UniCredit’s Commerzbank stake limit has actually reached a critical point right now, as the Italian bank officially declared it won’t exceed 29.9% ownership in Germany’s Commerzbank. This UniCredit Commerzbank stake limit announcement effectively puts a stop to UniCredit takeover rumors and also shows the bank’s careful approach to German banking consolidation through its UniCredit equity strategy.

UniCredit Takeover Rumors Grow as Shareholding Cap Stalls Moves

The Friday filing actually revealed UniCredit’s position on its Commerzbank shareholding cap, which puts an end to immediate UniCredit takeover rumors for now. The Italian lender communicated directly to Commerzbank about maintaining its current UniCredit Commerzbank stake limit, and this signals a temporary pause in German banking consolidation efforts.

UniCredit had this to say:

“The purpose of the acquisition … is to implement strategic objectives.”

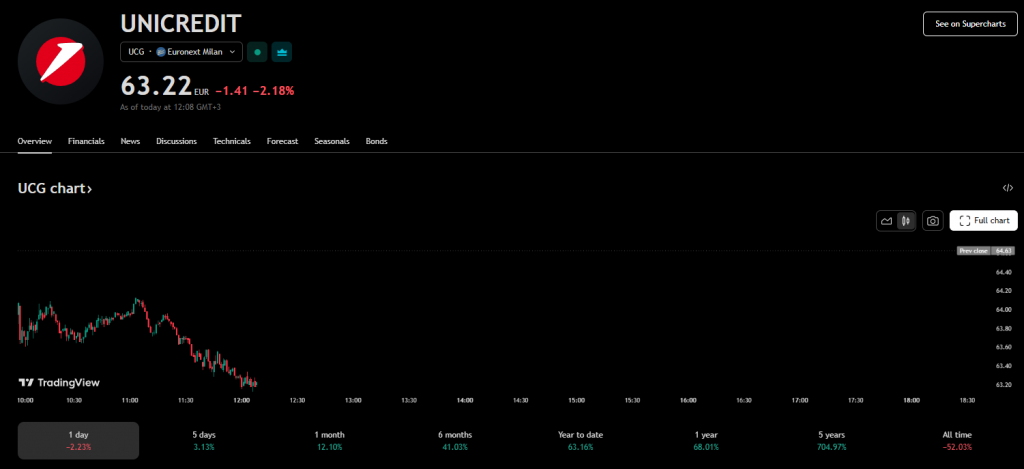

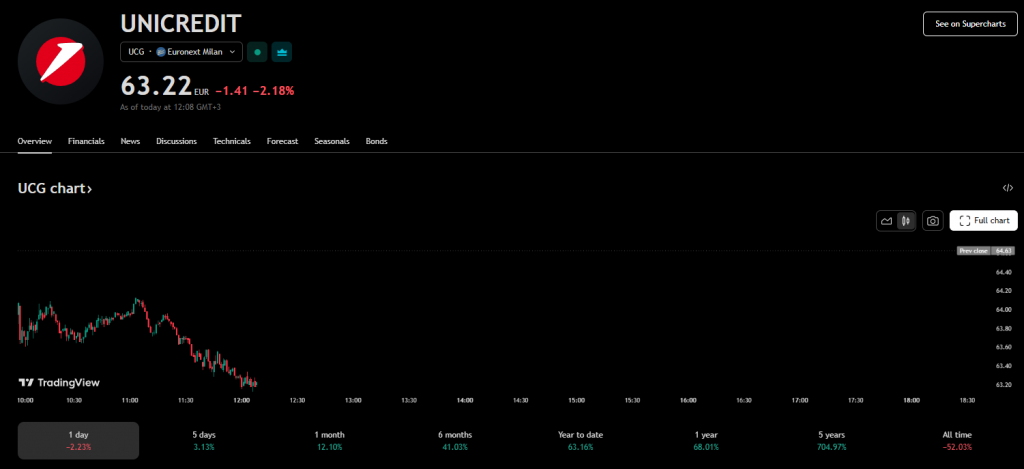

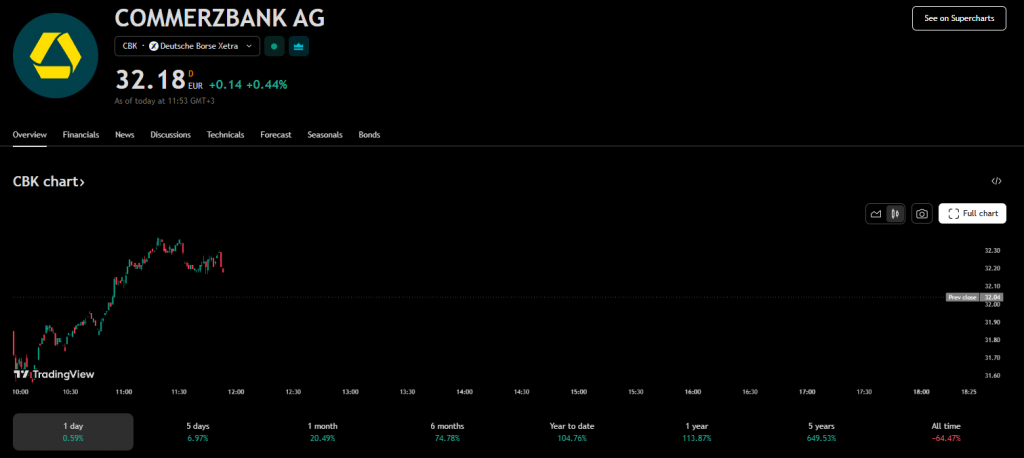

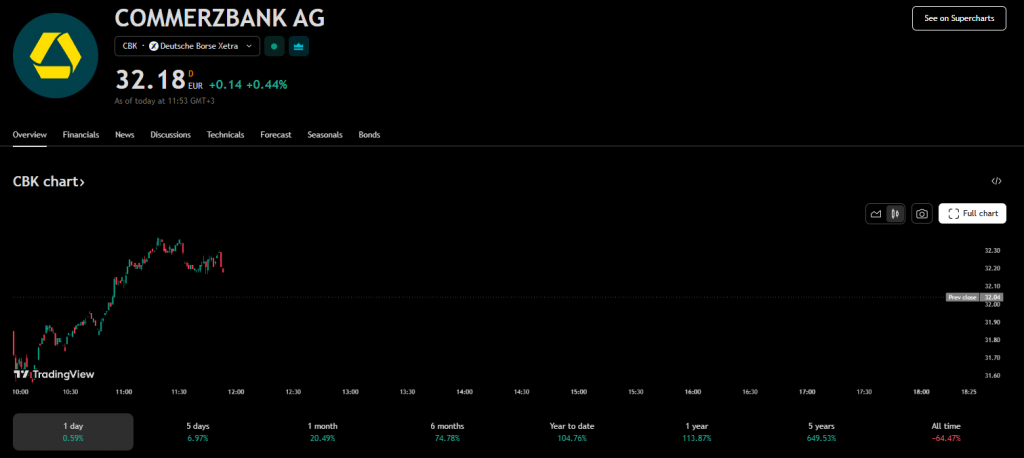

Market reactions were swift after the announcement was made. UniCredit shares actually declined 2.18% while Commerzbank gained 0.72%, which reflects how investors feel about the stalled UniCredit takeover rumors right now.

Also Read: De-Dollarization Moving Central Banks To Other Assets: BlackRock

What’s the Market Impact and How Does It Affect You?

Market participants have closely watched the UniCredit Commerzbank stake limit announcement, and the Commerzbank shareholding cap decision demonstrates how UniCredit equity strategy prioritizes staying within regulatory boundaries over aggressive expansion moves. At the time of writing, this approach seems to be working for both banks involved.

Future Implications for Banking Consolidation

The 29.9% UniCredit Commerzbank stake limit actually represents more of a strategic pause rather than completely abandoning German banking consolidation goals. This particular Commerzbank shareholding cap allows UniCredit to maintain significant influence while also avoiding mandatory takeover obligations that get triggered at 30% ownership.

Also Read: Central Banks Buying Gold From Domestic Miners in Local Currencies

The quantified UniCredit equity approach reports larger issues that are present in European cross-border banking mergers at this time, as regulatory oversight is as yet exceptional and the unpredictability of the market influences the strategic decision-making mechanism.