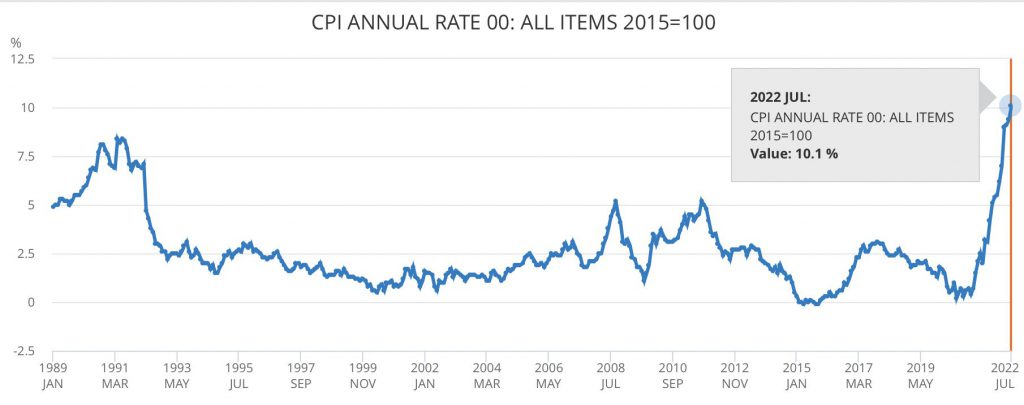

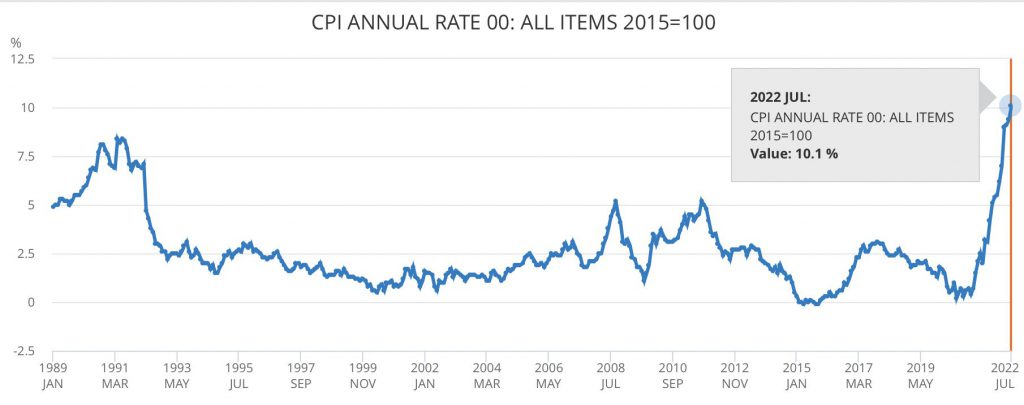

The United Kingdom (UK) reached record inflation numbers for the month of July. According to the Office for National Statistics, Consumer Price Index (CPI) rose to 10.1%, from 9.4% for the month of June. The number is north of the anticipated result of 9.8%. This is the highest inflation rate the country has faced in nearly 40 years.

According to the Office of National Statistics report, the increase in food prices between June and July had the most impact on yearly inflation rates for the UK. Moreover, in an effort to control inflation, the Bank of England has raised interest rates six times in a row so far.

Furthermore, according to ONS statistics released on Tuesday, the second quarter of 2022 saw the worst yearly decrease in real wages in the history of the United Kingdom at 3%. Despite a 4.7% increase in pay, the cost of living far outpaces wage growth.

Any relief for the United Kingdom on the horizon?

The Bank of England expects CPI numbers to top out at 13.3% in October.

The findings contribute to a crisis in the cost of living, as earnings continue to lag behind growing costs for all types of goods and services. Additionally, Andrew Bailey, the governor of the Bank of England (BOE), indicated he is willing to hike interest rates further. Furthermore, candidates vying to succeed Boris Johnson, have pledged further assistance to families who are having trouble making ends meet.

The likelihood of a recession in the United Kingdom is currently viewed by economists as being significantly more likely. Moreover, the BOE predicts that a recession will begin in the fourth quarter and persist through the beginning of 2024.

Meanwhile, the Canadian inflation numbers seem to be more at ease. Yesterday, the nation released its inflation rates which dropped to 7.6% for July, from 8.1% in June.