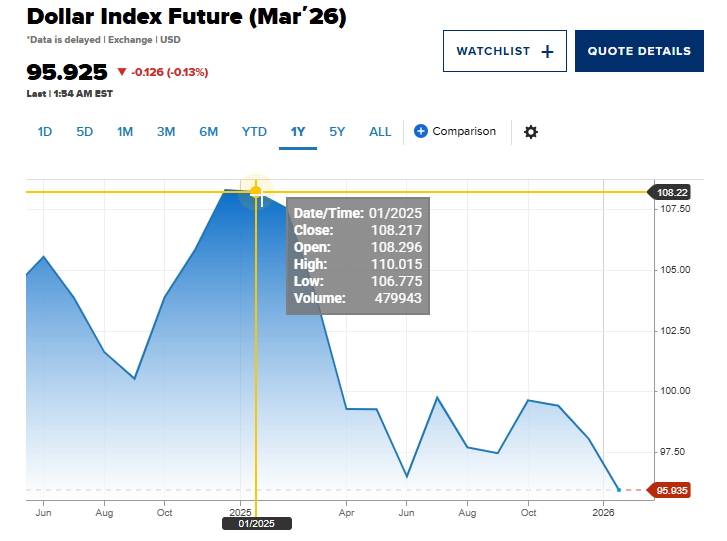

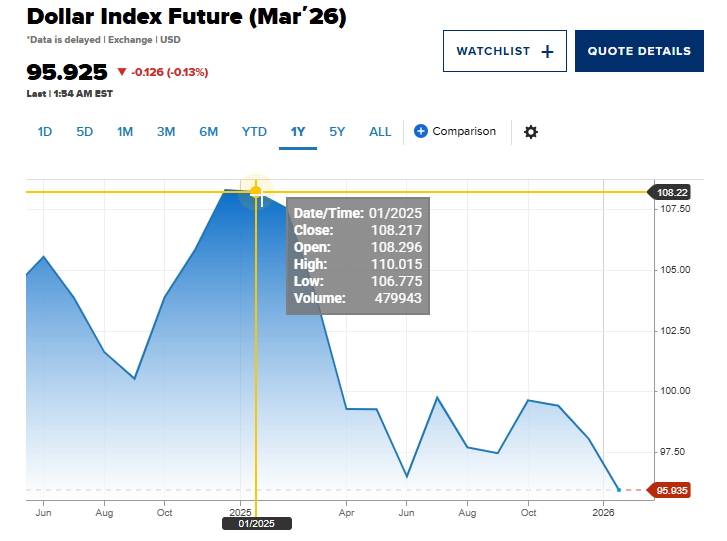

The US dollar dropping today marks its steepest decline since April 2025, and the currency tumbled 1.3% on Tuesday after President Donald Trump signaled he’s comfortable with the weaker greenback. The dollar index drop comes as Trump’s weak dollar stance triggered renewed concerns about market stability, and also the currency touched its lowest level since February 2022.

Speaking to reporters during a visit to Iowa, Trump was asked whether he was comfortable with the current value of the dollar and if he thought it had fallen too much after sliding 10% over the past year. The president’s response was captured by multiple news outlets, stating:

“I think it’s great. I mean the value of the dollar, look at the business we’re doing. No, [the] dollar is doing great.”

Trump went on to reference his previous frustrations with China and Japan, noting:

“If you look at China and Japan, I used to fight like hell with them, because they always wanted to devalue their yen. You know that, the yen and yuan, and they’d always want to devalue it. They devalue, devalue, devalue. And I said, ‘not fair.’ They devalue, because it’s hard to compete when they devalue.”

Also Read: BRICS: Fed Set to Sell Dollars, Buy Yen For First Time This Century

Trump Weak Dollar Remarks Fuel Dollar Index Drop And Market Turmoil

President Endorses Currency Weakness

Trump had unexpectedly supported the decline of the currency, which set off the worst drop in the US dollar in 4 years. Markets construed the remarks as a substantive change in policy, and traders questioned whether the administration will aggressively pursue a weaker dollar policy.

The remarks hit the dollar index especially badly since it represents the US currency versus six major trading partners. On Tuesday, dollar index fell as much as it had fallen on April 10, where the currency was down almost 2 percent due to increasing trade arguments and US threats to impose a 145 percent tariff on China. Other wider markets were also hit the same day with the S&P 500 falling 3.5 and the Nasdaq Composite dropping 4.3.

Various circumstances beyond Trump’s comments have contributed to the present decrease, including Federal Reserve policy expectations and investor sentiment. The players in the market are currently re-evaluating their dollar positions with confusion over currency preferences of the administration.

Analysts Warn Of Continued Dollar Weakness

Analysts expect the US dollar dropping today to be part of a broader pattern of weakness extending into 2026, and they anticipate continued volatility in the coming months. At the time of writing, some forecasts suggest the dollar index could dip towards 94 in the second quarter of 2026.

Win Thin, chief economist at Bank of Nassau, described the situation as a calculated risk. Thin stated:

“Many in the Trump cabinet want a weaker dollar in order to make exports more competitive. They’re taking a calculated risk. A weaker currency can be nice until things get disorderly.”

Karl Schamotta, chief market strategist at Corpay, warned about the current market conditions. Schamotta said:

“With the ‘tariff man’ showing no sign of repentance and the US government headed into another shutdown, economic policy uncertainty is soaring once again, leading to an intensification in the ‘Sell America’ trade that has dominated markets for the better part of a year. Positive fundamentals should eventually reassert themselves, but for now, no one is willing to catch the falling chainsaw that is the US dollar.”

Steve Kulchyk from Monex Canada also noted political concerns, stating:

“The US dollar continues to lose momentum as political uncertainty resurfaces in United States. Renewed tariff threats from Trump and civil unrest are undermining confidence and encouraging diversification.”

A short-term, modest rebound is possible as the market digests Federal Reserve policy, though many analysts anticipate a generally softer dollar throughout 2026. The trajectory will depend heavily on the Fed’s interest rate decisions, inflation data, and the economic impact of policy decisions made this year.

Market Outlook And Policy Uncertainties

Analysts say that the US dollar falling is in a down and not out period, implying that it is not expected to fall to its deathbeds yet, but a recovery to pre-2024-2025 levels is unlikely in the short term. The current position of the dollar has brought out a concern of competitiveness and trade dynamics especially when Trump cited historical issues surrounding currency devaluation by key trading partners.

Also Read: De-Dollarization vs USD Dominance: Is the US Dollar Actually at Risk?

The greenback is at its lowest point in almost three years, and the Trump weak dollar stance is becoming more apparent, so markets will be paying close attention to any further administration currency policy cues. This is the worst decline of the US dollar in four years reverberating all over the world markets and today the US dollar has fallen sharply reminding us of the current policy ambiguities.