The US dollar is hammering its way to the top, making leading Asian currencies fall to new yearly lows. Despite boasting a robust economy, the Indian rupee failed to stay afloat against the US dollar in August.

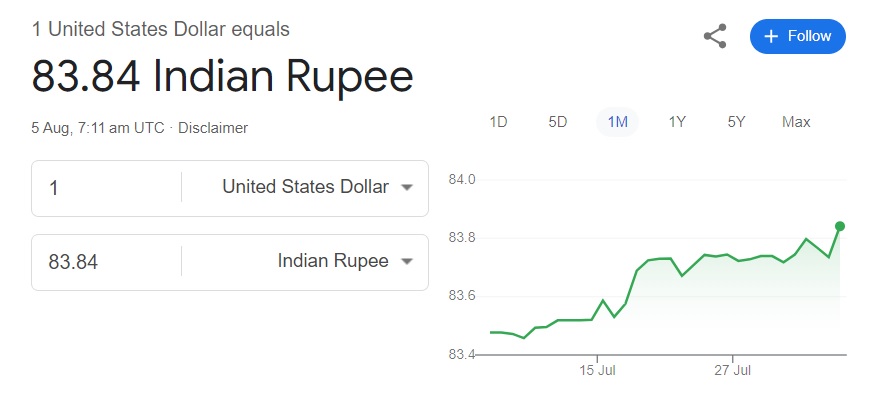

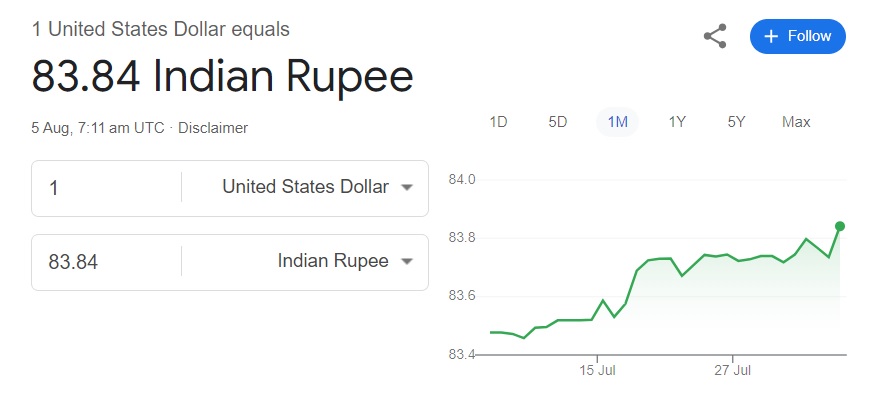

The Indian rupee fell to 83.84 on Monday’s opening bell, leading to fears of a crash to 84. Analysts had been warning that if the rupee dips below 83.80, the path to 84 could become more manageable for the US dollar.

Also Read: Top 2 Cryptocurrencies To Watch in August 2024

Now that the US dollar has broken the 83.80 threshold against the Indian rupee, the chances of the currency slipping to 84 remain high. This is the all-time low for the INR against the USD ever recorded.

To add to India’s woes, Sensex and Nifty are in deep red on Monday. Sensex is down by over 2,500 points, and Nifty is below 750 points.

This is aiding the US dollar in dominating against the Indian rupee, making it fall to its all-time lows. No other currency has come close to challenging the USD in the forex markets in August.

Also Read: Japan’s Stock Market Suffers Worst Losses Since 1987

US Dollar: The Indian Rupee is Only Behind the Japanese Yen

The Indian rupee is now the second worst-performing currency in the forex market in August against the US dollar. The Japanese yen is down to its 1990s low, and the rupee is currently second in line.

The Chinese yuan has also dipped to an eight-month low against the USD. Despite developing countries kicking off the de-dollarization agenda, local currencies lag behind the US dollar.

Also Read: BRICS: Idea of De-Dollarization Is ‘Non Sense’: Analyst

Moreover, India’s recent financial budget has dampened the stock market’s overall mood. The Finance Minister increased Long-Term Capital Gains (LTCG) from 10% to 12% and Short-Term Capital Gains (STCG) from 15% to 20%.

The development led to an outflow of funds as taxes remained high.