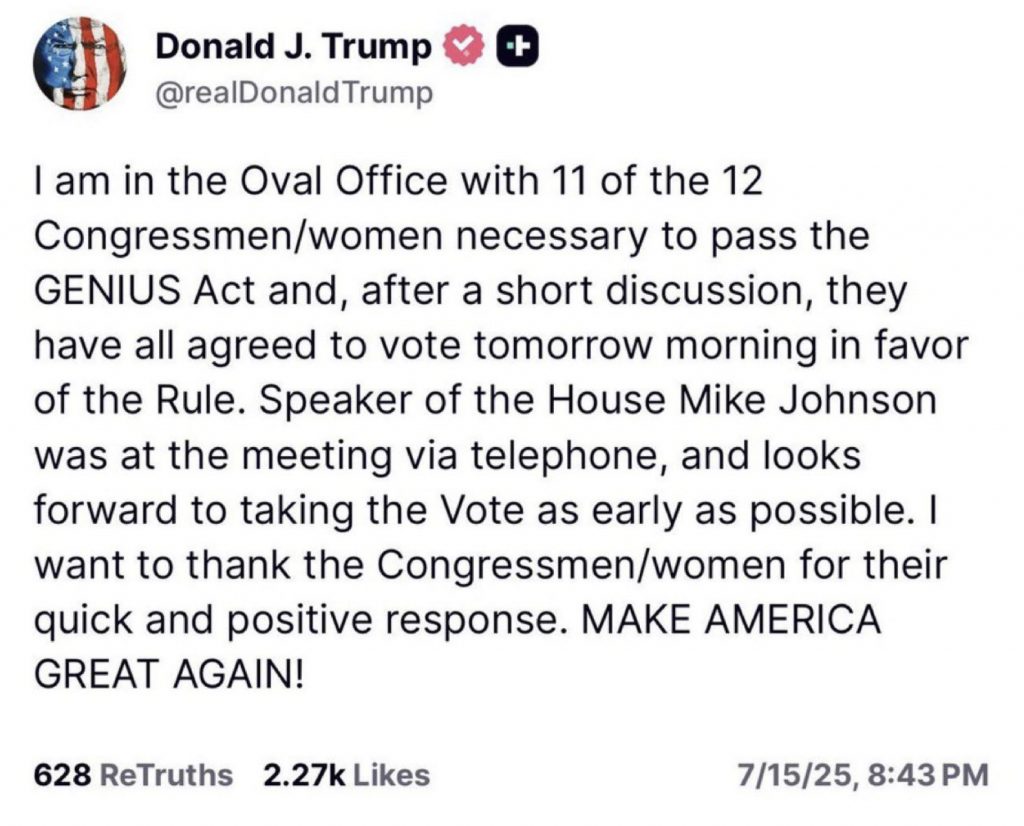

US President Donald Trump took to Truth Social and stated that he was with 11 of the 12 Congressmen and Congresswomen needed to pass the much-anticipated GENIUS Act.

According to Trump’s post, all 11 members have agreed to vote in favor of the legislation. The GENIUS Act aims to bring more clarity and regulatory oversight into the stablecoin arena in the US. Let’s discuss if the legislation will have a positive impact on Bitcoin (BTC) and the larger cryptocurrency market.

Can The GENIUS Act Help Bitcoin Hit $140,000?

The GENIUS Act does not have anything to do with the larger cryptocurrency market. The legislation will deal with uncertainties in the stablecoin industry. While stablecoins are not directly linked to the performance of other crypto assets, the legislation could lead to a general bullish environment. Such a development could help Bitcoin (BTC) and other crypto assets.

The GENIUS Act could pave the way for other legislative actions for the crypto industry. President Trump had stated that he wants the crypto industry in the US to thrive. The SEC is also currently helmed by pro-Bitcoin candidate Paul Atkins. Atkins has stated that having clear regulations is a priority for the financial watchdog.

Also Read: Bitcoin Whale Bought BTC at $8k: Now Has $110 Million Profit

A possible bullish sentiment arising from the passing of the GENIUS Act could lead to increased inflows into Bitcoin (BTC). Retail investors have mostly been absent over the last few months. The passing of the GENIUS Act could lead to retail players taking more action. Such a development could lead to Bitcoin (BTC) breaching the $140,000 mark.

It is also possible that BTC will not react to the passing of the GENIUS Act. It is possible that the legislation will lead to more people embracing stablecoins globally. The move could also lead to a surge in US dollar adoption, as most stablecoins are pegged to the dollar.