In what is certainly a notable development for the ongoing approval process, US lawmakers have urged the US Securities and Exchange Commission (SEC) to approve Spot Ethereum ETFs. Indeed, a letter from the Congress of the United States has called on the agency’s chair, Gary Gensler, to approve the investment offering.

Lawmakers request consistency in the agency’s approach to digital asset exchange-traded product approval. Specifically, they have insisted Gensler “apply the same principles set forth in the approval of Spot Bitcoin ETFs” to the Ethereum-based investment vehicle.

Also Read: BlackRock Files updated 19b-4 Form for Spot Ethereum ETF

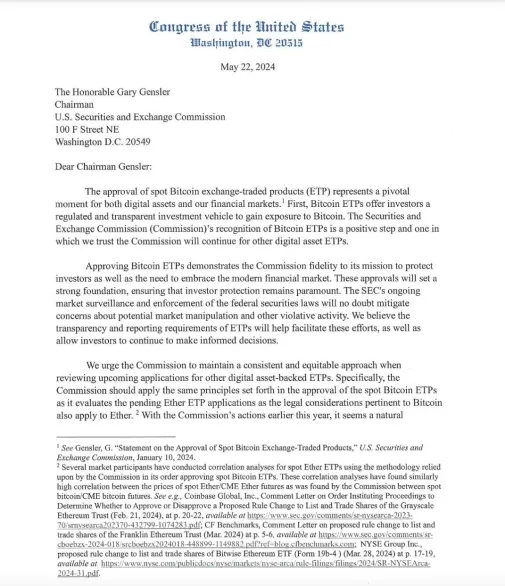

US Lawmakers Issue Letter Urging SEC to Approve ETH ETF

Over the last several days, the prospect of spot Ethereum ETF approval in the United States has drastically increased. The approval chances at the start of the month were not indicative of impending issuances. However, that changed this week as Bloomberg increased approval odds from 25% to 75%.

Now, a letter from US lawmakers has surfaced, as they have urged the SEC and its chairman, Gary Gensler, to approve spot Ethereum ETFs. Specifically, the letter is clear on its desire for consistency. Through that methodology, they asked the agency to approach an Ethereum ETF, in the same way, they did their Bitcoin ETF applications.

Also Read: Top 3 Cryptocurrencies To Buy For 5X Gains In Anticipation Of Ethereum ETF Approval

Spot Bitcoin ETF approval was granted in January of this year. Moreover, its arrival had massive ramifications on the overall value of the digital asset. Just three months after the investment offering was greenlit, the asset reached an all-time high of $73,000.

According to the letter from lawmakers, that approval represented “a pivotal moment for both digital assets and our financial markets.” Conversely, there is the belief that Ethereum could follow Bitcoin’s trajectory following its approval.

Over the last 24 hours alone, the asset has increased by almost 7% and nears the $4,000 mark, according to CoinMarketCap. Moreover, there are expectations that a spot ETH approval could catapult the asset to new heights in the coming weeks.