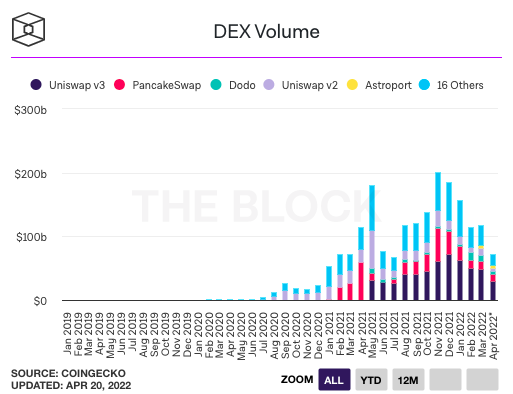

Market participants’ trading interest usually peaks during bull market periods and withers away during bearish phases. In effect, the volume pendulum keeps swaying from one extreme to the other.

Decentralized exchanges, or DEXes, behave in no different way. Consider this – When the market was recovering post last year’s flash crash, the cumulative DEX volume gradually climbed up the stairway. Post-November, however, when the asset prices started falling again, the aggregate volume figure started descending.

So far in April, transactions worth only $71.8 billion have been carried out on DEXes when compared to last November’s $200.45 billion.

Uniswap rules in this protocol’s empire

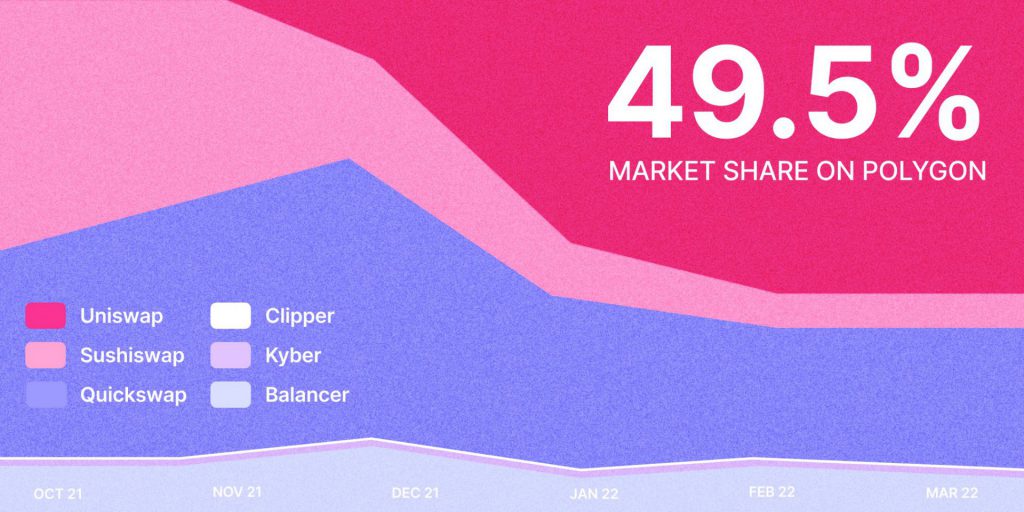

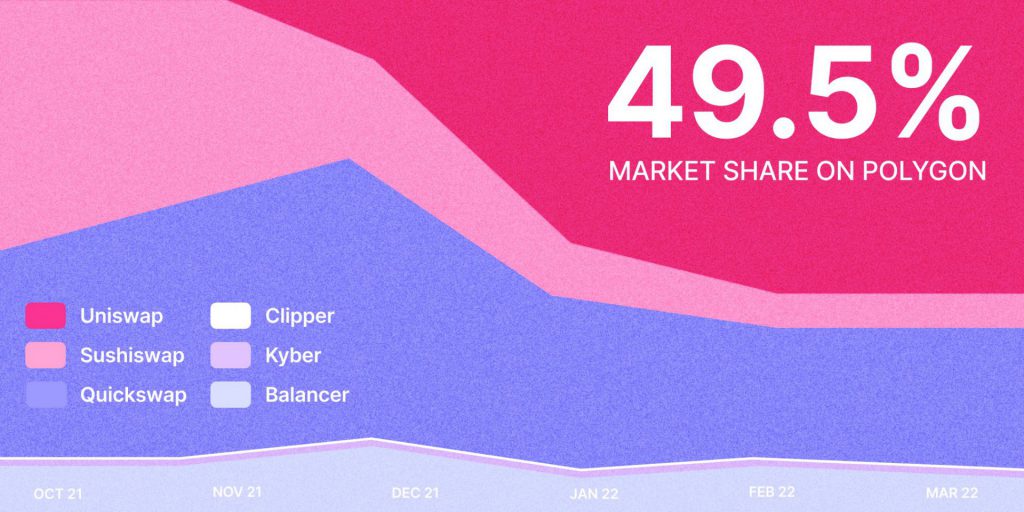

However, in an interesting feat achieved recently, Uniswap went on to highlight that its protocol commands almost half the market share on Polygon’s DEX.

Notably, Uniswap launched its services on the Polygon blockchain towards the end of December last year when UNI HODLers approved the same. The consensus check passed with 44M (98.87%) YES votes and 500k (1.13%) NO votes.

Elucidating on the latest development, the protocol’s official tweet noted,

“Just 3 months post launch, the Uniswap Protocol has nearly 50% market share on @0xPolygon. Bet your other favorite DEX couldn’t do that”

Other DEXes like Sushiswap, Quickswap, Clipper, Kyber, and Balancer were fairly behind Uniswap in the race.

The protocol’s native UNI token hardly reacted to the said development. At press time, it was trading at $9.4, down by more than 377% from its $44.9 peak attained in May last year.

Is Polygon PoS in a fix?

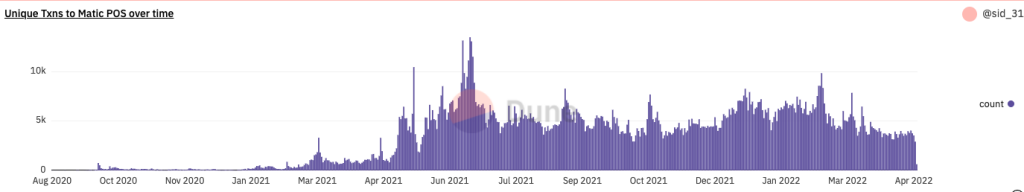

Right after Ethereum’s L1, Polygon PoS has the second strongest DeFi ecosystem. However, on the macro scale, the unique number of transactions executed here has been on the decline.

As per data from Dune Analytics, the count of the said metric mostly revolved above 5k from mid-December to February. In March, things slowly started changing, and of late, the number has been hovering in and around 3k.

The declining numbers, despite Uniswap’s command, speak for themselves about Polygon’s current bland state.