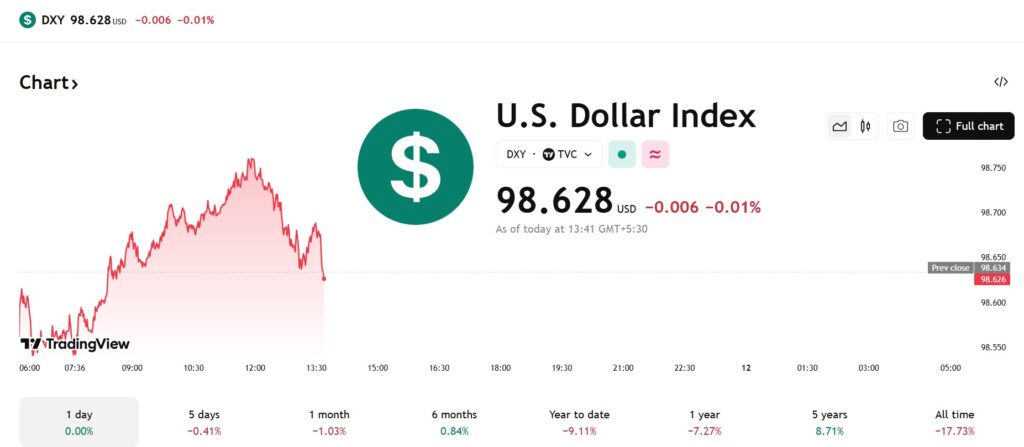

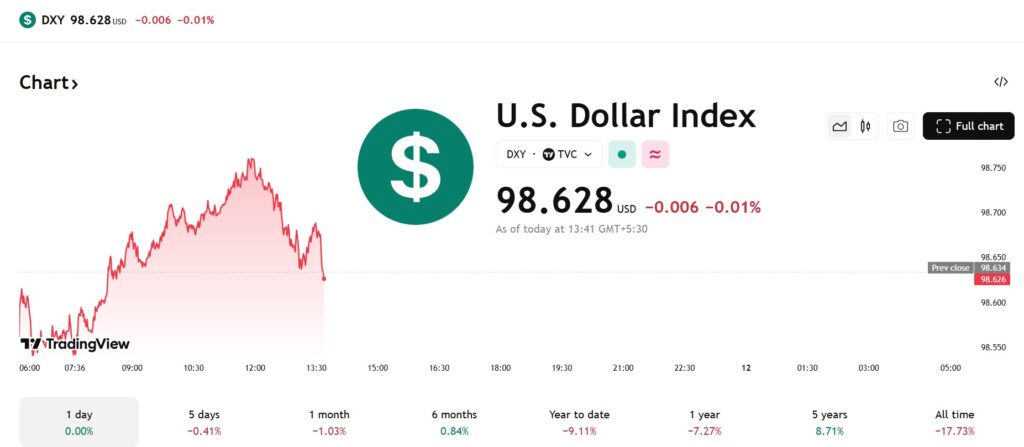

The DXY index, which measures the performance of the US dollar, has seen its worst performance in nearly a decade. The greenback is struggling to climb above the 100 mark and stabilize in the range. It is down more than 9% year-to-date and had dipped to 11% at one point. The extreme and unending weakness is making forex traders take entry positions in Asian currencies and not the US dollar. This is the first time in many years that forex investors are betting on local currencies over the dominant greenback.

Also Read: “It’s 1996 Again”: Tom Lee Says Early Dip Buyers Will Win Big in Crypto

Forex Traders Betting on Asian Currencies & Not the US Dollar

Reuters polled data showing that traders have taken long bets on Asian currencies, sidelining the US dollar. Local currencies are showing stronger growth prospects, especially the Singapore dollar, Thai baht, and Malaysian ringgit. Investments in these currencies are at their highest since mid-June as traders open long positions. The “ringgit has found support from fiscal reforms, strong domestic-led investment outlook, and narrowing yield differentials with the US,” said Lloyd Chan, Senior Currency Analyst at MUFG.

In addition, long positions in the Chinese yuan also rose to their highest level since January 2023. The Chinese yuan grew for four months straight till November, its longest gains in four years. The development indicates growing confidence in Asian currencies among forex traders as the US dollar weakens in the charts. China also has a record trade surplus of $1 trillion for the first time ever through non-US growth.

However, the only loser in the Asian currency market against the US dollar is the Indian rupee. Traders are shorting the rupee for profits as it’s the worst-performing currency in Asia in 2025. The rupee plummeted to a lifetime low of 90.47 on Thursday, and the Reserve Bank of India (RBI) failed to stop its decline. Analysts predict the INR could fall to the 92 level next and ring in new lows. Investors who have shorted the rupee could make bigger profits as the currency dips.