Uniswap has been one of the worst affected tokens of the recent wider-market sell-off. Over the past week, UNI has lost 35% of its value and continues to remain engulfed within its descending channel on the price chart.

Over the past 28 hours, however, the token has started consolidating and moving horizontally around in and around the $10 mark.

Uniswap: Caught and bowled?

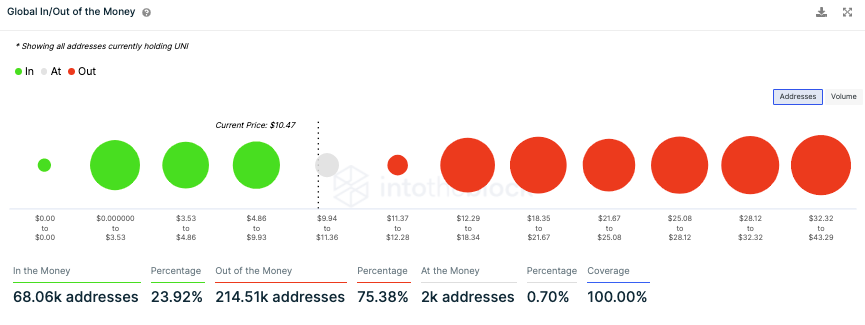

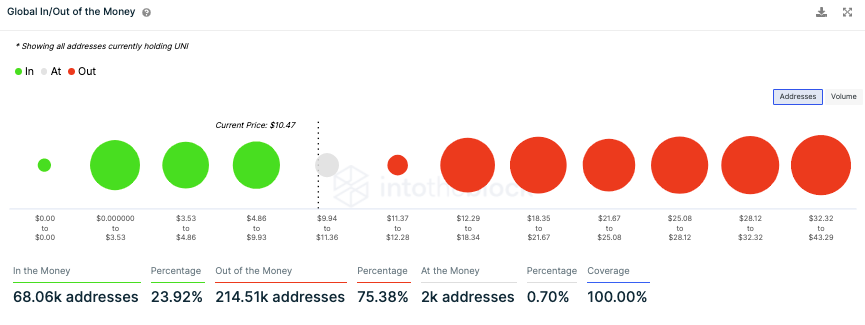

Owing to UNI’s depreciation, the average cost at which most of the tokens have been purchased is more than the current price as of now. In effect, more than 3/4th of the HODLers are currently “out of the money” or in losses.

READ ALSO: Uniswap Price Prediction: Why price could falter around the $20 mark

Before this, such a huge chunk of investors suffered losses in conjunction only in November 2020.

During the aforesaid diminishing returns period, Uniswap’s price remained stagnated for quite a bit before recovering and eventually rallying. So, something similar can be expected this time around too.

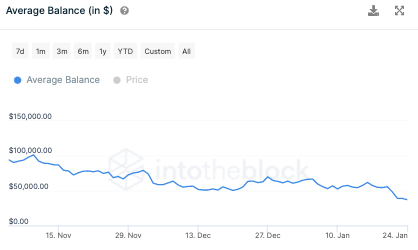

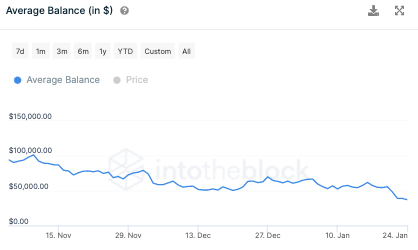

Over the past few weeks, the average HODLer balance has also been depleting. This metric was, in fact, seen at a multi-month low at the time of this analysis. Along with the shrinking market cap, this also brings to light the selling-spree that market participants have been in of late.

To make things even more clumsy, the total value locked on the protocol has also fallen to a value as low as $6 billion now. This means that the liquidity on the protocol has been eroding away-again another unfavorable depiction.

READ ALSO: Shibnobi: SHINJA amasses 50k holders as price soars by 50%

At this stage, Uniswap’s correlation with Bitcoin is at a yearly high of 0.95, and notably, this token has been following the king coins’ footsteps without much ado. So, unless and until a clear-cut uptrend is established by BTC, Uniswap’s prospects would continue to remain sour, given the fact that it doesn’t have much support from other ecosystem-centric factors too.