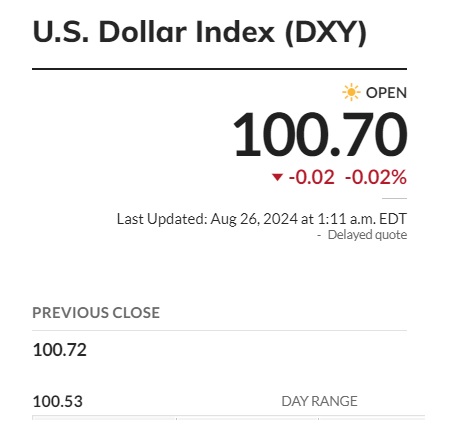

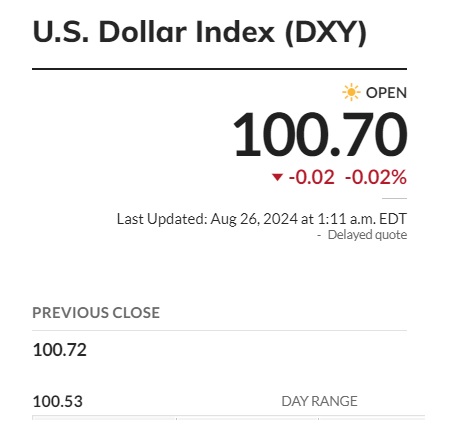

The US dollar is treading dangerous waters, falling to its seven-month low in the indices this week. The DXY index, which tracks the performance of the US dollar, shows the currency plummeting to 100.71 in the charts.

It fell from a high of 106.05 in June to 100.70 in August 2024. That’s a dip of 5.35 points in just two months, making local currencies top in the forex markets.

Also Read: Bitcoin Climbs 5% as Powell’s Remarks Ignite Crypto Market

Dangers loom for the US dollar as the DXY index is close to falling below the 100 mark. Leading financial analyst Peter Schiff took to X and predicted that the USD could “easily” fall below 90 next. “The Dollar Index closed at 100.67. The index could easily sink below 90 before year-end, challenging the 2020 low,” he said.

Also Read: BRICS: Payments in Chinese Yuan Surpasses the US Dollar by 2.5%

US Dollar: DXY Index Could Fall Below 90, Warns Peter Schiff

According to Schiff, the USD could fall to its 2020 low by the end of the year and trade below the 90 mark. That’s a sharp dip and could send the markets into a freefall. He forecasted that when the US dollar dips below 90, it could trigger a recession in the US economy. He said the timeline for the downturn could be next year in 2025.

Also Read: S&P 500 Index To Reach 6,000: Explains Analyst

“I think that low will be breached in 2025, triggering a US dollar crisis, crashing the economy, and sending consumer prices and long-term interest rates soaring,” he said.

The USD’s strength is being questioned as global macroeconomic pressures finally get into the currency. “The U.S. Dollar Index just tanked to a 13-month low. The ‘strength’ of the dollar is the main reason YoY inflation fell from 9% to 3%. Ironically, the Fed is using ‘low’ inflation as an excuse to cut rates, but cutting rates will send the dollar tanking and inflation soaring,” tweeted Schiff.