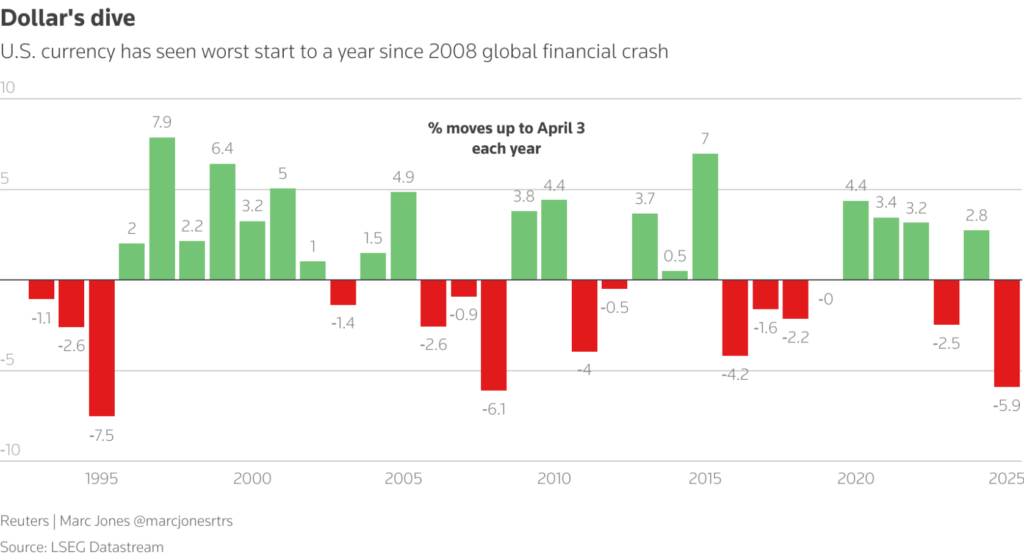

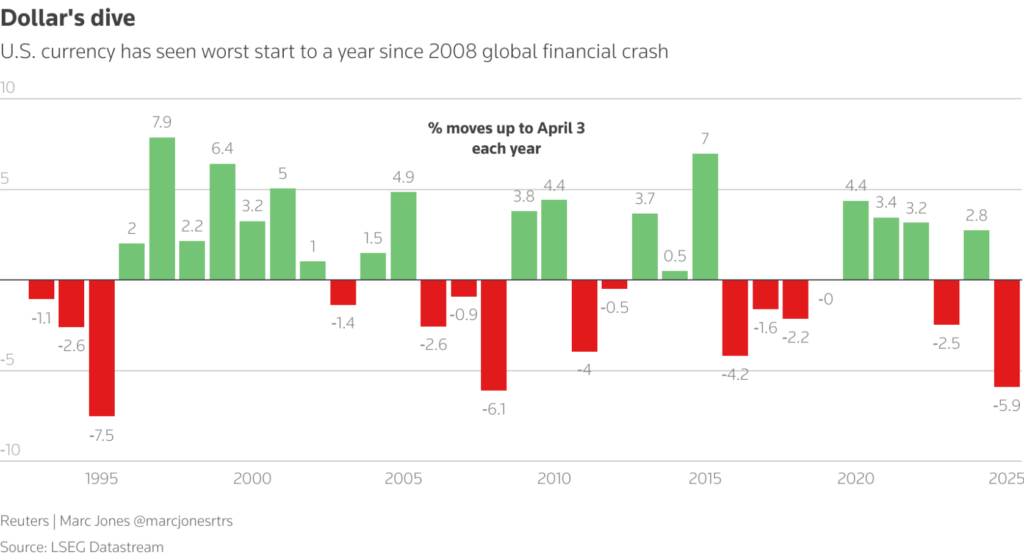

The US dollar is currently experiencing alarming weakness, and right now in 2025, the currency is actually seeing its worst start to a year since the 2008 financial crisis. At this moment, central banks worldwide are also rapidly increasing their gold reserves as market volatility continues and fears about global financial instability grow stronger. This ongoing shift suggests an acceleration in de-dollarization efforts that might, in the near future, permanently alter the international monetary system as we know it.

Also Read: De-Dollarization: 11 Former Soviet States Drop US Dollar in 2025 Shift

How Central Banks Are Reacting to US Dollar Instability and Gold Rush

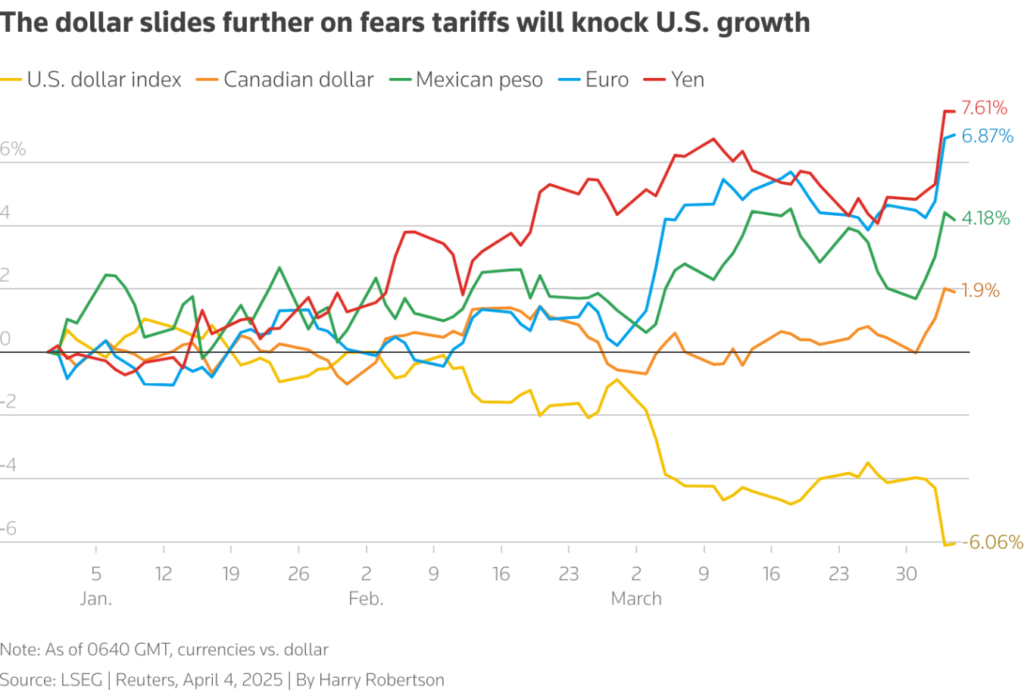

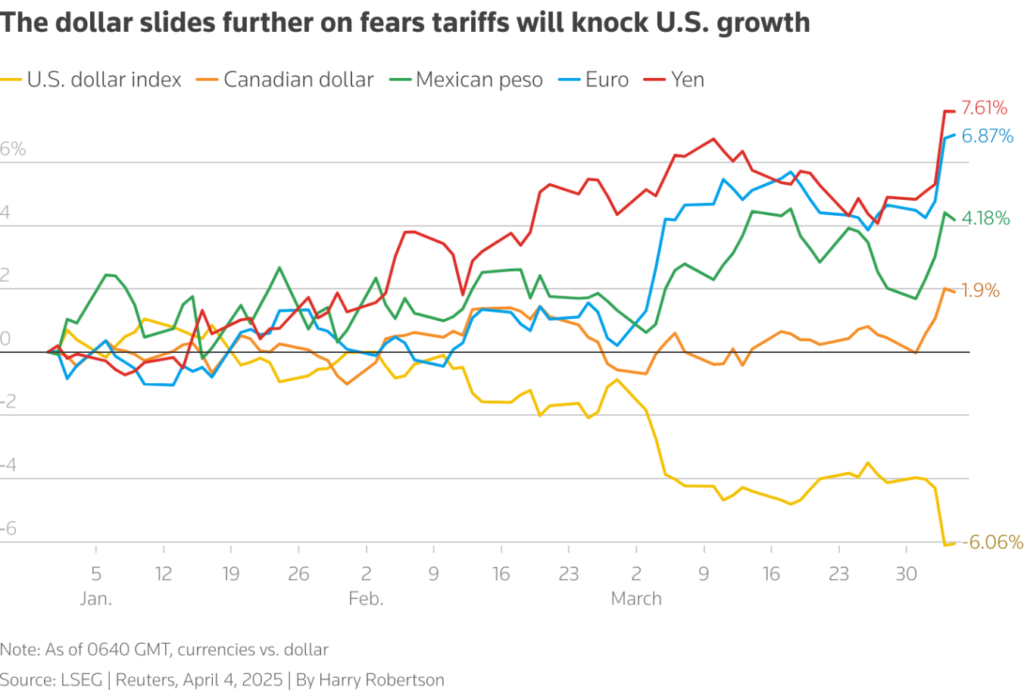

As of early April, the US dollar suddenly fell about 1.7% in value in just a single day after the new tariff announcements, and this also represented its largest daily drop since back in November 2022. Such unexpected behavior essentially contradicts its traditional and long-standing role as a safe haven during times of market uncertainty.

Thierry Wizman, global foreign exchange strategist at Macquarie, stated:

“What we’re seeing today is a further indication that the structure and nature of the U.S. dollar’s relationship to global markets has changed. There’s an underlying basis for this, which is the changing role of the U.S. in the world.”

Money Flows Reversing as US Dollar Loses Appeal

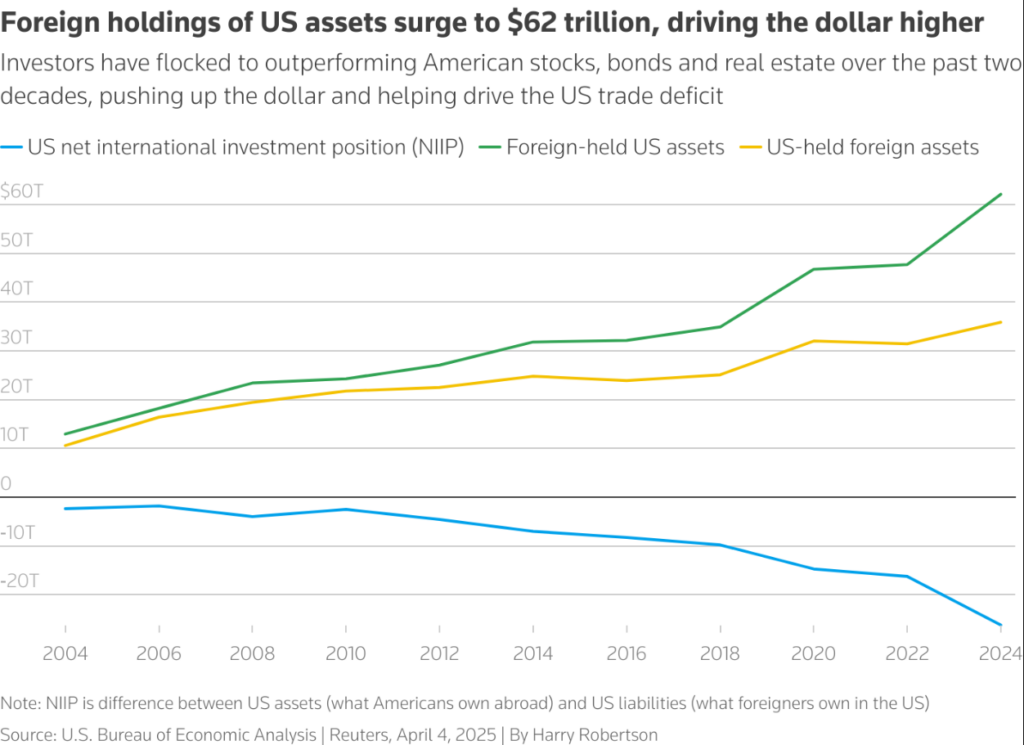

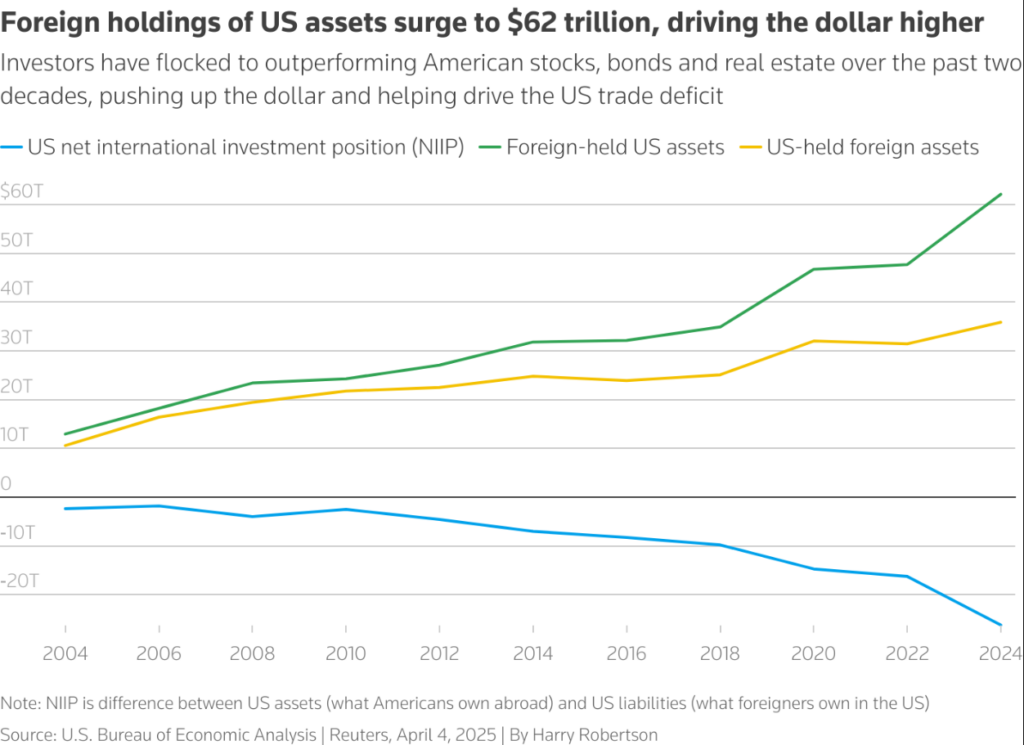

In recent months, the US dollar has fallen approximately 6.1% since the month of January. Foreign holdings of US assets had previously reached around $62 trillion in 2024, but these flows are now actively reversing as investors look for and seek out alternatives in various markets.

Paresh Upadhyaya, director of fixed income and currency strategy at Amundi, explained:

“The three pillars of support that helped the dollar were U.S. exceptionalism, high interest rates, and strong portfolio flows. All three have been severely weakened and potentially reversed as a result of the deluge of tariff announcements.”

Also Read: Ripple: 3 Ways To Enjoy When XRP Hits $10 In The Future

Central Banks Turn to Gold Amid US Dollar Concerns

At the present time, central banks have significantly increased their gold reserves as the US dollar also continues to weaken. This strategic shift certainly reflects some deep concerns about the levels of market volatility and also the dollar’s future as the primary reserve currency in the global economy.

Per Jansson, Sweden’s central bank deputy governor, warned:

“If the dollar’s status would change, that would be a big change for the world economy… and would basically create a mess.”

Despite these ongoing challenges, the US dollar is still supported by America’s large economic size and also its deep capital markets. However, many experts are increasingly questioning just how long this dominance can actually continue given the current trends.

James Malcolm, head of FX strategy at UBS, noted:

“While we will get a different set of events, the effect – the dollar going down a lot more – should be the same.”

Also Read: New Country Begins Ditching US Dollar, Accumulates Gold in Central Bank