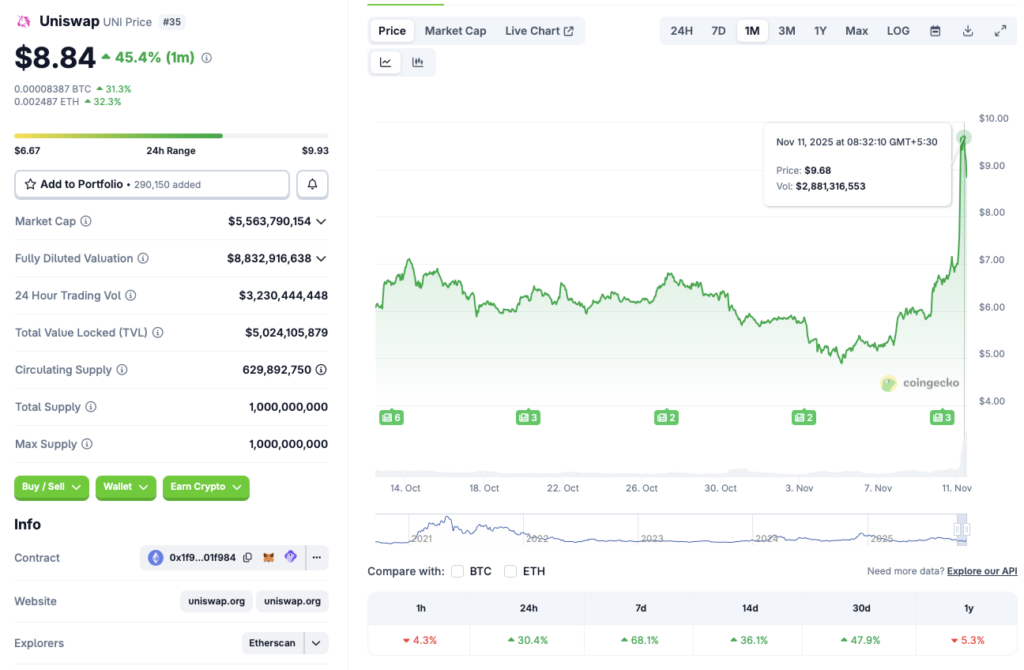

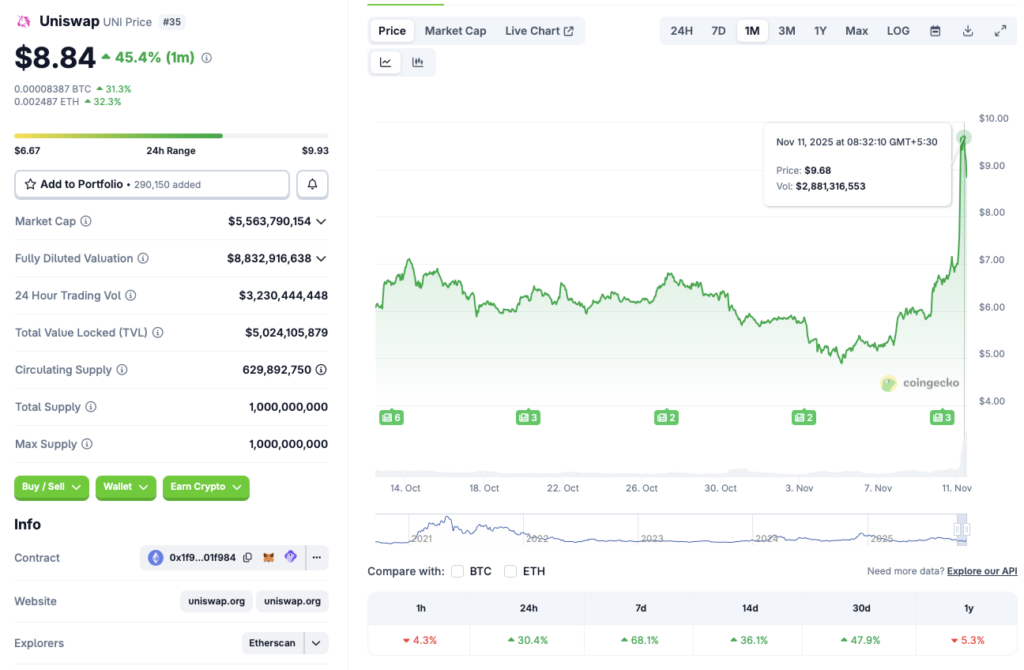

Uniswap (UNI) is currently dominating the cryptocurrency market charts, becoming the best-performing crypto asset in the daily and weekly charts. According to CoinGecko data, ANI’s price has surged 30.45% in the daily charts, 68.1% in the weekly charts, 36.1% in the 14-day charts, and 47.9% over the previous month. ANI is currently trading at its highest level in nearly 2 months. Despite the upswing, the popular cryptocurrency is still down by 5.3% from November 2024. Let’s discuss why Uniswap (UNI) is experiencing such a price rally today, and if the upswing will continue.

What’s Behind Uniswap’s Price Rally?

Uniswap’s latest upswing is likely due to Founder and CEO Hayden Adams announcing a host of new developments for the protocol. Adams took to X and stated that he has made his first proposal to Uniswap governance.

According to the X post, the proposal aims to use network fees to burn Uniswap (UNI) tokens. It will also send Unichain sequencer fees to burn UNI tokens. The proposal aims to burn 100 million Uniswap (UNI) tokens from the treasury. The move will also introduce Protocol Fee Discount Auctions. This is a novel way to improve liquidity pool outcomes and internalize MEV to the protocol. The proposal also aims to drive protocol growth and adoption, among many other developments.

The announcement has likely led to a spike in investor sentiment. Burns alone may have garnered the attention of Uniswap (UNI) investors and market participants.

Also Read: US Senate Ends Govt. Shutdown: Cryptocurrency Yet To Respond

While Uniswap (UNI) is making big price movements, the larger crypto market seems to be consolidating. Given the general bearish market environment, there is a possibility that UNI will face a correction soon. However, if Bitcoin (BTC) enters a bullish phase, UNI could continue its upswing. Many anticipate BTC to pick up the pace over the coming weeks, given that the US government shutdown has ended and the Federal Reserve has reduced interest rates by an additional 25 basis points. Both developments could aid Uniswap (UNI) in sustaining its ongoing price rally.