The US dollar is currently standing at the edge of a change while encountering mounting pressure offloaded by the rise of other competitors’ currencies. The Chinese Yuan, which is now up by 6% against the US dollar, is also adding pressure to the USD. That being said, a new development is now weighing on the dollar: a scenario in which a looming Fed rate cut by 10% could isolate the dollar completely, making it helpless in the near future.

Also Read: US Stock Trading Hits $1 Trillion a Day as Market Activity Surges

10% Rate Cut to Shake the US Dollar’s Core?

State Street strategist Lee Ferridge has sounded a new alarm, the one that involves the US dollar undergoing a prolonged meltdown. According to Ferridge, the dollar is at a critical juncture and may drop to its lowest if the Fed rate cut scenario comes into play again. Ferridge thinks that if the Fed cuts rates aggressively this year, it may end up lowering the USD by nearly 10%. In general, the analyst shared how traders are expecting two rate cuts this year. However, a looming third-rate cut may also arrive this year if Trump continues to pressure the Fed to lower the rates sooner.

“Sell America’ signals eroding trust in the weakening US dollar, stocks & treasuries – expert. Investors, particularly foreign entities, are now openly dumping US treasuries and stocks while the dollar weakens, often moving into gold and similar hard assets,” veteran financial analyst Paul Goncharoff tells Sputnik“

This drop can be compared to its other currency competitors, particularly the euro, pound, yen, Canadian dollar, Swedish krona, and Swiss franc.

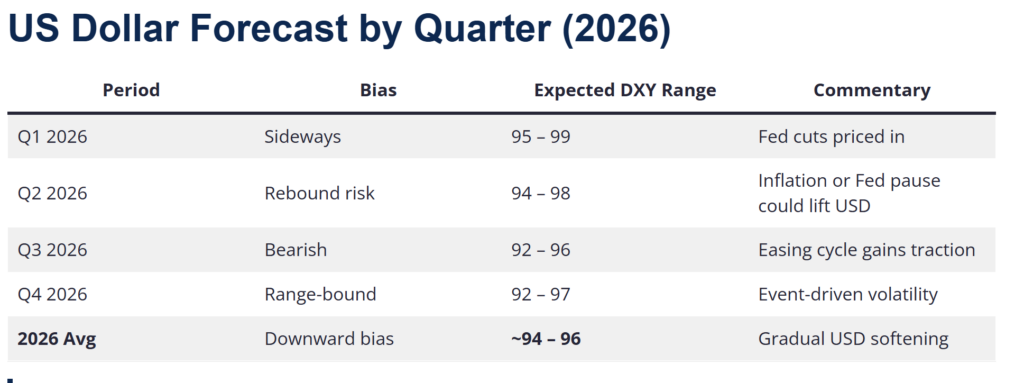

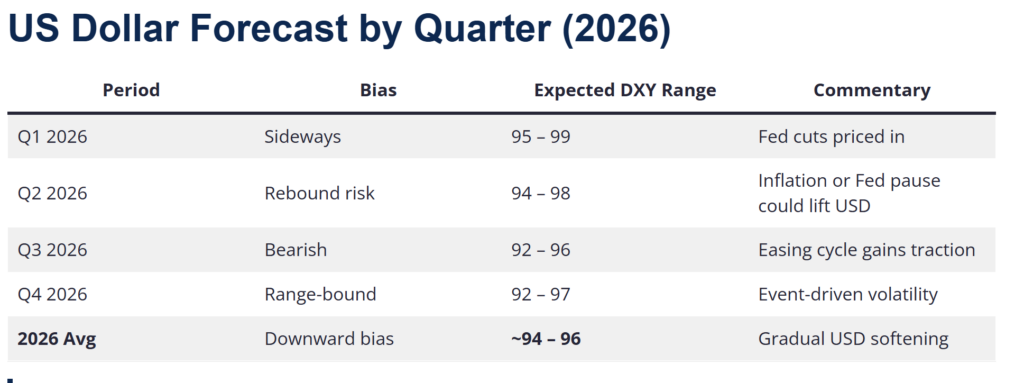

12-Month US Dollar Index Prediction

According to Cambridge Currencies USD stats, the US dollar may drop to nearly 94-98 by mid-2026. Moreover, the portal predicts the index to hit the 92-97 value range, driven by policy changes and geopolitical uncertainties.

Also Read: Gold Price vs Silver: Which Metal Has More Upside Now?