As the crypto space grows, platforms that aggregate data from the cryptocurrency markets are becoming increasingly important as a source of information. These systems provide information on price movement, market conditions, exchange trading volumes, asset market capitalization, listed cryptocurrencies, and trading pairs.

Market analytics tools are adding new indicators and enhancing current ones in pace with the rise of the bitcoin business. CoinMarketCap and CoinGecko, are two of the most popular cryptocurrency market analytics platforms today.

CoinMarketCap and Coingecko

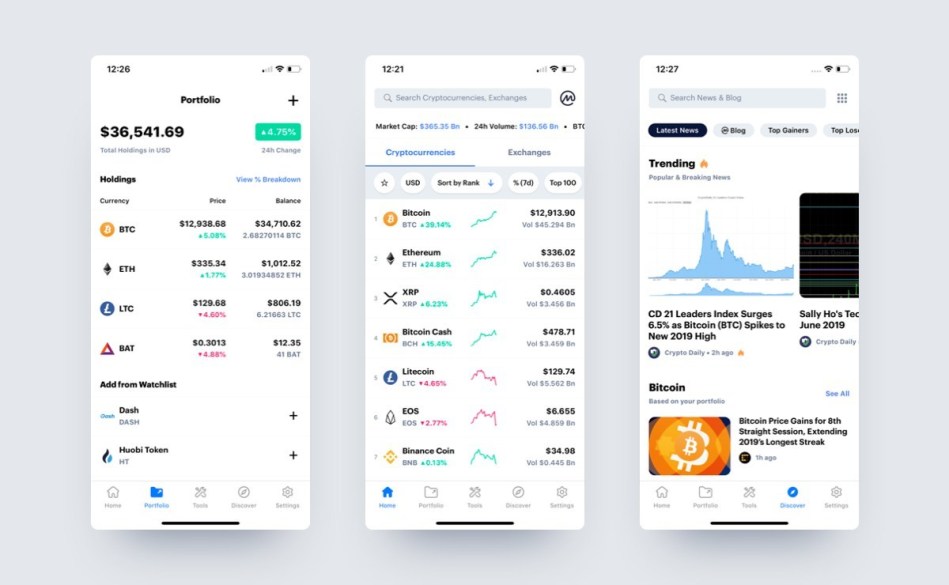

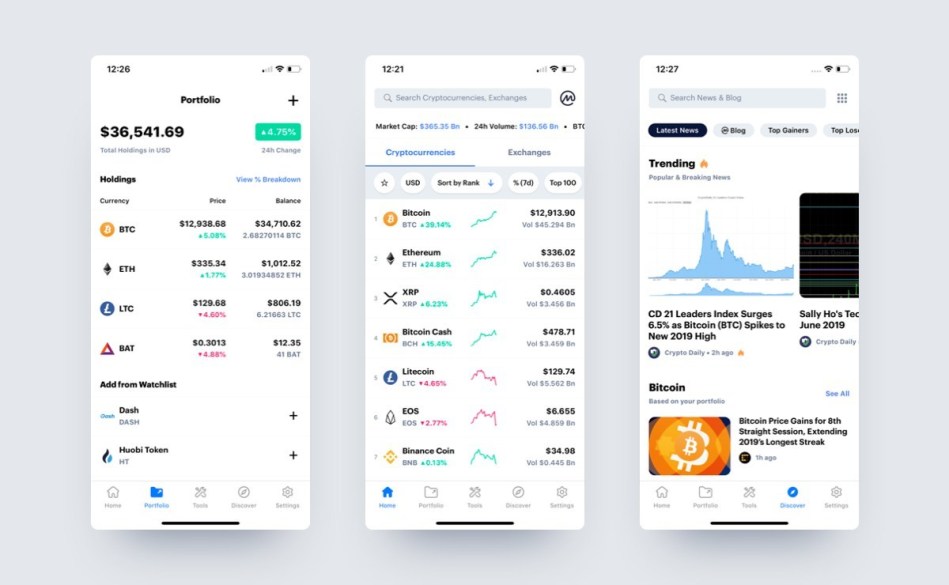

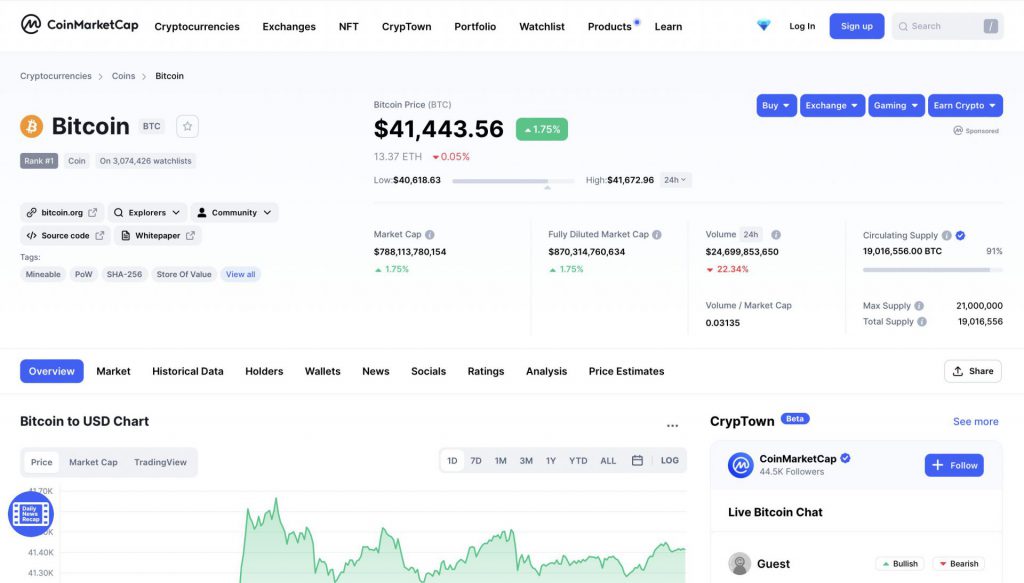

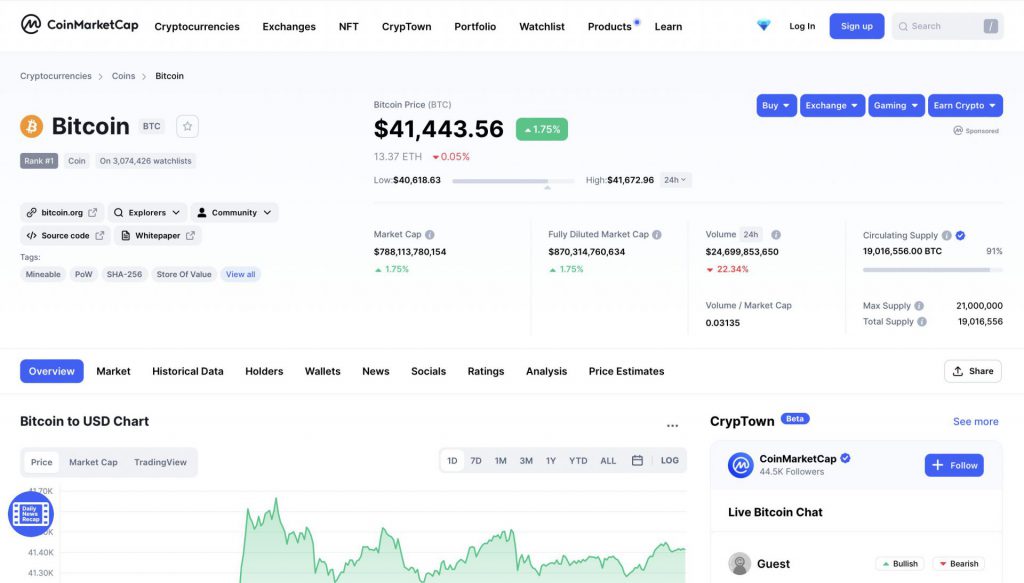

CoinMarketCap is the world’s most popular cryptocurrency market aggregator and price tracker. The company’s major goal is to supply merchants with the proper, unbiased, reliable, and high-quality information in order to assist them to make informed decisions.

CoinMarketCap was created in 2013 and has swiftly become the world’s leading source of information for individuals, businesses, and the media.

CoinMarketCap was acquired by Binance Capital Management in April 2020. Binance is the world’s largest cryptocurrency exchange by trading volume, number of users, and listed coins. CoinMarketCap also has a section dedicated to news and blogs regarding any token that is listed on its platform.

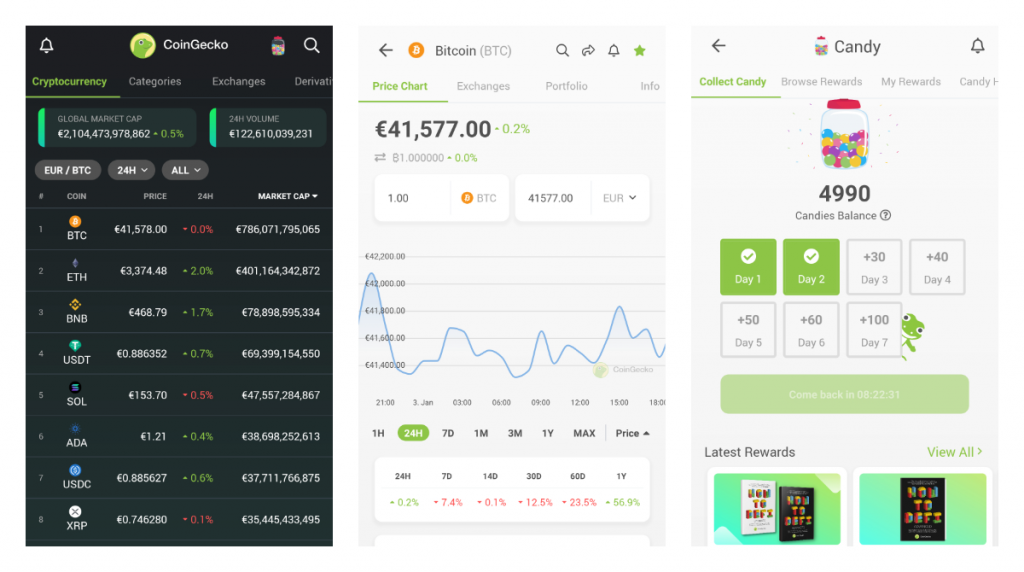

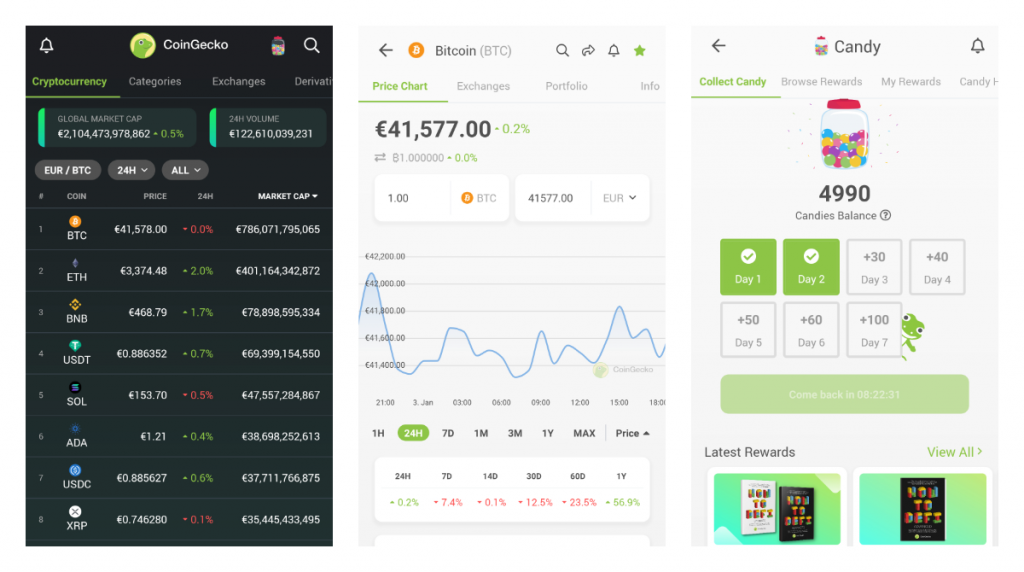

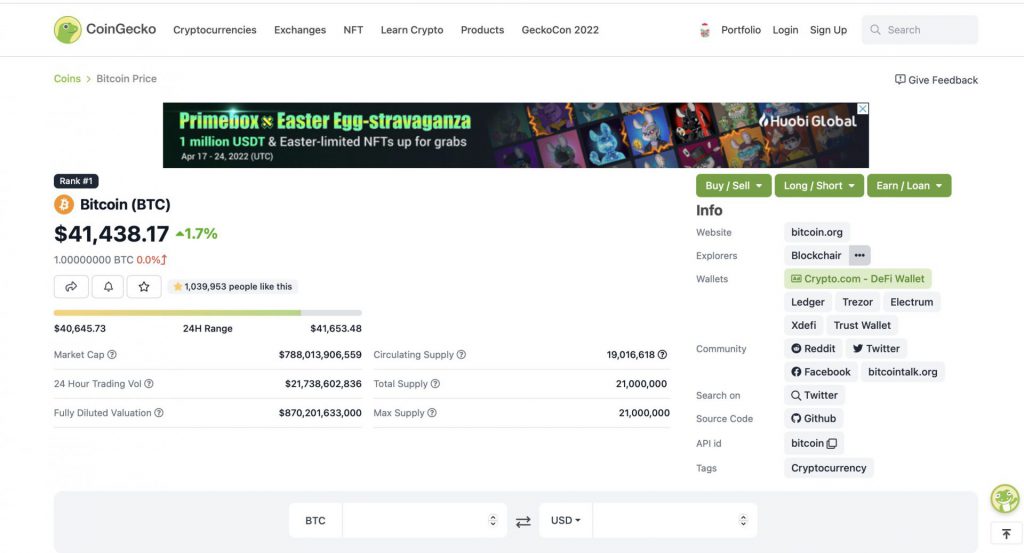

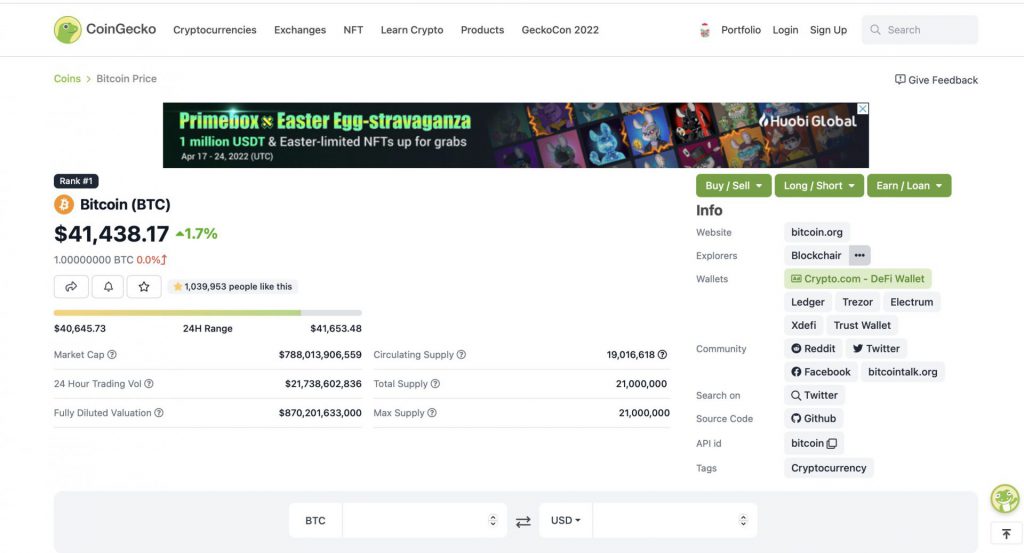

CoinGecko keeps track of cryptocurrency’s price, volume, social media, and development statistics. In 2014, Bobby Ong and TM Lee, in collaboration with Humboldt University in Berlin and Western University in Canada, established a platform that offers bitcoin research. The company keeps track of 3,587 tokens across 259 cryptocurrency exchanges.

Popularity in the Crypto space

CoinMarketCap had 37 million site views in February 2022, while CoinGecko had 8.33 million, according to SimilarWeb data. Both platforms are expanding in terms of monthly traffic, according to the data, albeit CoinMarketCap is growing significantly faster than CoinGecko.

CoinMarketCap acquired access to an already established internet audience as a result of Binance’s acquisition, which should help it grow its traffic. CoinMarketCap is projected to gain from enhanced development as a result of Binance’s strong financial resources.

The two platforms’ mobile apps have similar app usage and internet rankings. This is due in part to the fact that CoinMarketCap’s app came out a year after CoinGecko.

Crypto Volume and Liquidity

Many price-tracking services have attempted to present real trade volumes for various crypto assets, but differences in data displayed across platforms remain a concern.

This problem is solved by CoinMarketCap, which ranks and scores exchanges based on traffic, liquidity, trading volumes, and confidence in the legitimacy of stated trading volumes. Markets on highly-ranked exchanges will have high Liquidity Scores, Volume, and Web Traffic Factor scores, as well as high Confidence scores.

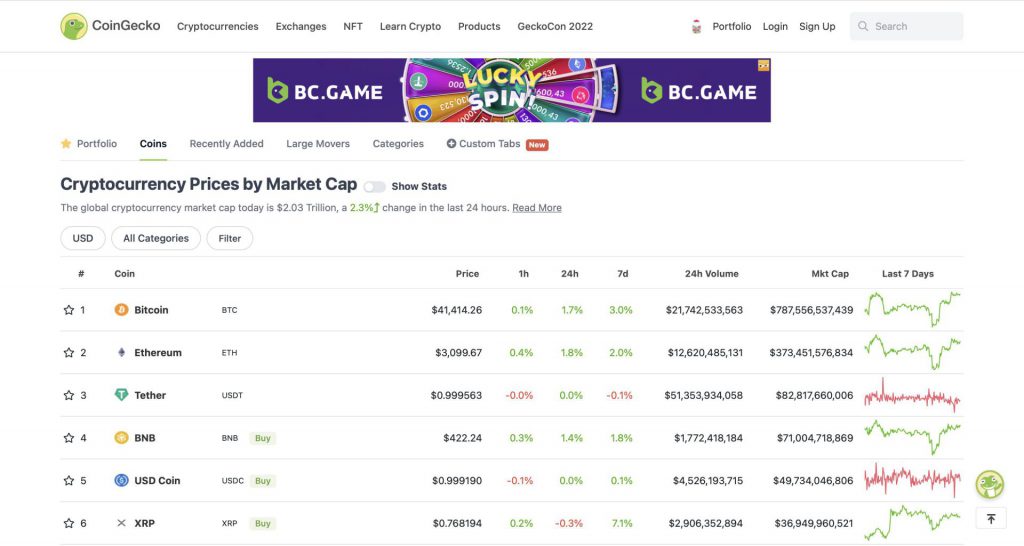

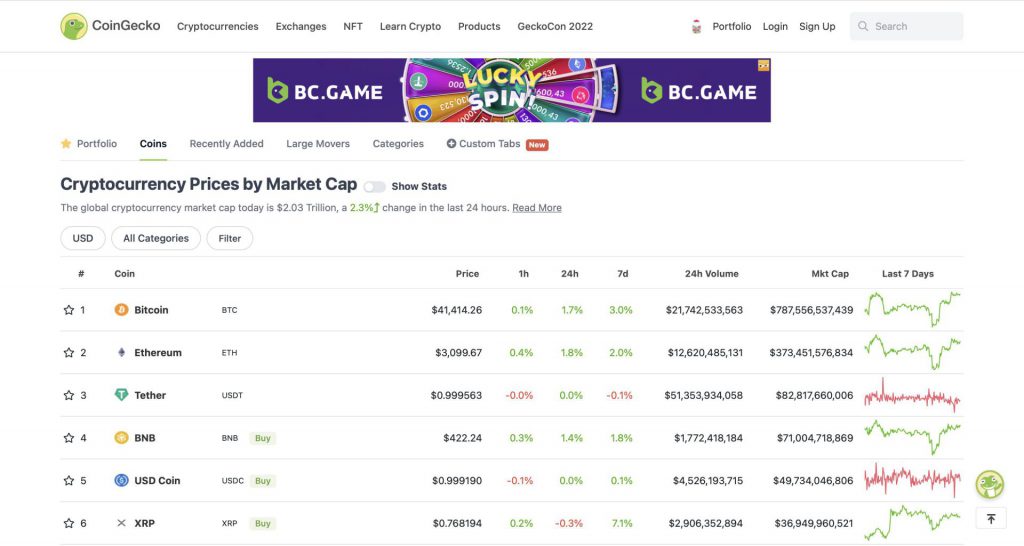

CoinGecko measures metrics such as community growth, open-source code development, and the project’s code advancement in addition to measuring and tracking tokens and coins by their market size and cryptocurrency exchanges by their trading volume.

CoinGecko originated as a developer-focused aggregator of crypto data tracking measures. Developers such as Gitlab, Bitbucket, and Github are tracked, as are communities such as Facebook likes, Twitter followers, new posts and comments, and Reddit subscribers. Keeping track of developer and community statistics is supposed to provide you with a full picture of any coin.

CoinGecko features

CoinGecko has its own set of unique features that make it stand out. Apart from its website and app, the platform also has a free API that can be integrated into websites and blogs. The site has its portfolio tracker, quarterly reports, its own newsletter, podcast, blogs and articles, crypto comparison tool, and an aggregator for crypto updates.

The CoinGecko Beam function was introduced in November 2018 with the goal of increasing user trust and transparency. Additionally, users can use it to track the progress of numerous projects.

The CoinGecko Earn function brings together loan requirements from several lending sites as well as working conditions into a single platform. It was first released in March of 2020. Safety audits, profitability standards, and threat evaluations of diverse platforms are among them.

Due to extensive data tampering, trading volume cannot be used to evaluate liquidity in the bitcoin market. The CoinGecko team recently introduced a new feature called “Trust Score,” which ranks exchanges according to their Trust Score rather than their overall 24-hour reported trading volume.

When combined with other indicators, the Trust Score provides a more complete picture of every trading pair’s genuine liquidity on any exchange. CoinGecko also provides analytics like hot and cold wallet analysis, transaction history analysis, crowd-sourced reviews, cybersecurity analysis, social media statistics, and API quality evaluation.

CoinMarketCap features

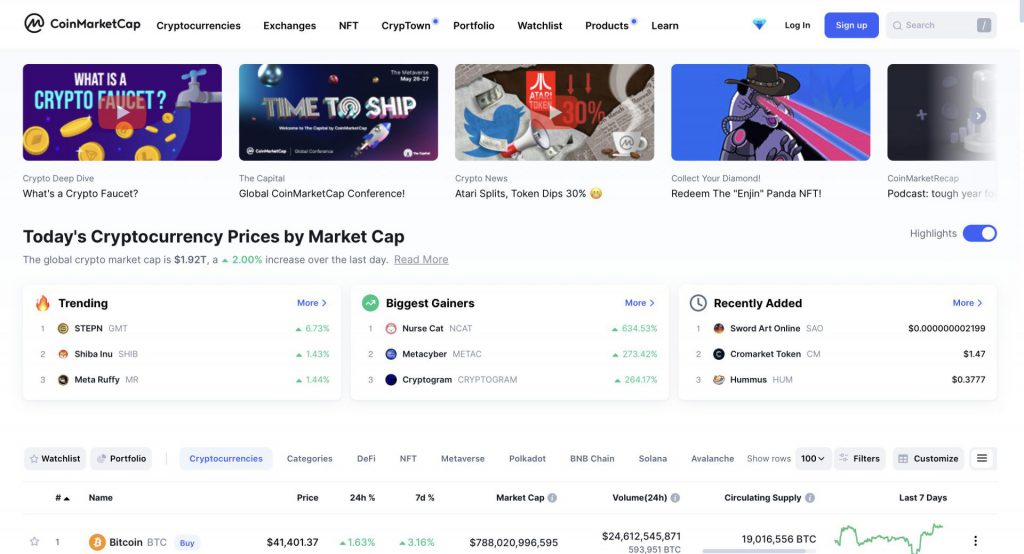

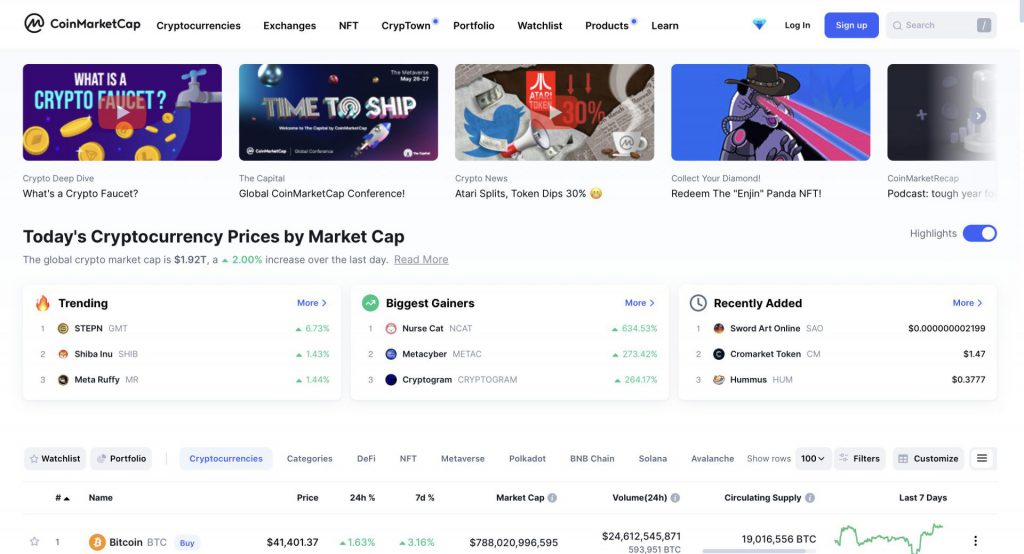

CoinMarketCap provides a variety of data, such as market capitalization, exchange rate changes over the last 24 hours and 7 days, and volume and supply.

CoinMarketCap also has a crypto portfolio tracker, crypto watch list, calendar for ICOs, events, etc., a built-in Ethereum swap, crypto to fiat currency calculator, blockchain explorers, an APY tracker for DeFi and CeFi, and an Earn-to-learn feature where users can earn crypto by learning about crypto. The site also has its own newsletter.

The platform also has its website and apps for iOS and Android.

Like its rival Coingecko, it also provides different forms of data, mostly to help users gain a better understanding of the crypto sector and stay up with current events. It also has a big number of different cryptocurrencies to pick from and is a reliable source of cryptocurrency-related information. The data is updated in real-time and users can improve their results by using filters and other customization features.

Conclusion

Both the platforms have unique as well as shared features. Both are equally popular and powerful. However, the end result is mostly up to what the user needs. In most cases, investors use both to get an even more detailed idea about different projects. Each brings something new to the table. Hence, using both platforms to one’s best benefit is the way to go.