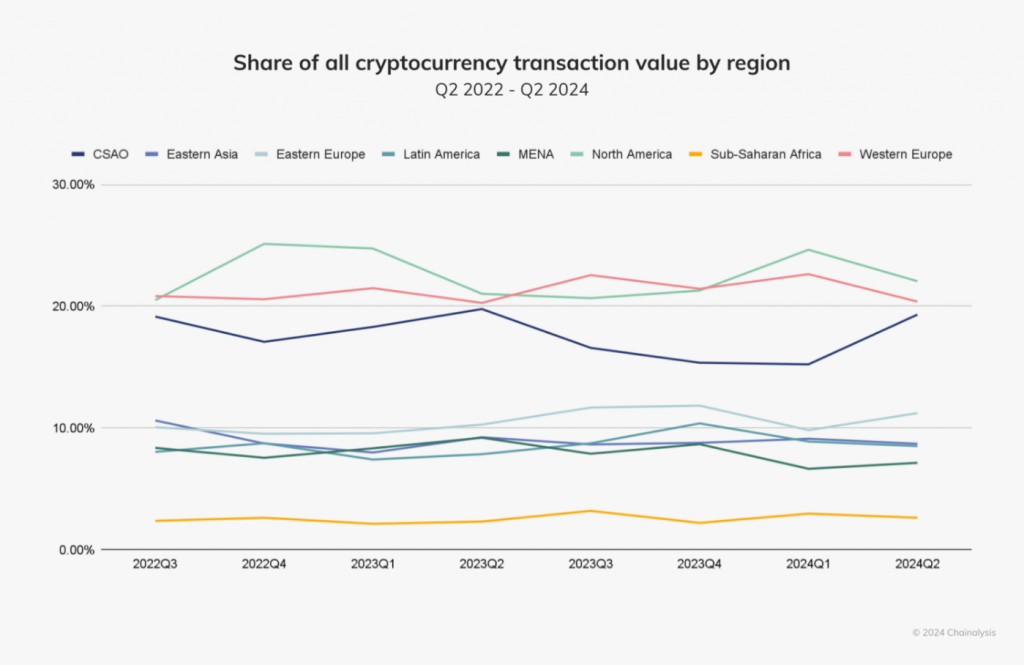

UAE’s stablecoin market grew to US$9.8 billion in early 2024, up 55% from 2023. Stablecoins lead with 51% of crypto activity, more than Bitcoin and Ether combined. This growth shows trust in cryptocurrency regulations and digital money systems.

Also Read: China Retaliates on Trump’s Tariffs: Bans 50% of US Material Exports

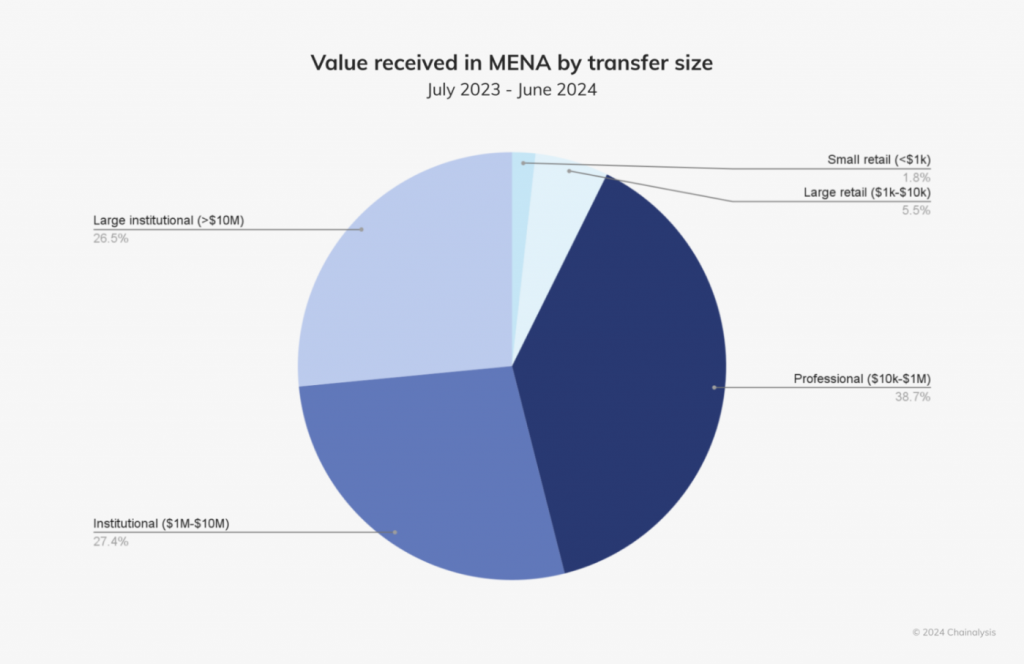

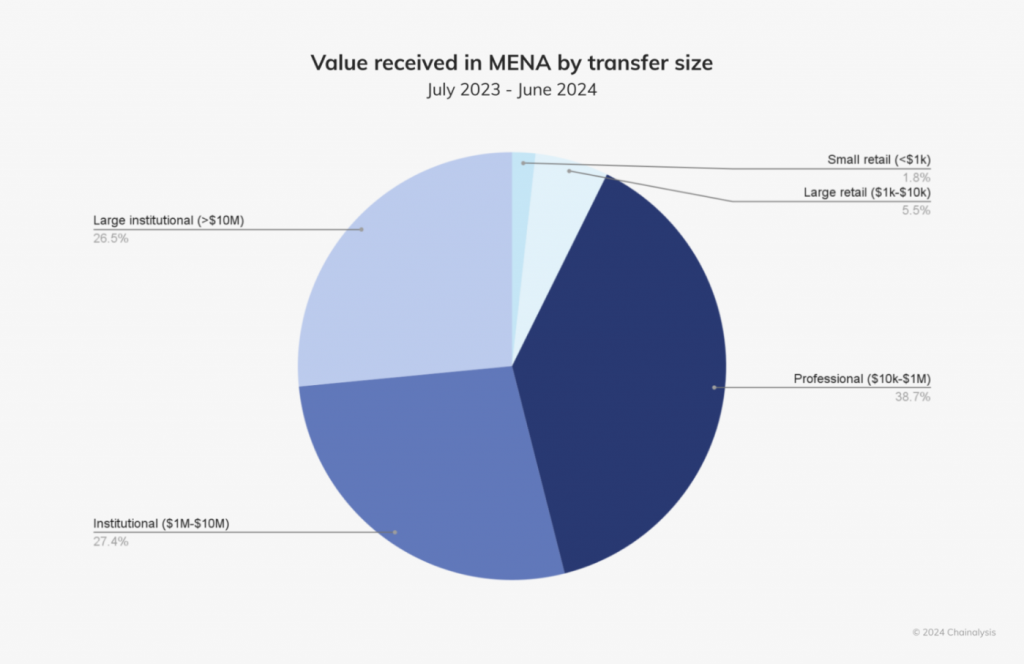

Retail and Institutional Adoption

Small transfers make up 93% of all transactions, but big institutions move most of the money. Business and institutional trades account for 74% of all value moved. The AED-backed stablecoin will likely boost these numbers by offering a safe, regulated platform.

Future Developments and Market Impact

More stablecoins are coming to UAE. Tether plans to launch its AED-backed coin in early 2025 with Green Arcon Investments Ltd and Phoenix Group PLC. This makes UAE a stronger digital currency center. The UAE central bank’s rules ensure these new tools are safe and stable.

Integration with Financial Services

The new stablecoin will change online shopping, money transfers, and decentralized finance. It gives companies and people modern banking tools while keeping traditional currency stability through cryptocurrency regulations.

Also Read: Bitcoin: What Could a $1,000 Investment Today Be Worth in 2030?